Download Pintu App

Dogecoin Gains 3% Today; Weekly Chart May Be Signalling Bullish Turn

Jakarta, Pintu News – Amidst the increasing volatility of the crypto market, Dogecoin (DOGE) is also feeling the pressure. Currently, DOGE is trading at around $0.16, recording a decline of 11.7% in the last seven days. This steep decline reflects the bearish sentiment that is sweeping the market as a whole.

The 7-day price chart shows a clear downward trend, with a significant drop occurring around November 13 – when the crypto market in general crashed. Although there were slight signs of recovery, the overall price movement for the week was still negative.

So, how is the Dogecoin price moving today?

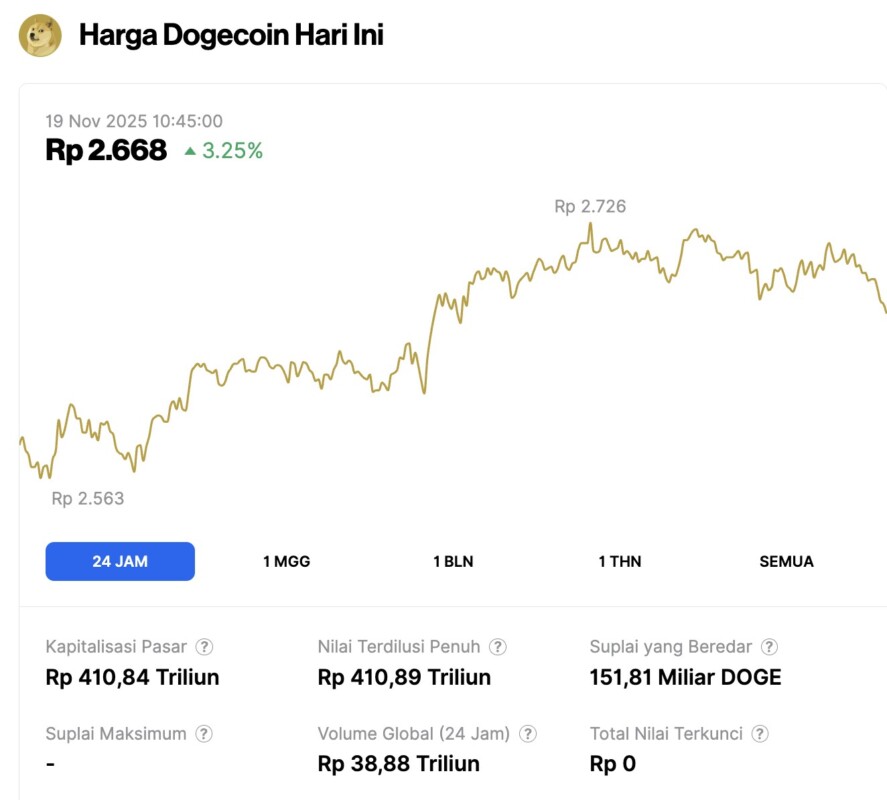

Dogecoin Price Rises 3.25% in 24 Hours

On November 18, 2025, Dogecoin saw a 3.25% gain over the past 24 hours, trading at $0.1602 — equivalent to IDR 2,668. During that time, DOGE moved within a price range of IDR 2,563 to IDR 2,726.

As of this writing, Dogecoin’s market capitalization is approximately IDR 410.84 trillion, with a 24-hour trading volume of around IDR 38.88 trillion.

Read also: Ethereum Price Climbs Back to $3,000 Today (11/19/25): Will ETH Recover?

Dogecoin Price Analysis

Technically, Dogecoin’s daily chart shows signs of consolidation just above an important support area. As of November 18, 2025, DOGE is hovering around $0.161 – below the 0.236 Fibonacci level at $0.16541, which has acted as a resistance zone in recent days.

If DOGE manages to break the level, the next potential upside is at the resistance zones of $0.17384 (Fib 0.382) and $0.18066 (Fib 0.5). Conversely, if the support at $0.1578 fails to hold, the price risks retesting the previous low, or even dropping further.

Meanwhile, the Relative Strength Index (RSI) indicator is currently at 37.93 – close to the oversold area, which technically is usually below 30. This suggests that selling pressure may be starting to weaken, and if buying interest returns, DOGE could potentially experience a reversal or at least a relief bounce.

Dogecoin Weekly Chart: Early Signs of Bullish Potential?

On the other hand, technical analysts at Trader Tardigrade revealed that Dogecoin (DOGE) is currently showing quite important technical developments on the weekly chart. The latest weekly candle closed just above the major support trend line in the $0.15 range – marking the third touch of the trend line.

Read also: Bitcoin Price Turns Green Today: Spot BTC Sales Increase!

The current price formation is compared to a similar structure that occurred between 2023 to 2024, which was then the start of a slow but steady rise as part of the overall 2021-2026 Dogecoin market cycle.

If this pattern repeats and the support level at $0.15 is maintained, then DOGE could potentially be in the early phase of a larger bullish move. This could be an important signal that positive momentum is starting to build, provided there is no downward breakout from the support zone.

FAQ

What is Dogecoin (DOGE)?

Dogecoin (DOGE) is a cryptocurrency that was originally created as a joke but has grown into a digital asset with a large and active community.

Why has the Dogecoin price dropped recently?

Dogecoin’s price dropped due to the bearish sentiment sweeping the crypto market as a whole, triggered by various external and internal market factors.

What is RSI and how does it affect the Dogecoin price?

RSI or Relative Strength Index is a technical indicator used to measure the speed and change of price movements. A low RSI indicates that the asset may be oversold and ready for a rebound.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Crypto Basic. Dogecoin Is Trading Near Key Support Level, Can A Rebound Ensue. Accessed on November 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.