Download Pintu App

3 Small-Cap Altcoins That Broke Out of Accumulation Zones in November 2025

Jakarta, Pintu News – When an altcoin experiences a sharp spike and manages to break out of the long-term accumulation zone, it can be an indication of renewed attention to the project. This pattern becomes even more significant in small-cap altcoins as they usually have higher growth.

Several altcoins showed this pattern throughout November. Here are 3 analyses of small-cap altcoins that are attracting attention, based on BeInCrypto’s records.

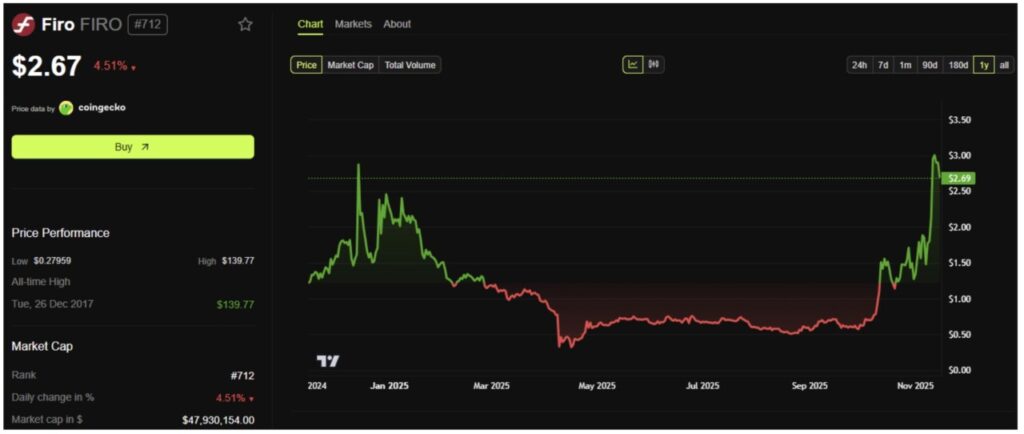

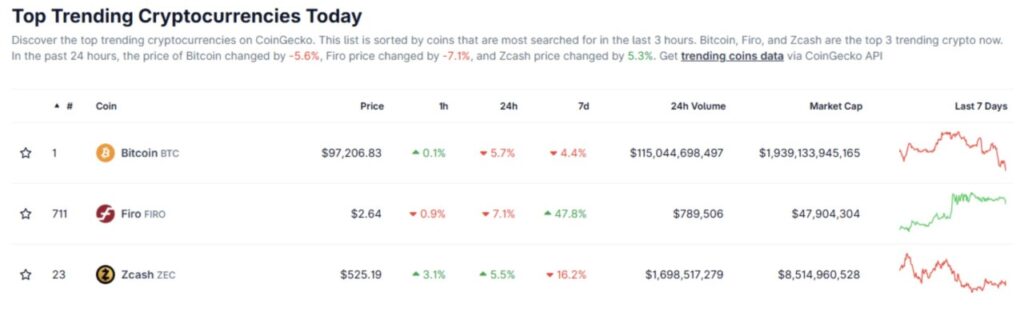

Firo (FIRO)

Firo (FIRO) is a cryptocurrency that emphasizes the privacy aspect. The recent rally it experienced was driven by the growing interest in privacy in blockchain technology.

Read also: Arthur Hayes offloads ETH, ENA, and AAVE assets amid crypto market crash

Price data from BeInCrypto shows that FIRO’s market capitalization jumped from $10 million to over $48 million since October. The asset also managed to break out of the 2025 accumulation zone.

Although its market capitalization has increased almost fivefold, FIRO is still classified as a low-cap altcoin. Many investors predict that successfully breaking out of the 2025 accumulation zone opens up opportunities for FIRO to continue its rise and potentially reach a price of 10 USD by 2026.

FIRO was also consistently at the top of the Trending category on Coingecko throughout the week, reflecting the high level of research interest among investors.

“FIRO was ranked #1 Trending on Coingecko for an entire week. If the technology is truly superior, market interest will present itself. Potential billions,” commented investor Zerebus.

Along with the price increase, the number of FIRO tokens held on exchanges fell by more than 21%, leaving only around 256,000 tokens according to data from Nansen. This decline signals that accumulation interest remains strong, despite market sentiment in November being dominated by concerns.

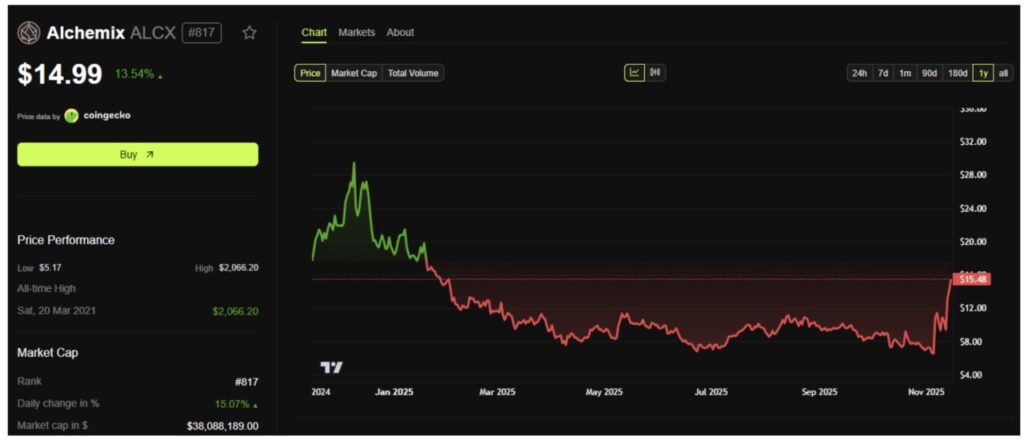

Alchemix (ALCX)

Alchemix (ALCX) is a DeFi protocol that allows users to borrow synthetic assets such as alUSD or alETH, based on the future returns of the collateral they deposit.

Price data shows that ALCX experienced a surge of 140% during November. This increase officially ended the sideways movement phase that had been ongoing since February.

The altcoin has a low circulating supply of slightly more than 3 million ALCX. Based on Ethplorer data, the first two weeks of November recorded the highest volume of ALCX on-chain transactions in the last three years, with over 20,000 ALCX transferred in the first week and over 10,000 in the second week.

This activity reflects a strong accumulation phase. Data from Nansen also shows that ALCX’s balance on exchanges decreased by more than 35% in the last 30 days.

These indicators reinforce investors’ expectations of ALCX’s continued growth. Such optimism is also supported by its relatively small market capitalization of around USD 37.5 million.

Read also: XRP 2025 Price Prediction: Likely to Surge Before the Year Ends?

“ALCX has more than 100-fold upside potential, given the large price breakout that occurred at the start of this cycle – and the current price may just be the initial stage towards such growth…” predicts investor JAVON MARKS.

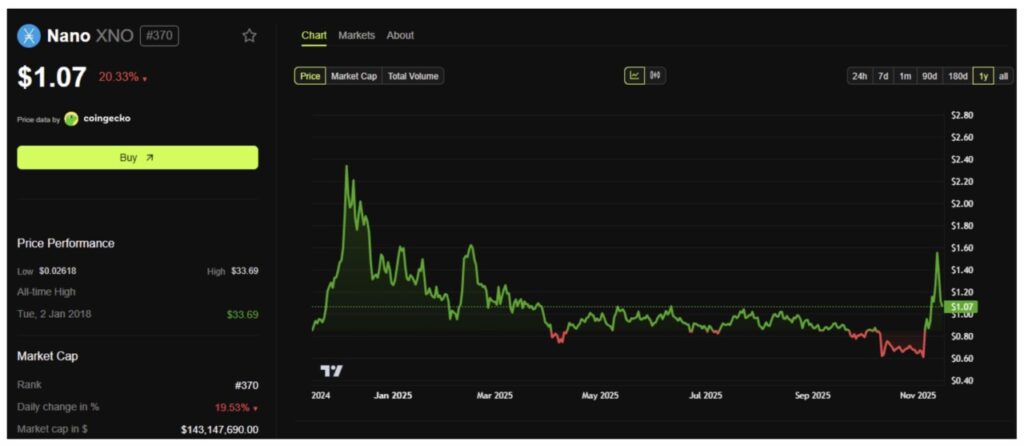

Nano (XNO)

Nano (XNO) is a cryptocurrency designed for real-world payments. Its technology enables fast, costless, and environmentally friendly transactions through its block-lattice architecture and energy-efficient consensus mechanism.

Price data shows that XNO is up more than 70% over the past month. The asset is now trading at around $1 with a market capitalization of $143 million. The rally pushed XNO out of the accumulation zone that it has been in since March.

Launched in the 2017 altcoin season, Nano has survived through various market cycles. The latest surge in trading volume sparked renewed hope from investors that XNO could potentially reach $5 or even $8.

More than 86.5 million XNOs-about 67% of the total circulating supply-have been staked by Representatives who validate network transactions. This high staking rate reflects investors’ commitment to the sustainability of the network and reinforces the upward price trend.

Breaking out of the long-term accumulation zone remained a strategy that many analysts highlighted throughout November. However, low-cap altcoins remain high risk. Lower liquidity can trigger sharp volatility when the market weakens.

Therefore, maintaining a moderate allocation is an important step in dealing with this kind of asset.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Low Cap Altcoins Broke Out of Long-Term Accumulation. Accessed on November 21, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.