Download Pintu App

ASTER Crypto Surges 15%—Is a Break Above $1.50 Next?

Jakarta, Pintu News – Aster Token (ASTER) is starting to attract widespread attention in the market after recording a sharp surge of 15%, pushing its price to a new monthly high. The altcoin is getting a boost from rising demand and growing confidence among large investors.

This increase comes as accumulation continues by large holders, who are optimistic that ASTER prices still have the potential to rise further in the near future.

Major ASTER Holders Take Control

Large investors or whales are starting to show strong interest in ASTER, signaling a significant change in market sentiment.

Read also: Dogecoin Price Drops to $0.15 Today: Does DOGE Have the Potential to Fall Further?

In the past two days, wallet addresses holding between 100 million and 1 billion ASTER have accumulated nearly 230 million tokens. This massive buying spree-worth more than $310.5 million-demonstrates the high conviction of high-end investors.

This rapid accumulation supports the current price recovery and creates market conditions conducive to further gains. Large holders usually have a great influence on the liquidity and short-term direction of the market. Their revived interest provides a positive boost to ASTER’s growth potential.

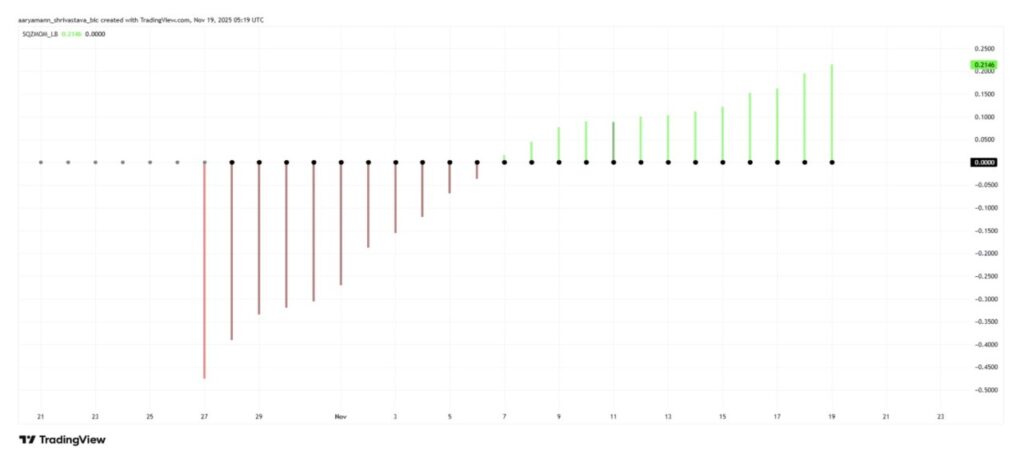

In terms of technical analysis, the momentum squeeze indicator shows pressure building due to compressed volatility. This pattern often signals the start of a big move, showing that momentum is starting to favor buyers.

If this pressure releases in a bullish direction, ASTER could potentially experience a spike in volatility accompanied by a sharp price increase. This kind of pattern has been seen in the past with other mid-cap cryptocurrencies that have recorded quick spikes.

ASTER Price Increases Significantly

ASTER’s price jumped 15% on November 19 and was hovering around $1.35. The altcoin is approaching an important resistance level of $1.39, which is also a monthly high. To break this barrier, ASTER needs consistent investor support.

Also read: Pi Network Price Jumps 8% Today: Pi Network Ready to Build a Decentralized AI Supercomputer?

Aggressive accumulation from whales and bullish macro signals indicate that the current momentum is in favor of the bulls. If ASTER manages to cross $1.39, the upside potential towards $1.50 is wide open – it could even go higher if market conditions are favorable.

However, if it fails to break the resistance, ASTER risks a correction. A drop to $1.25 could occur if uncertainty increases.

If the selling pressure continues, the price could drop further to $1.15. If the level is broken, the bullish outlook will be nullified, and ASTER could slip towards $1.00 as market sentiment weakens.

FAQ

What is Aster (ASTER)?

Aster (ASTER) is an altcoin that has recently caught the attention of the crypto market due to its sharp price increase and accumulation by large investors.

How much has the price of ASTER risen in the last 24 hours?

ASTER’s price has increased by 15% in the last 24 hours, reaching $1.35.

How many ASTER tokens have been accumulated by large investors recently?

Large investors have accumulated nearly 230 million ASTER tokens, worth more than $310.5 million.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Aster Price Jumps 15%, Aims at $1.50 as Investors Begin Accumulation. Accessed on November 20, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.