Download Pintu App

Dogecoin Plunges to $0.15 Today: Is Further Decline on the Horizon?

Jakarta, Pintu News – As of today, Dogecoin (DOGE) is trading at $0.15, with a market capitalization of $23.84 billion. As the most popular meme coin, Dogecoin showed resilience by moving in the range of $0.1533 to $0.1625 in the past day.

In the longer term, Dogecoin has shown considerable volatility. Over the past seven days, the price of DOGE has dropped by around 8.9%. This pressure is also seen in the 4.8% decline over the past two weeks, signaling continued selling pressure.

Despite the short-term recovery, traders are now watching to see if Dogecoin has bottomed out or if it still has the potential to fall further.

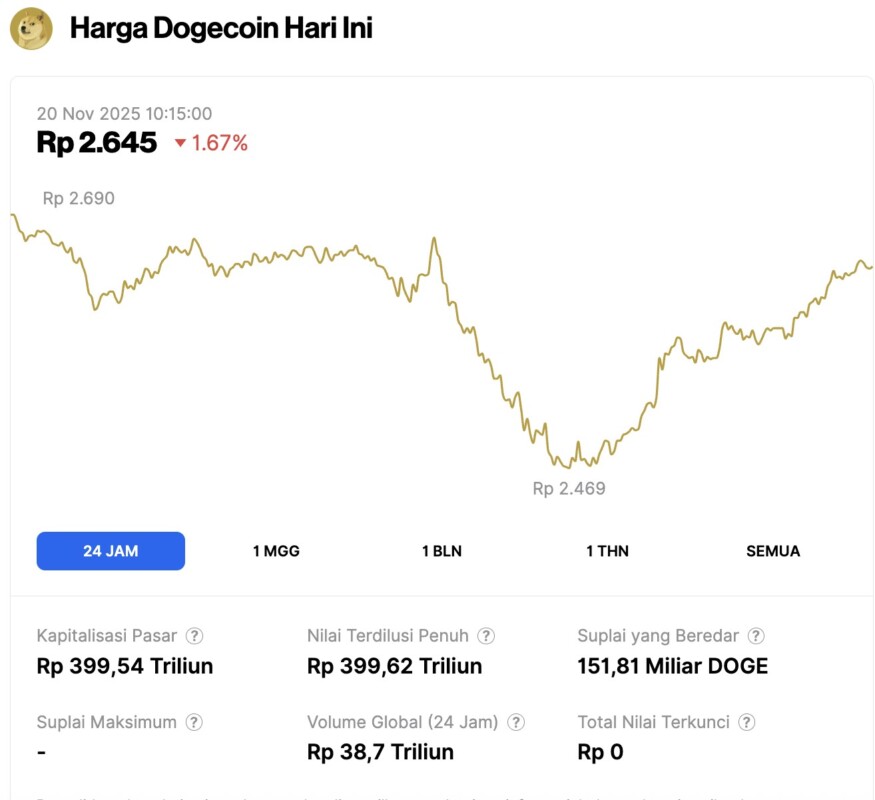

Dogecoin Price Drops 1.67% in 24 Hours

On November 20, 2025, Dogecoin saw a 1.67% pullback over the past 24 hours, with the price trading at $0.1578, or approximately IDR 2,645. During this period, DOGE fluctuated between IDR 2,690 and IDR 2,469.

At the time of writing, Dogecoin’s market capitalization is around IDR 399.54 trillion, with a 24-hour trading volume of approximately IDR 38.7 trillion.

Read also: Will Dogecoin Price Recover? Grayscale ETF Speculation Increases!

Dogecoin Price Analysis: Fibonacci Level Test is Key to Next Moves

Based on daily price movements, technical indicators suggest that Dogecoin (DOGE) is preparing to test the 0.236 Fibonacci retracement level around $0.1654.

Earlier, DOGE bounced off a key support level at Fibonacci 0, which is $0.15178. This level has so far proven to be quite strong, signaling that the price may have found a temporary low there.

However, there are still a few other Fibonacci levels worth keeping an eye on if the price starts to recover. Among these are the 0.382 and 0.5 levels, located at $0.1738 and $0.1807 respectively. These two levels could potentially be the next resistance zones.

Meanwhile, the Relative Strength Index (RSI) indicator stands at 39.35 – in the neutral zone of oversold. While the RSI has yet to touch the extreme oversold level of below 30, it shows that DOGE still has room to move, both upwards and downwards.

With the current RSI value, the market still seems to be trending bearish, which means there’s a chance Dogecoin hasn’t really bottomed out yet.

Analysts Highlight the Strongest Support Level for Dogecoin

On the other hand, crypto analyst Ali Martinez highlighted the accumulated price range for about 27.4 billion Dogecoins that investors bought at $0.08.

This means that most investors bought DOGE at this price range, making it the most important support zone right now. Since the $0.08 price is the entry point for whales who buy DOGE in bulk, this level is also considered a very crucial lower limit.

Read also: Ethereum Holds Steady at $3,000 — Has ETH Entered a Key Opportunity Zone?

Meanwhile, the upper accumulation price range was between $0.201 to $0.205, where a total of 12.16 billion DOGEs were accumulated. This zone will most likely be a resistance area. If the Dogecoin price experiences an upward rally, holders at this level may start selling to realize profits, which could ultimately limit further price increases.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Crypto Basic. Dogecoin Bounces Off Key Fib Support, Is The Bottom In? Accessed on November 20, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.