Download Pintu App

3 Altcoins Actively Accumulated by Crypto Whales Ahead of US CPI Report

Jakarta, Pintu News – The delayed US CPI report – previously postponed due to the government shutdown – is scheduled to be released on November 13, with high expectations in the market. Inflation for October is expected to remain close to the headline figure of 2.6% and core 3.3% on an annualized basis in September.

A lower-than-expected figure could revive hopes of a rate cut, while a higher figure would probably put those hopes on hold. Ahead of the release, crypto whales made selective purchases.

They seem to be moving away from broad risk bets towards tokens with stable fundamentals and clear use cases. Here are 3 altcoins that crypto whales are buying up, based on data collected by BeInCrypto.

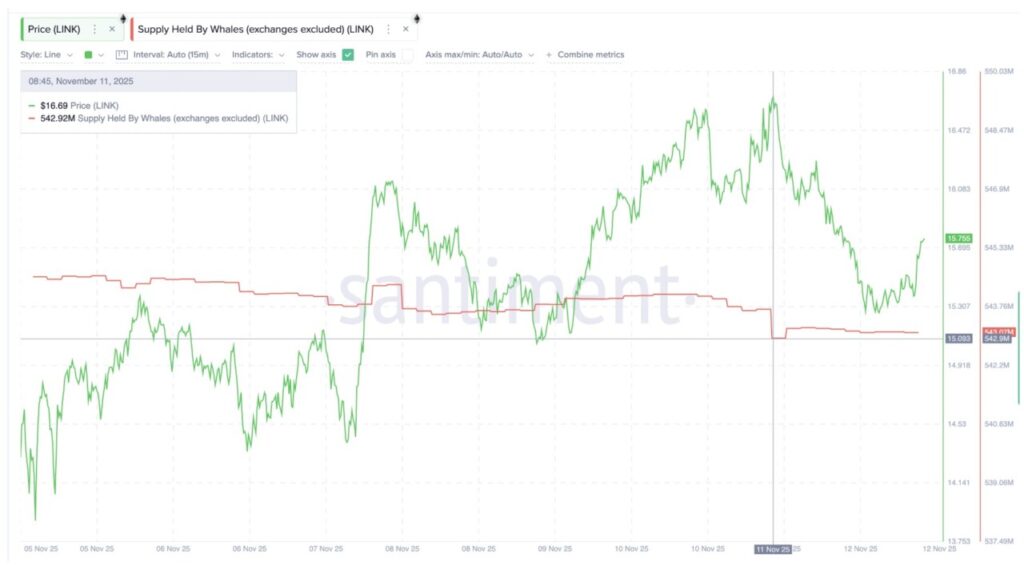

Chainlink (LINK)

Whale is buying Chainlink (LINK) again after several weeks of steady selling. In 24 hours (12/11), Whale’s holdings increased from 542.92 million LINK to 543.07 million LINK, about 150,000 LINK, which is worth about $2.36 million at current prices.

Read also: Bitcoin and Ethereum Plummet, These 3 Altcoins Are Bought by Crypto Whale to Billions of Dollars!

This sudden buying comes just before the US CPI report, which suggests that crypto whales are expecting lower or stable inflation, which could boost market sentiment more broadly. This renewed interest suggests confidence that Chainlink’s recent weakness may already be nearing a bottom.

On the technical front, LINK’s price registered lower lows between October 10 and November 4, while the Relative Strength Index (RSI) – which measures buying and selling strength – registered higher lows.

These rare bullish divergences often appear before trend reversals, suggesting hidden accumulation beneath the surface. Regarding the existing trend, LINK is down about 33% in the past three months, making the latest trend reversal theory more meaningful.

If this pattern materializes, the first key level to watch is $18.76, which has capped several rallies since late October. A breakout above it could open the next path towards $23.80, and possibly $27.92, confirming that the crypto whales have picked the right entry time.

However, if the price of LINK falls below $13.72, this setup will fail, and the price could return to test lower support. For now, the combination of whale accumulation, bullish divergence, and CPI-related optimism suggests reasons why crypto whales are buying Chainlink ahead of this important report.

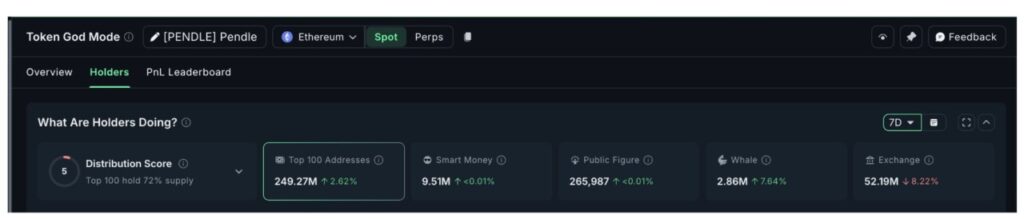

Pendle (PENDLE)

Crypto whales also started buying Pendle (PENDLE), slowly ahead of the CPI report release. In contrast to Chainlink’s 24-hour surge of whale activity (12/11), Pendle accumulation has been developing quietly over the past week.

Whale wallets holding between 100,000 and 1 million PENDLE increased their balance by 7.64%, reaching 2.86 million tokens. Meanwhile, the top 100 addresses (mega whales) increased their holdings by 2.62%, now reaching 249.27 million tokens – an additional approximately 6.37 million PENDLE, worth nearly $17.7 million.

Overall, whales and large holders have accumulated about 6.57 million PENDLEs in the past seven days, with a total value of nearly $18.3 million.

These purchases came during a modest price increase of 6.5% in the same period, suggesting that large holders started positioning themselves early, perhaps expecting a CPI-driven market push. Despite the short-term rebound, Pendle remains down 47.9% in the past three months, making these levels attractive for accumulation.

Technically, the chart shows why the whales are starting to come in. The Money Flow Index (MFI) – which tracks money entering or exiting an asset by comparing price and volume – has just broken the descending trendline connecting the lower peaks since early November.

This breakout indicates an increase in the momentum of money flow after several weeks of decline, which is often seen at the beginning of a recovery phase.

Read also: 3 Hot Altcoins with Interesting Trading Signals According to CryptoAmsterdam Analysts!

If the price continues to follow this pattern, PENDLE could test $3.37 first. A clean daily close above that level could open a path towards $3.94. And if the macro sentiment strengthens further, $6.25 remains the long-term target.

However, if Pendle drops below $2.50, this MFI breakout could fail, and short-term selling may resume. This could cause the DeFi token to test a new low.

Cardano (ADA)

The crypto whale is buying Cardano (ADA) again, but this time with a more cautious approach.

Large ADA holders who own between 100 million and 1 billion tokens have increased their balance from 3.7 billion ADA to 3.8 billion ADA since November 10. This means about 100 million ADA was added in just two days, which is worth about $57 million at current prices.

This accumulation marks the first significant wave of buying in weeks and comes just before the US CPI report, suggesting that the pope may be positioning himself in safer, low volatility assets while waiting for macro clarity.

In the past year, ADA has barely moved – trading in a wide but slow range. This makes ADA one of the more “defensive” choices among the major altcoins.

The technical chart further reinforces this move. ADA has dropped 41% in the last three months. However, between June 5 and November 4, the price registered lower lows while the momentum indicator formed higher lows. This is a classic bullish divergence pattern that often appears before a trend reversal.

Read also: Bitcoin Plunges: Is BTC Heading Into a Long-Term Downtrend? Analysts Weigh In

It should be noted that a similar divergence setup appeared earlier between June to mid-October. However, the previous rebound was limited below $0.69. This time, lower lows are more evident, which could provide stronger upside momentum if this pattern is proven.

The next key resistance for ADA is at $0.61, about 8% above current levels. A breakout above that level could open a path towards $0.73, and a consistent daily close above $0.73 could extend the upside towards $0.93 or higher.

However, if the price drops below $0.49, this bullish setup will fail, opening up the potential for a deeper correction.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Whales Buying LINK, PENDLE, ADA Before US CPI. Accessed on November 14, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.