Download Pintu App

Top Solana Holder Shifts 1.8 Million SOL to Coinbase — Is a Major Sell-Off Looming?

Jakarta, Pintu News – Forward Industries, the largest corporate holder of Solana (SOL), has sent more than $200 million in SOL to Coinbase (COINX) Prime. The move has sparked fears of a possible massive sell-off.

The move comes amid a near 29% drop in altcoin prices in the past month, bringing their value below the company’s average purchase price.

Is Forward Industries’ Digital Asset Treasury Strategy starting to falter?

Forward Industries began accumulating Solana (SOL) in September 2025 through a $1.65 billion Private Investment in Public Equity deal. The strategy was to build a large stake in the asset.

Read also: BTC Dominance Collapses as Bitcoin Drops Below $90K, Analysts Beware of Further Declines?

Based on the latest update, the company now holds about 6.9 million SOLs, which represents about 1.119% of the total outstanding SOL supply.

“Forward Industries’ total holding rose to 6.9 million SOLs as of November 15, 2025. We remain focused on the goal of increasing the number of SOLs per share,” the company team wrote.

The company’s strategy is to maximize value for shareholders through on-chain activities such as staking, lending, and participation in DeFi protocols. However, this approach is starting to face challenges as SOL prices continue to fall.

According to data from CoinGecko, the value of their treasury plummeted from $1.59 billion to $908 million. The NASDAQ-listed company now carries an unrealized loss of $677 million, having previously bought SOL at an average price of $232 just two months ago.

Forward Industries Holds $552 Million SOL

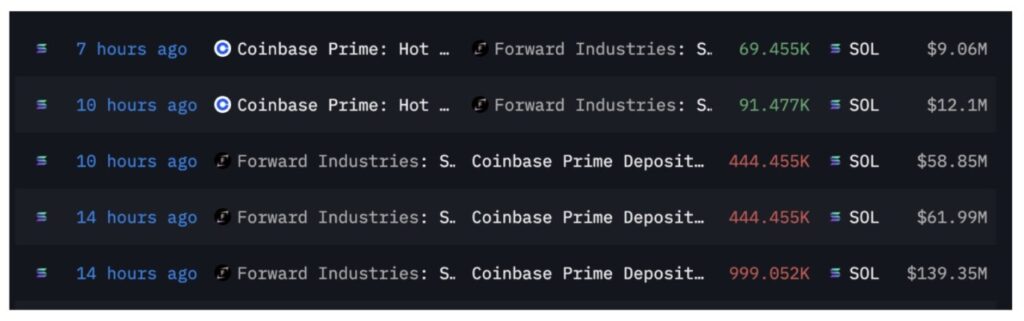

At the same time, analysts noted a large movement of Forward Industries’ digital wallet. Based on data from Arkham Intelligence, the company has transferred 1.8 million SOL worth approximately $237.6 million (based on current market prices) to Coinbase Prime through three separate shipments.

“Forward Industries bought Solana just two months ago, but has now sold it at a huge loss. Why are all investment funds selling crypto? Is it really over?” said one analyst.

However, the situation appears to be more complicated. Shortly after the outgoing shipment, on-chain data shows around 160,900 SOL were sent back from the Coinbase Prime hot wallet to the Forward wallet address. After all those transactions, the company’s wallet now holds 4.129 million SOL with a value of about $552.21 million.

Whether this transfer signals a planned sale or is simply part of a routine internal restructuring remains unclear. To date, Forward Industries has not issued any statements indicating an intention to liquidate their SOL holdings.

Read also: Ethereum Price Reclaims to $3,000 Today : Will ETH Recover?

However, concerns about a possible massive sell-off are not entirely unfounded. Throughout the fourth quarter (Q4), the crypto market was under severe pressure.

Previously, a Bitcoin (BTC)-focused digital asset treasury firm had liquidated nearly 30% of its BTC holdings earlier this month, in a bid to reduce their convertible debt burden.

Bearish pattern emerges as Solana price plummets nearly 29%

Meanwhile, Solana (SOL) continues to face growing selling pressure. Data from TradingView shows that SOL prices have fallen by almost 29% in the past month, deepening its downward trend.

The altcoin has retreated to price levels last seen in late June. As of November 18, SOL was trading at $132.47, recording a 5.4% drop in 24 hours.

Adding to the bearish sentiment, an analyst revealed that a head and shoulders pattern is starting to form on the SOL price movement chart. This pattern is a technical signal that usually signals weakening buying strength and an increased risk of a deeper correction once theneckline is broken.

“The price is currently testing the neckline of this large head and shoulders pattern. Many get upset when I post charts like this, when in fact they should be thanking me for giving them an early warning to exit while prices are still high,” the analyst wrote.

With strong market pressure and increasingly negative technical indicators, investors will be closely watching the next steps of Solana’s price movement.

FAQ

What is Solana (SOL)?

Solana is a cryptocurrency that focuses on providing a fast and efficient blockchain to support decentralized applications.

Why did Forward Industries send Solana to Coinbase Prime?

This shipment led to speculation that Forward Industries may be preparing to sell part of their holdings in Solana, especially as the current SOL price is lower than their average purchase price.

How many SOLs does Forward Industries have?

Forward Industries has about 6.9 million SOL, which is about 1.119% of Solana’s total supply.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Forward Industries: Solana Losses, Outflows. Accessed on November 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.