Download Pintu App

Is the Crypto Market Entering a Bear Phase? Experts Weigh In

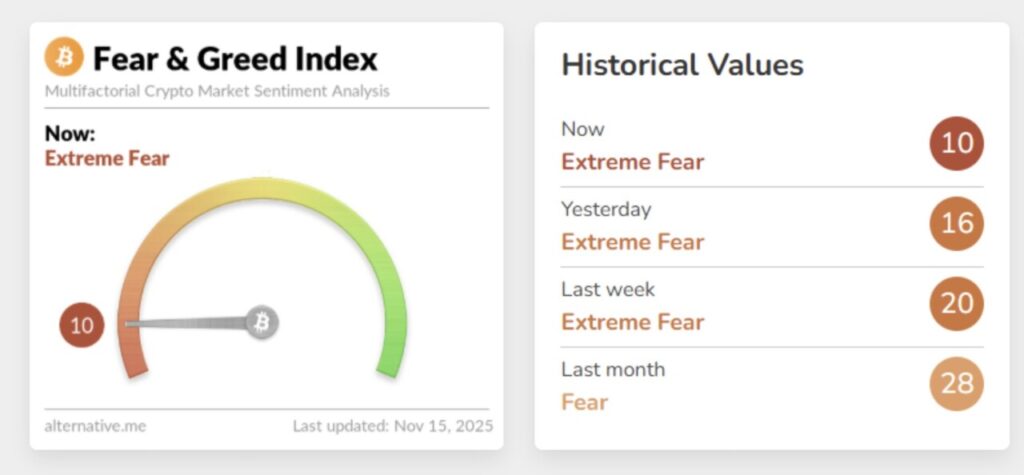

Jakarta, Pintu News – Bitcoin (BTC) fell below the $100,000 level for the second time in a week, recording a monthly decline of 12%. In the same period, the overall crypto market has lost more than $700 billion, as the Fear and Greed Index dropped to the “extreme fear” zone.

Do these market indicators indicate the beginning of a bear market phase? To answer this, a thorough technical analysis and historical review is necessary.

Sentiment Signals Lead to Bearish Market Levels

The Fear & Greed Index currently at 10 reflects extreme levels of fear, comparable to conditions in early and mid-2022-two periods confirmed as bear market phases.

Read also: Bitcoin Tends to Be Bearish, These 3 Altcoins are in the Spotlight

Latest developments:

- Yesterday: 16

- Last week: 20

- A month ago: 28

This data indicates a continued increase in fear, rather than a stabilization of sentiment. Such a phenomenon often characterizes the beginning of a long-term market downtrend, where fear pressure continues to increase without any significant recovery.

However, sentiment indicators are not definitive proof that the market has entered a bearish phase. They only reflect investor capitulation or fatigue, not confirmation of the direction of the long-term trend.

Bitcoin Breaks Major Bull Market Support

The 365-day moving average (365-day MA) serves as a long-term structural turning point in the Bitcoin price cycle. Currently, this indicator is around $102,000, while Bitcoin price is trading below that level.

This mirrors the events of December 2021, when prices also lost support from the 365-day MA and began a bear market phase that lasted months.

Historically, failing to reclaim this level in a short period of time has often signaled a price cycle regime shift, from a bull market to a bear market. In a technical context, this is one of the strongest signals in favor of a potential transition to a bear market phase.

On-Chain Cost Basis Indicates Early Capitulation, Not Peak Distribution

UTXO’s 6-12 month realized price is currently around $94,600, and Bitcoin’s price is only slightly above this level. This group of holders are investors who made purchases during the post-ETF rally, reflecting confidence in the bull cycle.

When their positions start entering loss territory, the market structure tends to weaken. A similar situation occurred in 2021, when Bitcoin dropped below the cost basis of this group-which then became one of the last signals before the long-term downward trend began.

Now, this pressure on the cost base is reappearing for the first time since 2022, indicating a possible mid-cycle correction rather than a full-fledged macro bear trend.

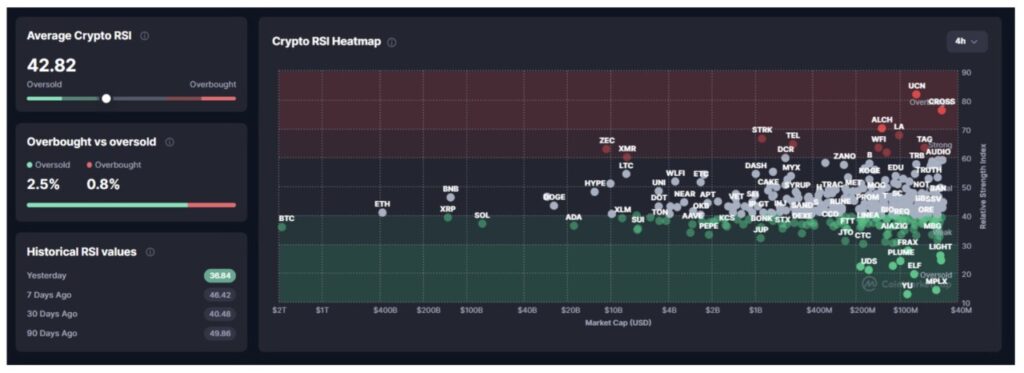

RSI Shows Oversold Condition, Typical of Mid-Cycle Correction

Broad Relative Strength Index (RSI) readings suggest the market is oversold:

- Average RSI of crypto assets: 43,09

- Bitcoin’s RSI is among the lowest among large-cap crypto assets

- Only 2.5% of assets are in overbought territory

- Majority are in the oversold zone

Read also: Zcash Could Overtake XRP? Arthur Hayes Makes Bold Claim Amid 45% ZEC Rally!

This resembles the patterns in May-July 2021, August 2023, and August 2024-all of which were mid-cycle correction phases, not the beginning of a long-term bear trend.

If the RSI stays within the oversold zone for a few weeks, it may reinforce the bearish momentum, although currently the indicator is still showing market pressure without confirmation of a trend reversal.

MACD Shows Strong Divergence Across Markets

The normalized MACD average is currently at 0.02, indicating a return of bullish momentum which is still weak. Currently, around 58% of the crypto assets are recording positive momentum.

However, Bitcoin remains in a deep negative zone, while altcoins show mixed performance. This situation reflects a transitional phase of the market, rather than an overall bearish trend.

In a full-fledged bear market, more than 90% of assets usually show a negative MACD simultaneously. Currently, this condition has not been reached, thus confirming that the market is still in the adjustment stage, not in the middle of an established macro downtrend.

Is this a bear market?

The crypto market has not currently entered a confirmed bear market, but rather is in a mid-cycle correction phase with the potential to increase towards a bearish trend, depending on subsequent developments.

Three key conditions that will confirm the transition to a bear market:

- Bitcoin stays below its 365-day moving average for 4-6 weeks. This pattern triggered the beginning of the bear market in 2014, 2018, and 2022.

- Massive distribution by long-term holders (LTH). If sales by this group exceed 1 million BTC in 60 days, then the peak of the cycle has likely been reached.

- The MACD of the overall market turns fully negative. Currently, this has not happened.

Overall, although the market has not yet entered a structural bear trend, the current fragile price position and technical pressure puts the market in a high-risk zone, where a bear market could form if Bitcoin fails to reclaim long-term support in the near term.

FAQ

What is theFear and Greed Index?

The Fear and Greed Index is a measurement tool that shows the sentiment of the crypto market, where low numbers indicate extreme fear and high numbers indicate extreme greed.

Why is the 365-day moving average important for Bitcoin?

The 365-day moving average is considered an important long-term structural pivot as it gives an idea of the Bitcoin (BTC) price trend in the past one year.

What is UTXO?

UTXO, or Unspent Transaction Output, is the output of a Bitcoin transaction that has not been spent and can be used as input for a new transaction.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Is Crypto Bear Market Officially Here. Accessed on November 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.