Download Pintu App

Bitcoin (BTC) Faces Recovery Hurdles — Will It Break Through?

Jakarta, Pintu News – Bitcoin (BTC) has struggled to regain ground since late October, with several failed recovery attempts extending its decline. The leading cryptocurrency continues to fluctuate near critical support levels, while on-chain indicators show signs of emerging weakness. Increased volatility and lack of directional certainty continue to define market behavior.

Bitcoin (BTC) May Face Resistance

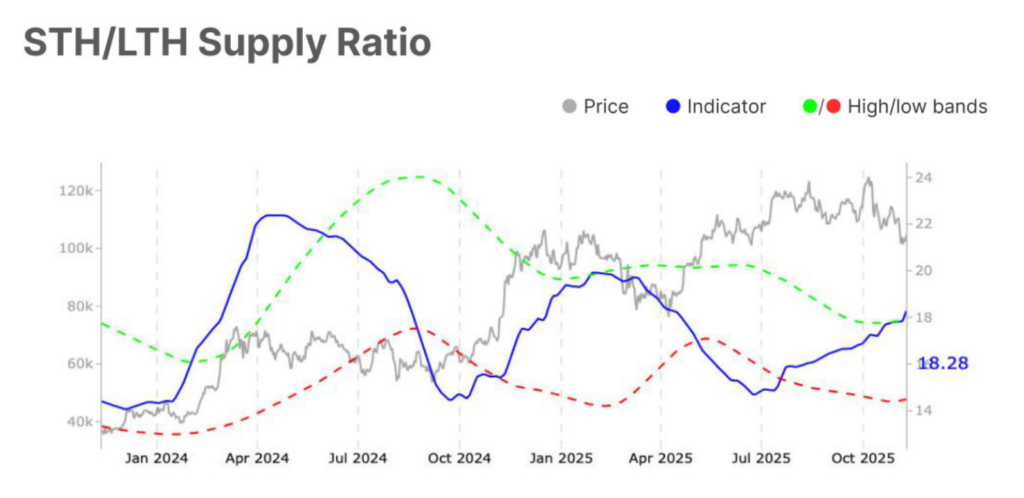

The Short Term Holder to Long Term Holder (STH/LTH) Supply Ratio recently rose to 18.3%, surpassing the upper limit of 17.9%. This signals increased speculative activity as short-term traders dominate market movements. Increased churning without sustained price direction has led to high volatility in the Bitcoin (BTC) trading environment.

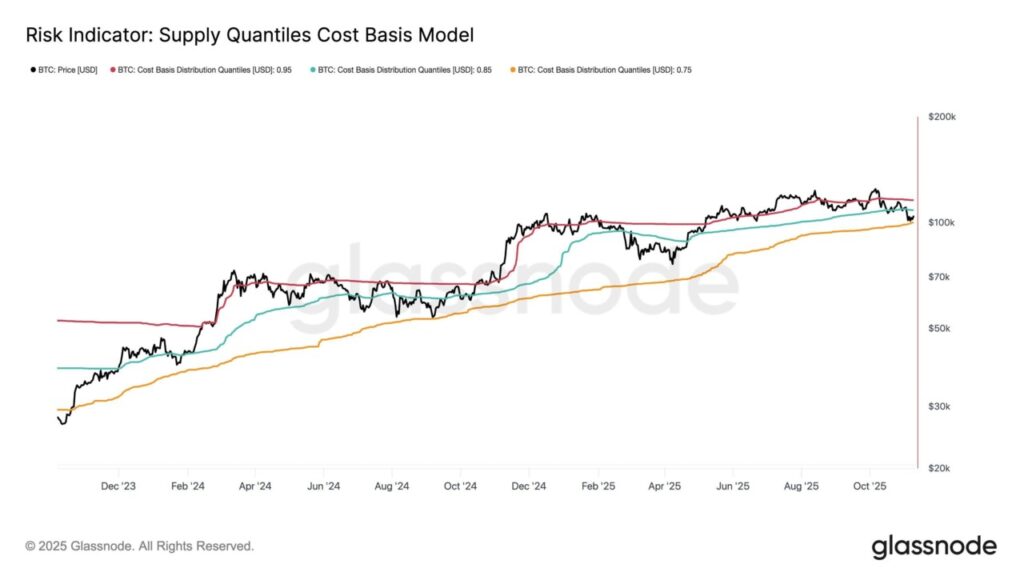

The spike in this ratio also shows that traders are quick to switch between profit-taking and accumulation phases. As a result, market turbulence has increased, making Bitcoin (BTC) vulnerable to sharp yet brief price swings. According to the Supply Quantile Cost Basis model, Bitcoin (BTC) has bounced off the 75th percentile cost basis near $100,000 and is consolidating around $106,200.

This area reflects a critical psychological and technical zone for traders, marking a temporary stabilization after weeks of selling pressure. The next resistance lies at the 85th percentile cost base of $108,500, which has historically limited recovery attempts during similar phases. Model data suggests that Bitcoin’s (BTC) upside may remain limited in the short-term.

Read also: Circle ready to launch new tokens for Arc network, revenue to rise sharply?

Bitcoin (BTC) Price Break Opportunity

Currently, the price of Bitcoin (BTC) stands at $103,922, struggling to overcome a downtrend that has been active for almost two and a half weeks. The cryptocurrency has failed twice to break this resistance, reinforcing the strength of bearish market sentiment. Currently, Bitcoin (BTC) is trading below $105,000 but remains above the $101,477 support zone.

This area is likely to form a consolidation base amid continued volatility and cautious investor behavior. If the bullish momentum strengthens, Bitcoin (BTC) could break $105,000 and challenge resistance near $108,000. Successfully reversing this level would mark the first significant recovery since October, signaling renewed optimism across the broader crypto market.

Read also: 3 Altcoins that Crypto Whale Crave When the Market Starts Recovery

Technical and Psychological Analysis of the Market

An in-depth understanding of the current market dynamics and technical analysis suggests that Bitcoin (BTC) is at a tipping point. The current price movements reflect significant uncertainty among investors, with technical analysis suggesting that there are several obstacles to overcome before a sustained recovery can take place. This observation is important for investors looking for strategic entry or exit points in their investments in Bitcoin (BTC).

Conclusion

Taking all these factors into account, the Bitcoin (BTC) market is currently in a very crucial phase. Investors and traders should stay alert to changes in market indicators and be ready to adjust their strategies according to changing market conditions. Timely and data-driven decisions will be key in navigating this uncertain Bitcoin (BTC) market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Price is Now Facing Historical Recovery. Accessed on November 13, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.