Download Pintu App

Ethereum Holds Steady at $3,000 — Has ETH Entered a Key Opportunity Zone?

Jakarta, Pintu News – The price of Ethereum (ETH) has experienced a sharp decline in recent days, touching its lowest level in two months. This decline comes as market volatility increases and investor confidence weakens.

Despite being under pressure, historical patterns suggest that this trend could soon reverse, opening up recovery opportunities for the altcoin king. Then, how will Ethereum price move today?

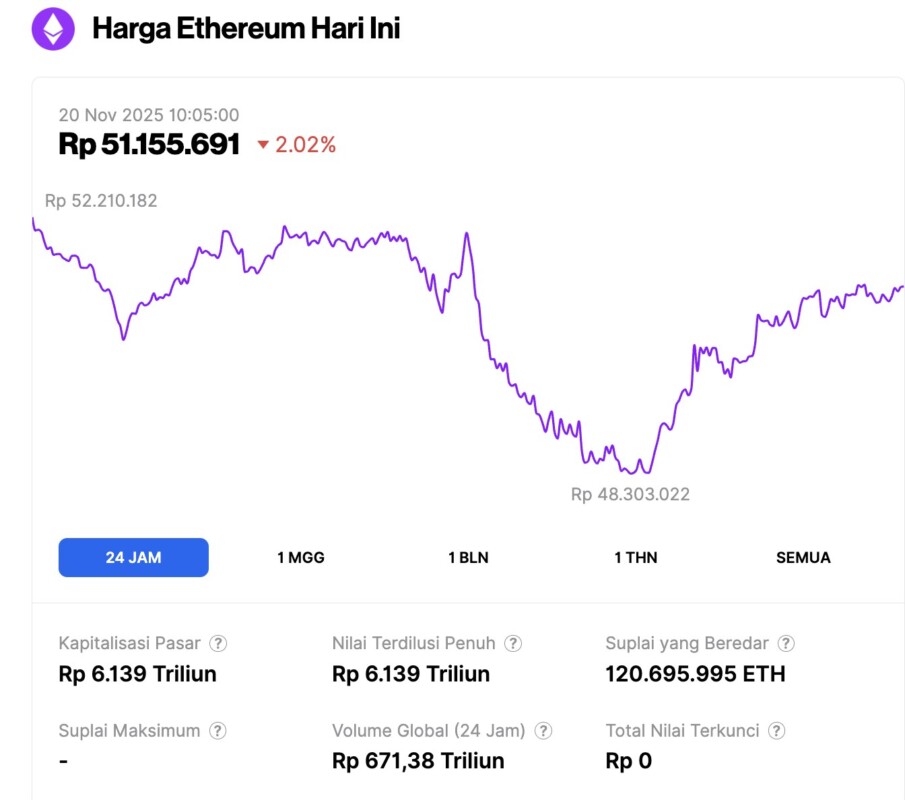

Ethereum Price Drops 2.02% in 24 Hours

As of November 20, 2025, Ethereum was trading at approximately $3,045, or around IDR 51,155,691 — reflecting a 2.02% decline over the past 24 hours. During this period, ETH hit a low of IDR 48,303,022 and climbed as high as IDR 52,210,182.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 6,139 trillion, while its daily trading volume has increased by 9% to reach IDR 671.38 trillion in the last 24 hours.

Read also: Bitcoin Holds at $92,000 — Is This the Start of a Bear Market or Just a Temporary Dip?

Ethereum Enters the “Opportunity” Zone

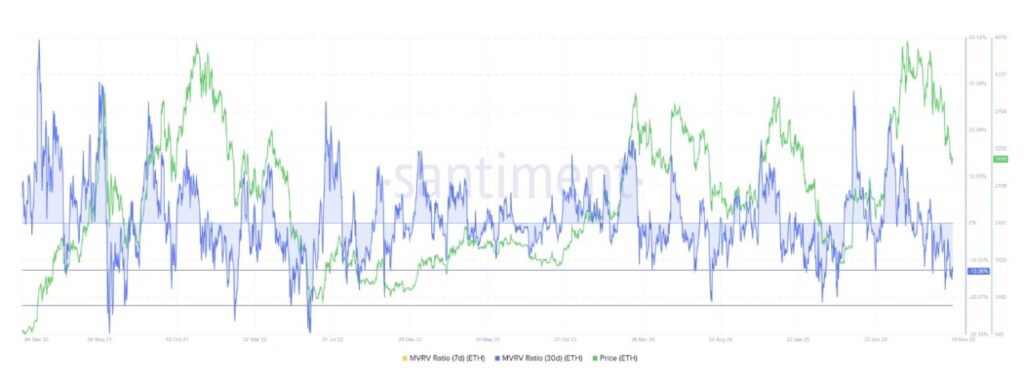

The current MVRV ratio indicates an attractive opportunity for Ethereum. The MVRV figure stands at -13%, which puts ETH firmly within the opportunity zone between -12% to -22%. Historically, this range is often a loss saturation point where selling pressure begins to ease.

Many investors consider these levels to be attractive buying areas, which often favor price recovery.

With Ethereum re-entering this zone, the situation is similar to previous periods followed by significant recoveries. The reduced incentive to sell and the emergence of new accumulations usually help ETH prices to stabilize.

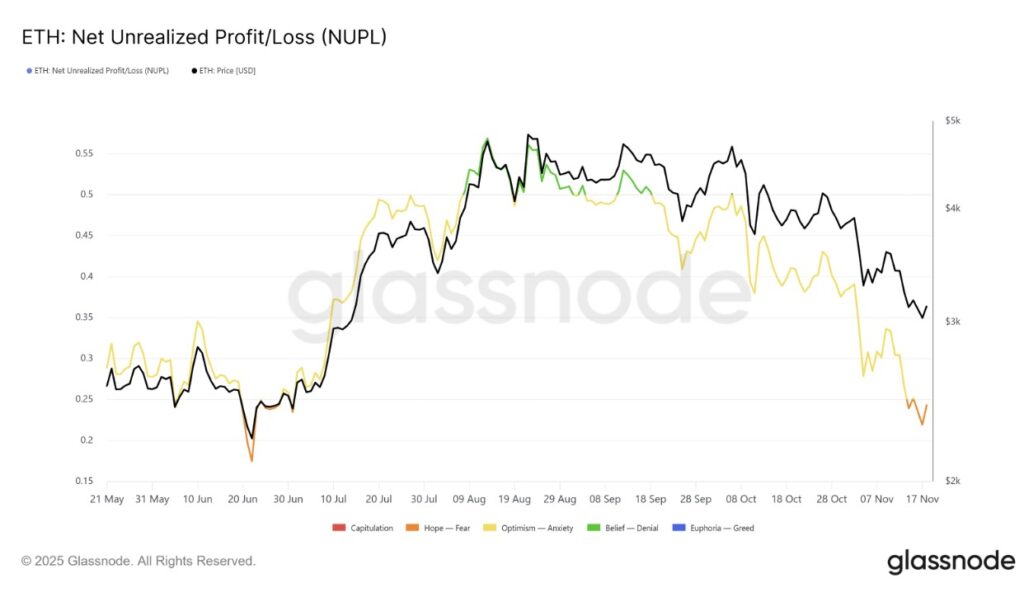

Macro momentum indicators also reinforce this potential reversal. Ethereum’s Net Unrealized Profit/Loss (NUPL) indicator started to drop below the 0.25 threshold. This zone reflects the growing fear among ETH holders, which arises from the accumulation of unrealized losses.

The last time this happened, Ethereum managed to bounce back and enter the Optimism zone. That movement marked a major turning point in the price trend.

If a similar pattern is repeated, the current fear-filled market conditions could be approaching saturation point. If NUPL follows its historical path, Ethereum has a chance to regain market confidence and upward momentum.

Read also: Bitcoin dominance drops below 60%, Altcoin Season is about to begin?

ETH price has the potential to bounce back

Ethereum briefly traded at $3,094 on November 19, still holding above the crucial $3,000 support level after a sharp decline. This is the first time in two months that ETH has dropped this low.

Maintaining this support level is crucial to prevent a deeper drop and open up opportunities for price recovery.

Currently, ETH is below the $3,131 resistance level and waiting for a trigger that could push the price up. Favorable on-chain signals suggest that a rise towards $3,287 is quite possible.

If the market momentum strengthens, Ethereum has the potential to extend its rally and aim for the $3,489 level in the next few trading sessions.

However, if selling pressure increases, ETH could break below $3,000, which would invalidate the current bullish outlook. A drop past this support level could pave the way for a further correction to around $2,814, reflecting broader market weakness and delaying a potential major recovery.

FAQ

What is Ethereum (ETH)?

Ethereum (ETH) is a blockchain platform that allows developers to build and run decentralized applications (dapps) and smart contracts.

Why has the price of Ethereum (ETH) dropped recently?

Ethereum (ETH) price fell due to increased market volatility and decreased investor confidence, hitting its lowest point in two months.

What are opportunity zones for Ethereum (ETH)?

The opportunity zone for Ethereum (ETH) is the range where the MVRV ratio is between -12% and -22%, often signaling a selling saturation point and a potential price rebound.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Crashes, Repeats History. Accessed on November 20, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.