Download Pintu App

Ethereum Price Bleeds to $2,800 Today: What Happened?

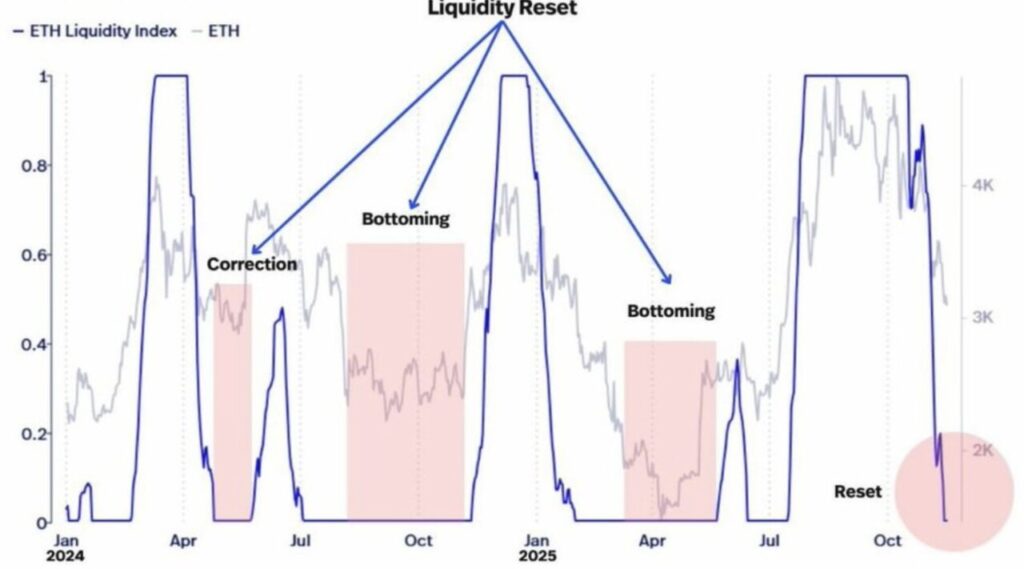

Jakarta, Pintu News – Ethereum (ETH) price is currently moving within the zone that was previously an important turning point in previous cycles. The liquidity reset signal shows a sharp decline similar to the conditions before the strong recovery took place.

ETH is moving in an increasingly narrowing pattern, with both sides of the market responding at familiar levels. Market depth is thinning again, forcing prices to move more aggressively with each swing.

This creates a scenario where price movement direction can be established quickly once liquidity starts to recover from the lower boundary of the zone.

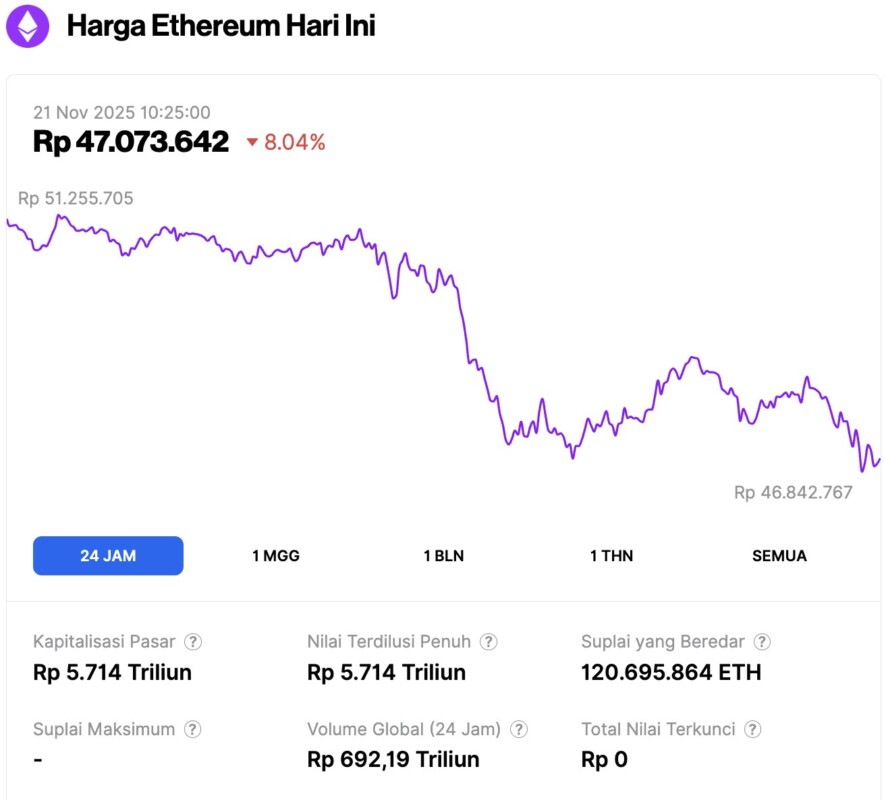

Ethereum Price Drops 8.04% in 24 Hours

On November 21, 2025, Ethereum was trading at approximately $2,804, equivalent to IDR 47,073,642 — marking a decline of 8.04% over the past 24 hours. During this time, ETH dipped to a low of IDR 46,842,767 and reached a high of IDR 51,255,705.

At the time of writing, Ethereum’s market capitalization is around IDR 5,714 trillion, while its daily trading volume has increased by 9% over the past 24 hours, reaching IDR 692.19 trillion.

Read also: Bitcoin Price Drops to $88,000 — Is a Major Rebound Coming, According to On-Chain Data?

Ethereum Price Liquidity Reset Shows Similar Patterns to Previous Cycle Bottom Points

The current liquidity data indicates a full reset that mirrors the previous historical bottom zone with a striking degree of similarity. Every liquidity dip in the past was followed by a strong reaction as market depth began to improve again.

Ethereum price is currently trading around $3,019, while the market is absorbing this new reset phase. ETH is moving around the zone that previously triggered a major trend reversal at the beginning of the year, and this has again attracted the interest of buyers. Many market participants have reacted quickly to similar reset areas in previous cycles, and similar behavior could potentially occur again this time.

Currently, the Ethereum price is interacting with levels where the thinning market depth is causing an increasingly sharp compression of price movements. This compression narrows the room for maneuver and increases the chances of a strong directional move as market depth begins to return.

Reset zones rarely stay calm for long as market participants usually move quickly once the first signs of market recovery appear. This latest reset places ETH in a familiar technical zone, where significant activity often emerges quickly.

Traders are responding to these conditions as the pattern in the previous cycle showed a clear change from a similar structure. This similarity provides a strong reason for the market to keep a close eye on ETH’s movement as it approaches the next phase of trend reversal.

Descending Wedge Pattern Forms a Clear and Tightening Technical Map

The chart shows that ETH is currently moving inside a descending wedge pattern that has shaped the direction of price movement over the past few weeks. ETH price touched the bottom of the wedge at around $2,930 and showed a consistent buy response each time it was tested.

Read also: Dogecoin Price Drops 2% Today: Will DOGE Hold at $0.15 or Plummet Lower?

Sellers continue to defend the descending upper boundary, while the space between the upper and lower lines narrows with each price swing. This increasingly tight pattern creates additional pressure inside the wedge and limits the room forsideways movement.

Immediate resistance is at $3,206, while a stronger barrier is at $3,607 – both of which must be broken before buyers can take wider control.

Ethereum price is now forming a clearer technical map as the wedge structure tends to break when its boundaries converge tightly. The Money Flow Index (MFI) is currently in the middle range and indicates a steady inflow of funds, not a signal of exhaustion or weakness. This position opens up the opportunity for ETH to attempt a breakout if it is able to break the downtrend line.

ETH’s long-term outlook will improve significantly if the price manages to close above the upper boundary of the wedge, as this paves the way towards the $4,244 target. A successful breakout could give ETH room to aim for the $4,800 level as the chart structure improves and upside momentum strengthens again.

Conclusion

Ethereum price is currently in a zone that has the potential to push the direction of the movement quickly. ETH is still respecting the lower boundary of the wedge while approaching the point where compression pressure could trigger a stronger movement.

If it manages to break the $3,206 level cleanly, the path to the middle area at $3,607 opens up, with a potential extension to $4,800. However, failure to break the upper boundary of the wedge will keep ETH near the support level and delay a more significant recovery phase.

FAQ

What is Ethereum (ETH)?

Ethereum (ETH) is a blockchain platform that allows developers to build and run decentralized applications and smart contracts.

Why is Ethereum (ETH) liquidity important?

Liquidity determines the ease of buying or selling Ethereum (ETH) without significantly affecting the price. High liquidity indicates a healthy market.

What does “liquidity reset” mean in the context of Ethereum (ETH)?

A liquidity reset refers to a sharp drop in market depth that is often followed by a period of price recovery as the market begins to stabilize.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Hits Historical Liquidity, Reset: Is a Bounce Coming?. Accessed on November 21, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.