Download Pintu App

3 Technical Patterns that Could Determine Chainlink (LINK) Price According to Analysts!

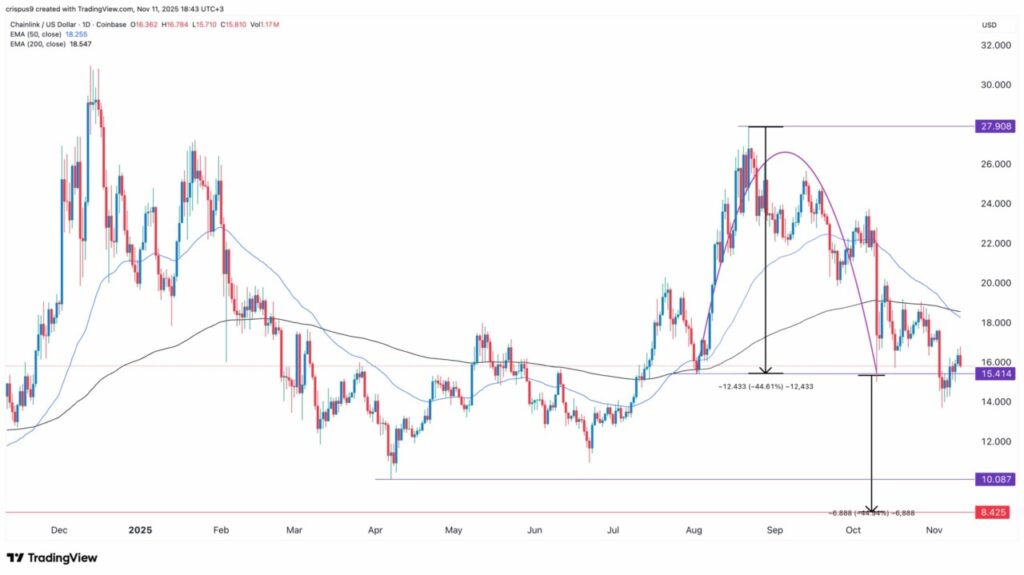

Jakarta, Pintu News -The price of Chainlink (LINK) is back in the spotlight as an emerging technical pattern signals a potential further decline. In recent months, the price of LINK has fallen sharply from its peak of $27 (equivalent to IDR450,063) in August to around $15.75 (IDR262,524) as of November 11, 2025. Selling pressure from whales and the formation of negative technical patterns have kept this crypto closely monitored by analysts.

Three Bearish Technical Patterns Reappear

Based on daily chart analysis, Chainlink (LINK) is now forming three bearish technical patterns that many professional traders are watching. As stated by analysts at CoinGape, these patterns are the death cross, inverse cup and handle, and head and shoulders.

The death cross appeared on November 6, 2025, when the 50-day moving average (MA50) cut below the 200-day average (MA200). This is a strong indicator that the medium-term trend is undergoing significant weakening. According to chart data highlighted by Crispus analysts, an inverse cup and handle pattern has also formed, with a downside target to around $8.50 or IDR141,686, if support at $10 (IDR166,690) is broken.

Meanwhile, the weekly chart shows a head and shoulders formation, which is known as a trend reversal signal. In this pattern, the “head” is at $30.1, with two “shoulders” and a sloping neckline that is currently being tested. If this neckline is broken, the potential for the price to go to $8 could occur in the near future.

Whale Selling Adds Pressure

Although Chainlink’s fundamentals are showing positive developments, the massive sell-off by whales is a major suppressing factor. Data from Nansen shows that since October 2025, whale’s total holdings have decreased from 3.14 million tokens to 2.34 million tokens-a decrease of 800 thousand LINKs or about $12 million (Rp200 billion).

Ironically, this action coincided with some good news from the project side. During the latest SmartCon conference, Chainlink announced strategic collaborations with major companies such as SBI Markets, Apex Global, Lido, and Aptos. However, retail investors’ accumulation has not been able to arrest the downtrend triggered by selling pressure from whales.

On the other hand, the supply of LINK on crypto exchanges also decreased from 287 million to 221 million tokens. Typically, this indicates that investors prefer to keep their assets in self-custody. Even so, high selling volumes continue to hold back price recovery in the short term.

Also Read: Bitcoin Poised to Surge After US Government Shutdown Deal: History Repeats?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crispus/CoinGape. Chainlink Price Could Crash as 3 Risky Patterns Form Amid Whale Selling. accessed on November 13, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.