Download Pintu App

Ready to Soar? Analysts Say Dogecoin (DOGE) is Getting Ready to Pass This Critical Zone!

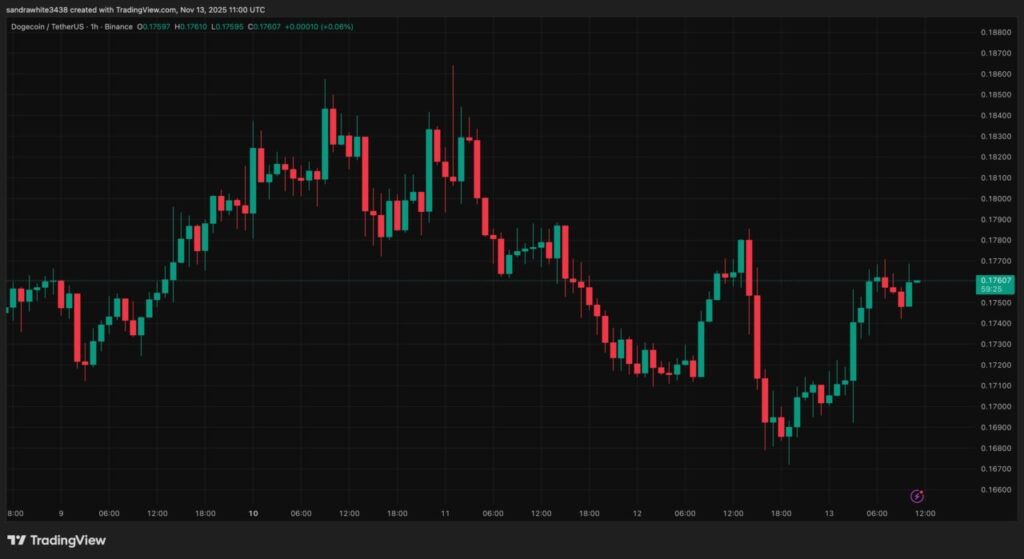

Jakarta, Pintu News – After several days of trying to recover from an industry-wide decline, the Dogecoin (DOGE) price is now showing a more constructive structure. From a downward trend at the beginning of the month, the Dogecoin price is now starting to form a more promising pattern with a series of higher lows, indicating significant upside potential if it manages to break through the critical resistance zone.

Dogecoin Price Movement: Trying to Rise

At the beginning of the month, Dogecoin bottomed out in the $0.15 range, but soon after, buyers began to re-enter the market. This was evident from the price consolidation that took place around that range, which then formed the basis for a potential rise. On November 7, Dogecoin managed to break out of the declining structure and pushed the price to the mid $0.18 range, signaling a shift in momentum from sellers to buyers.

This transition from lower highs to a more aggressive upward slope has laid the foundation for the rebound that is now taking shape. However, Dogecoin is now facing an overhead resistance zone around $0.186, which came about as a result of a downside block order on November 2nd. Technical analysis suggests that this price level is now the most important barrier to break.

Also Read: Shocking Prediction from Donald Trump’s Son: Bitcoin Will Break $1 Million!

Decisive Critical Zone

Dogecoin’s price is now just below the $0.186 resistance zone, the same zone that has been hampering upside attempts over the past week. A technical discussion from BitGuru, supported by charts shared on social media platform X, highlights the importance of this zone as a key decision point.

A chart shows a tight candle cluster forming just below this level, with a small intraday rejection but no significant drop. The price action in this region sends a clear message: the bulls are trying to take control, and the structure is starting to resemble a pre-breakout consolidation.

Strong Spike Potential if Successful Breakout

The critical question now for Dogecoin’s short-term technical outlook is whether it can push decisively above the $0.186 resistance. If successful, this would open the door for an upward continuation, setting up the Dogecoin price for the next impulsive leg above $0.2.

A failure to break through probably wouldn’t derail the developing bullish structure, but it could trigger a short pullback before another upside attempt. Everything now depends on how Dogecoin behaves at this price resistance, as momentum is clearly building below it and a decisive breakout would change the entire short-term outlook to the upside.

Critical Moment for Dogecoin

Dogecoin’s ability to break through the $0.186 resistance zone will largely determine the next price direction. This is a critical moment that could trigger a wave of Dogecoin price gains if successful, or conversely, could be a turning point for a price correction if it fails. Market watchers and crypto investors should keep a close eye on this dynamic.

Also Read: Bitcoin Poised to Surge After US Government Shutdown Deal: History Repeats?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

- What is Dogecoin (DOGE)

? Polylang placeholders do not modify

- Why is the $0.186 zone important for the Dogecoin price?

Polylang placeholders do not modify

- What happens if Dogecoin fails to break the $0.186 resistance?

Polylang placeholders do not modify

- When did Dogecoin bottom out around $0.15?

- Dogecoin bottomed out at around $0.15 in early November, before buyers started to step back in and push the price upwards.

- What is the potential price of Dogecoin if it breaks $0.186?

- If it manages to break through, Dogecoin price could head to the next impulsive leg above $0.2, signaling significant upside potential.

Reference

- Bitcoinist. Dogecoin Price Sees Upward Push. Accessed on November 14, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.