Download Pintu App

Antam Gold Price Chart Today November 13, 2025: Up or Down?

Jakarta, Pintu News – As of November 13, 2025, the price of Antam gold shows a significant trend. With global market conditions continuing to evolve, gold prices have experienced slight fluctuations, but remain on a path that shows upward potential. This article will discuss the changes in gold prices that occurred today based on the available charts.

Antam Gold Price Movement Today

The spot gold price per gram saw an increase today at IDR 2,264,547, up about IDR 2,487 compared to the previous price. This shows a positive trend in gold price movements, despite minor fluctuations in the USD to IDR exchange rate. At the same time, the gold price per ounce also registered an increase, standing at USD 4,209.10, up by USD 5.60 compared to yesterday.

However, despite the steady increase, the Antam gold price experienced a slight decline in the USD/IDR exchange rate, which fell by IDR 4.01. Nevertheless, the price of Antam gold in Indonesia is still at a high level and attracts the attention of many investors.

Also Read: Dogecoin (DOGE) Investment Gold Opportunity: Potential for Big Profits by 2026

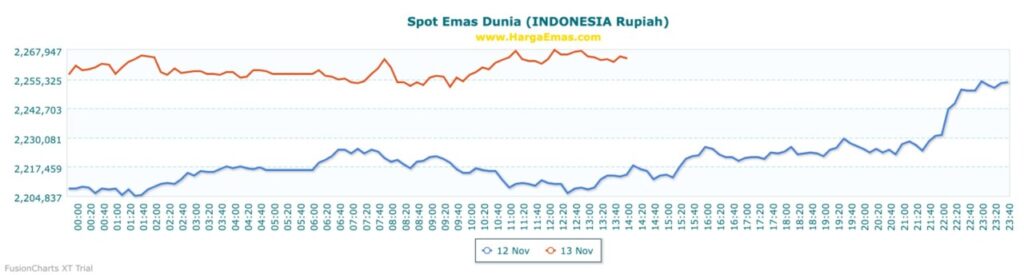

World Gold Price Movement Chart and IDR

In the world gold price chart presented, it is clear that the price movement increased significantly from 10:00 to 23:00. Along with the strengthening of the world gold price, the gold price in rupiah (IDR) also showed a comparable increase. In recent hours, gold prices have surged, sparking optimism among investors and gold market participants.

From the chart, it can be seen that the world gold price (in USD) is moving up, reflecting external factors that also affect the gold market, such as global economic uncertainty and increased demand for precious metals. This price increase does not only occur in spot gold, but also has an impact on the price of Antam gold in rupiah.

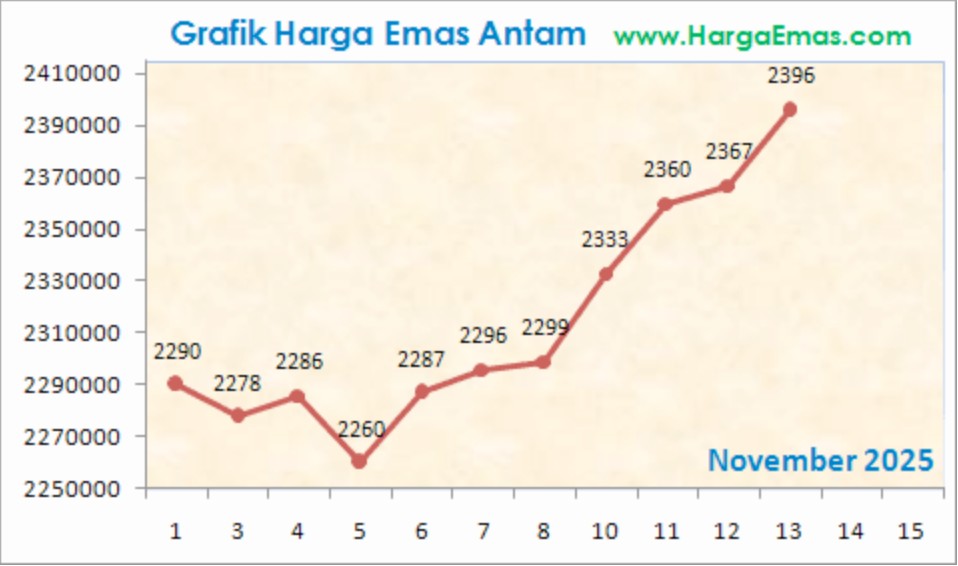

Continuing upward trend

Looking at the available Antam gold price chart, in November 2025, there has been a significant increase in the price of gold, especially in the last few days. The price of Antam gold per gram, which was initially stable at around IDR 2,290,000 at the beginning of the month, has now reached IDR 2,396,000 per gram on November 13, 2025. This price spike reflects the normal up-and-down pattern in precious metal price fluctuations, but the overall trend is towards strengthening gold prices.

Despite some minor dips, the long-term trend shows positive price movements. This increase is heavily influenced by international market dynamics, as well as domestic factors that drive demand for hedging against inflation and global economic uncertainty.

Conclusion: Antam Gold Price is Still Attractive

With the Antam gold price chart continuing to show an upward trend, both in terms of world price movements and in rupiah terms, this provides an opportunity for investors to consider gold as a safe investment option. While short-term fluctuations may occur, the long-term trend shows that gold still remains a profitable commodity.

Also Read: Bitcoin Poised to Surge After US Government Shutdown Deal: History Repeats?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Antam Gold Price. Antam Gold Price Chart Today. Accessed on November 13, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.