Download Pintu App

Aster Price Analysis: Poised to Break $1.38 — Is a Bullish Surge Imminent?

Jakarta, Pintu News – The price of Aster (ASTER) has surged sharply recently, catching the attention of traders after recording an 8% gain in just 24 hours and more than 8% over the week.

What triggered this surge? The rally reflects heightened optimism after the postponement of the token release schedule temporarily eased selling pressure.

At the same time, Aster’s announcement of the largest trading competition with a total prize pool of $10 million sparked enthusiasm among the crypto community. The renewed confidence in Aster’s token mechanism further strengthened the positive sentiment.

Market participants also appear to be more aggressive, looking for opportunities from momentum while watching technical levels with expectation.

Price Action Strengthens: Targets Begin to Open

The price of the Aster crypto broke through the 7-day and 30-day moving averages, crossing the resistance zone that had previously held the gains over the past month.

Read also: 3 Most-Awaited Crypto Unlock Tokens in the Third Week of November 2025

The momentum indicators are showing fairly clear signals. The RSI is at 57.5, indicating a balance between buying and selling pressure. The MACD histogram turned positive (+0.034), a classic indicator that bullish momentum is starting to dominate.

Technically, the price close above the 23.6% Fibonacci retracement level at $1.16 changed the price structure to bullish. The next target is at $1.38 as the next extension level. With continued momentum, this level could potentially be tested in the next few days.

However, volume data reveals a more complex dynamic. 24-hour trading volume jumped sharply by 147% to $1.07 billion, while spot volume actually fell by 32.89%. This discrepancy hints at a potential short-term caution, where the rally may need fresh impetus from buyers to stay afloat. The swing high level of $1.26 is a crucial point.

If the price is able to close above this level, a move towards $1.38 is further open. Conversely, if it fails, a correction could occur with $1.10 as a strong support level.

Crypto Bullish Theory: Aster Prospects

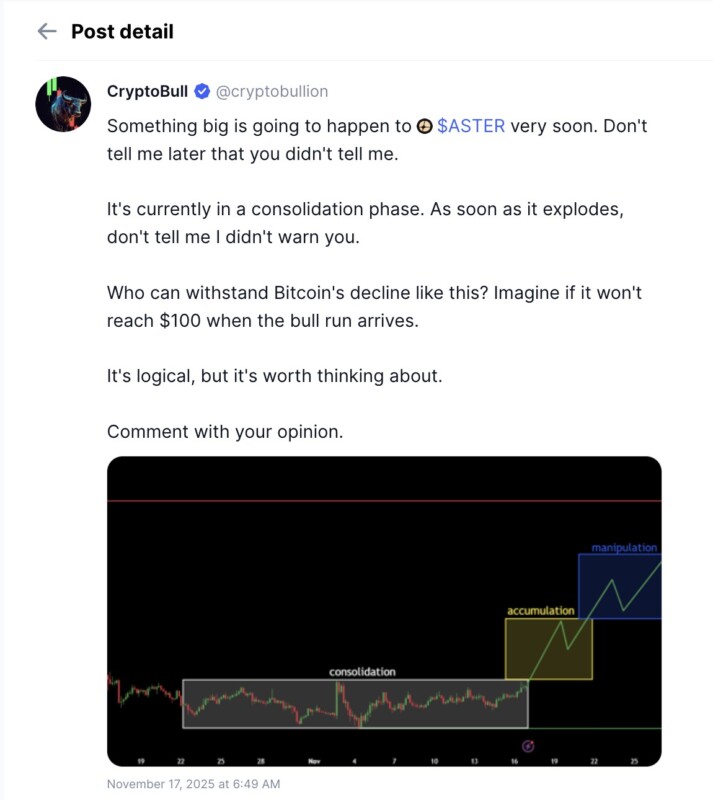

From a trader’s point of view, the current phase reflects a classic consolidation pattern. Price movements held within a narrow range are usually a harbinger of a major move. Optimists see this as an accumulation phase before the next surge, with projections of higher prices as the uptrend expands.

Read also: Pi Network’s Downtrend Ends After Breaking 262-Day Resistance – Pi Coin Ready to Recover?

According to CryptoBull, “Don’t tell me later you weren’t warned.” This sentiment reflects accumulative pressure that could potentially result in a price spike when buying momentum returns.

The narrative is growing that Aster is able to outperform Bitcoin’s performance despite the uncertainty in the main market. If market sentiment expands to become more positive, the $1.38 target could be a starting point towards the long-term potential above $3.

Bullish or Bearish?

Currently, technical indicators tend to favor a bullish view, albeit with cautious optimism. A close above $1.26 could potentially trigger a quick rise towards $1.38 and strengthen the uptrend. Conversely, if selling pressure dominates again, a correction to $1.10 or even $0.999 remains possible.

This decline reflects a potential correction of around 20%, important to note in risk management. If the bullish momentum holds, the price surge could strengthen as volume returns and the uptrend accelerates.

This makes Aster one of the key tokens worth monitoring by trend traders. Volatility will remain high, but the bias remains positive as long as key support levels are not broken.

FAQ

What triggered the recent surge in Aster prices?

Aster’s price surge was triggered by the delay in the token unlock, the announcement of a massive trading competition, and restored confidence in Aster’s tokenomics.

What is the next price target for Aster if the bullish momentum continues?

If the bullish momentum continues and the price manages to close above $1.26, Aster could reach its price target of $1.38 in the next few days.

What is the strong support level for Aster in case of a pullback?

In the event of a pullback, the strong support level for Aster is at $1.10, which could provide a solid base for the price.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Aster Price Analysis: Surge to $1.38 Awaits as Bulls Eye Breakout. Accessed on November 18, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.