Download Pintu App

5 Altcoins that Plummeted When Bitcoin Hit $86,000

Jakarta, Pintu News – Bitcoin’s (BTC) sharp drop to $86,000 (Rp1.44 billion) is driving huge pressure on the altcoin market. Market data shows that several crypto assets have experienced aggressive corrections in the last 1 month, especially projects with ecosystems that depend on high liquidity and DeFi activity. This article reviews 5 altcoins that have plummeted, complete with project descriptions and price drop data.

Five Key Points:

- Bitcoin’s drop below $90,000 triggered a massive sell-off in intermediate altcoins.

- Altcoins in the NFT, DeFi, and liquidity layer sectors experienced the deepest correction.

- Three altcoins recorded monthly declines of more than 65%.

- The largest market cap decline was experienced by Synthetix (SNX) with a valuation of IDR3.26 trillion.

- The data shows the high correlation of altcoin sell-offs to Bitcoin volatility.

- Summary: Five altcoins-LooksRare (LOOKS), Perpetual Protocol (PERP), Maple Finance (SYRUP), GT Protocol (GTAI), and DeepBook Protocol (DEEP)-experienced significant declines over the past month as market pressure emerged after Bitcoin (BTC) fell to $86,000.

1. LooksRare (LOOKS)

LooksRare (LOOKS) is the native token of the LooksRare NFT marketplace designed to incentivize users through trading activity-based rewards. The platform was a strong competitor to OpenSea in 2022 thanks to its “community-first” mechanism that provided users with a portion of the platform’s revenue. However, interest in NFTs declined sharply from 2023, causing great pressure on LOOKS’ performance.

Over the past month in November 2025, LOOKS prices fell 78%, from a range of around IDR145 to IDR31.95. This monthly decline was also compounded by the trading volume of NFTs, which fell by more than 40% month-on-month on the LooksRare marketplace. In addition, the token’s total market cap now stands at IDR31.8 billion, much smaller than its peak of over IDR1 trillion at the start of the NFT bull cycle.

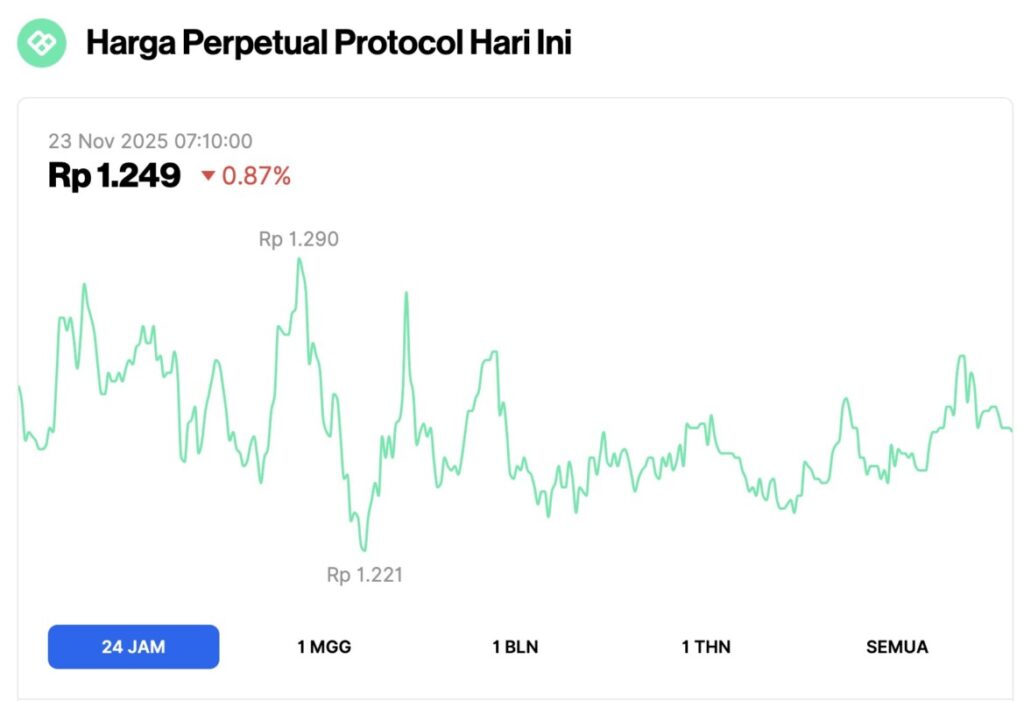

2. Perpetual Protocol (PERP)

Perpetual Protocol (PERP) is a decentralized derivatives platform that allows traders to open long or short positions on various crypto assets using perpetual futures. The protocol offers high leverage and on-chain liquidity through a specialized AMM model for derivatives contracts. Despite being one of the biggest players in the DeFi sector, the on-chain derivatives ecosystem is facing pressure as global liquidity tightens.

In the past 1 month, PERP recorded a 65.87% price decline, dropping from around IDR3,700 to IDR1,250. This decline coincides with a decrease in Total Value Locked (TVL) in the derivatives protocol by more than 30% based on DefiLlama data. PERP’s market cap is now at around IDR90.72 billion, relatively small compared to the protocol’s peak TVL value which once passed IDR10 trillion during DeFi summer.

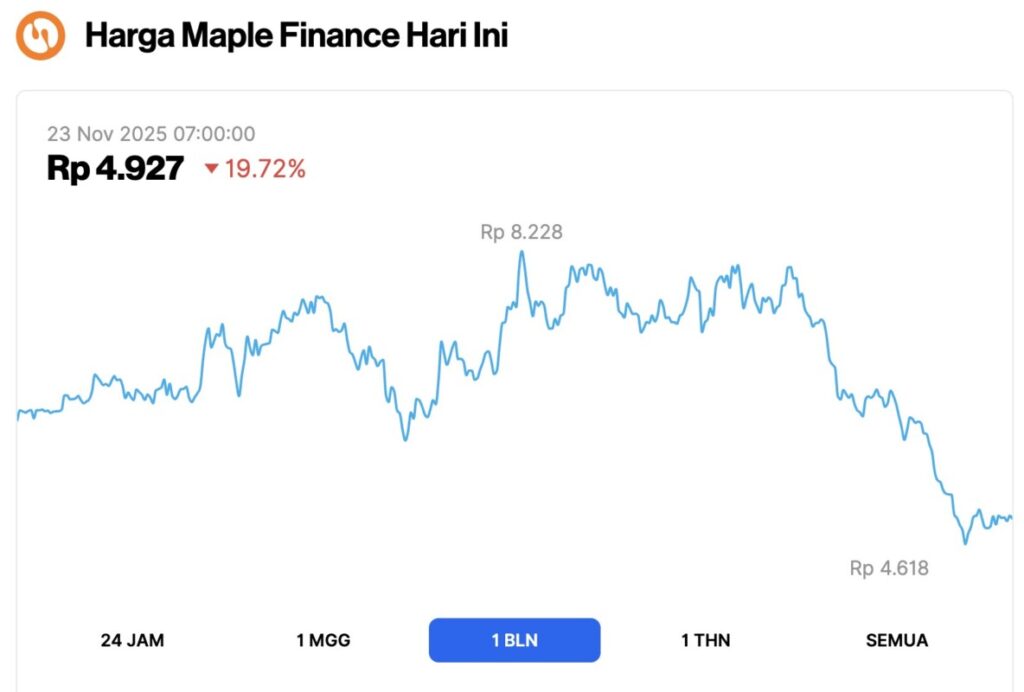

3. Maple Finance (SYRUP)

Maple Finance (SYRUP) is an institutional lending protocol that provides unsecured credit facilities to crypto funds and market makers. It plays an important role in providing liquidity to institutions with structured lending schemes. However, the decentralized credit sector is highly sensitive to macro volatility and borrower defaults.

SYRUP experienced a 16.02% price correction over the past month, dropping from around IDR5,900 to IDR4,958. This decline occurred after Maple announced an increase in credit risk on one of its loan pools with a delinquency rate of more than 8%. Although SYRUP’s market cap is still large at IDR5.64 trillion, concerns over credit risk are causing additional selling pressure amid bearish sentiment in the crypto market.

Read also: 7 Crypto Neobanks with the Potential to Shine in 2026

4. GT Protocol (GTAI)

GT Protocol (GTAI) is an AI Web3 platform that offers smart trading, copy trading, and automated asset management by utilizing artificial intelligence. The project experiences significant growth in 2024-2025 as the trend of AI in crypto increases. However, AI narrative-powered tokens are also highly susceptible to corrections when market sentiment weakens.

During November 2025, GTAI prices fell 49.40%, from around IDR1,670 to IDR845.1. A decline of more than 30% was also seen on a weekly basis, indicating continued selling pressure. In addition, GTAI’s market cap plummeted to IDR34.04 billion from a level that was previously above IDR150 billion. This correction is in line with the decline in the global AI crypto index, which fell by more than 25% in the past month.

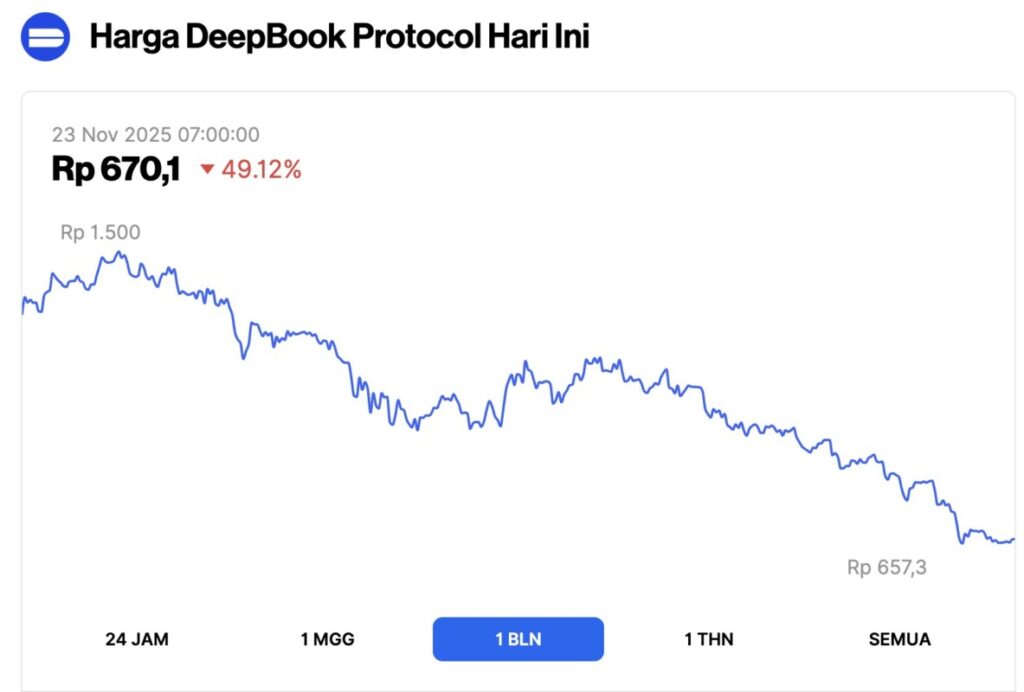

5. DeepBook Protocol (DEEP)

DeepBook Protocol (DEEP) is an on-chain orderbook built to provide institutional liquidity on blockchain networks, especially in the DeFi sector. The project aims to be the liquidity backbone for decentralized trading applications. However, the decline in spot and derivatives trading volumes during the bear market has depressed the token’s performance.

In one month, DEEP prices corrected 48.82%, from around Rp1,310 to Rp670.4. This decline also coincided with a drop in orderbook usage at several DEX aggregators. Although DEEP’s market cap reached IDR1.66 trillion, the decline in cross-chain liquidity was a major source of pressure for the token. Trading activity was also down by more than 20% compared to the previous month.

FAQ

What are the main reasons altcoins go down when Bitcoin falls?

Altcoins usually have a high correlation with Bitcoin (BTC), so when BTC drops to $86,000, most investors withdraw liquidity from higher-risk assets.

Why did DeFi altcoins like PERP and DEEP drop significantly?

The decline in DEX trading volume and liquidity during November 2025 prompted a major correction in DeFi assets that rely on on-chain activity.

Are NFT marketplaces like LooksRare impacted more?

Yes. The decline in NFT activity to above 60% made LooksRare (LOOKS) fall deeper than other altcoins with a 78% correction.

Are large altcoins more resilient to price drops?

Large altcoins with a market cap of trillions such as Synthetix (SNX) tend to be more stable, but still recorded a decline of more than 60% in the last 1 month.

Can this downward pressure continue?

If Bitcoin (BTC) continues to stay below the $90,000 psychological level, the risk of continued pressure on altcoins remains high based on historical correlation patterns.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Market Door

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.