Download Pintu App

Altcoins Aren’t Going Anywhere: 3 Positive Signals Emerging Amid Rising Market Fears

Jakarta, Pintu News – While total market capitalization has declined for four consecutive weeks and the market has lost nearly $1 trillion throughout the month of November, data shows a stark difference in how investors are withdrawing their capital. Mid- and small-cap assets are giving surprisingly positive signals.

What exactly is this signal, and what does it mean in the current context? The following report provides a detailed explanation.

3 Positive Signals for Altcoins Amid a Very Pessimistic Market

The market sentiment index was in the “extreme fear” zone throughout most of November. However, some positive signals are starting to emerge, providing a glimmer of hope for altcoins.

Read also: 2 Cryptocurrencies That Could Surpass a $100 Billion Market Cap by 2026

1. Mid- and Low-Cap Asset Resilience

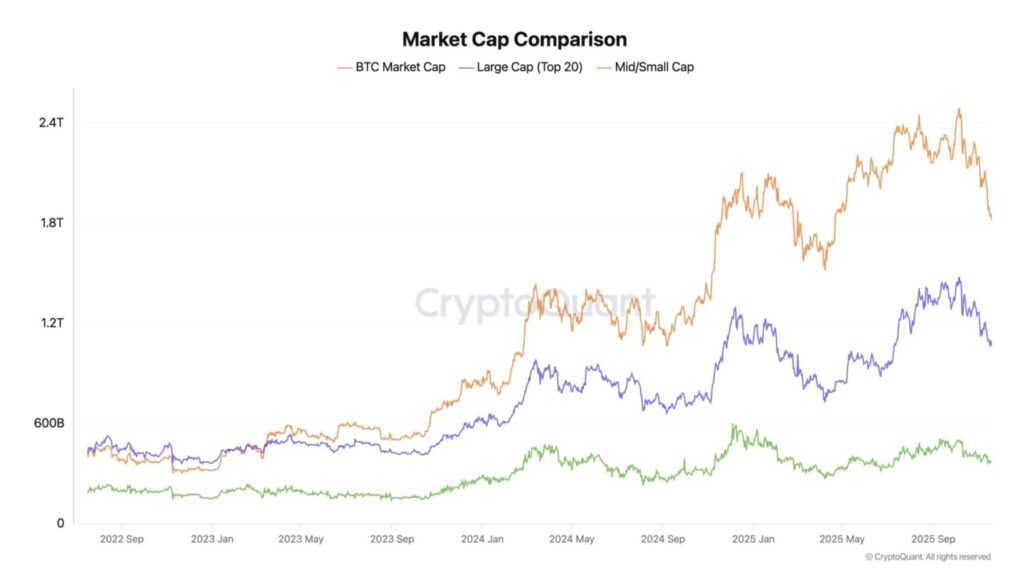

A report from CryptoQuant compared the market capitalization performance of Bitcoin (BTC), large-cap altcoins, and mid- and small-cap altcoins. The results showed that assets with lower capitalization showed significant resilience.

Based on the market capitalization comparison chart, Bitcoin recorded the sharpest decline during November. Large capitalization altcoins (top 20) also experienced a decline, although not as large as Bitcoin. Meanwhile, mid- and small-cap altcoins only experienced mild declines and were relatively more resilient to market pressures.

“Large caps are struggling, but not as badly as BTC, while mid-small caps are showing real resilience,” said Darkfost analysts.

Interestingly, the chart shows that only the market capitalization of Bitcoin and large altcoins have set new record highs. Mid- and low-cap assets have yet to return to the peaks they reached in late 2024.

Psychologically, when altcoins fall too deeply – losing 80-90% of their value – holders tend to think of their assets as “already lost,” and so are not compelled to panic sell.

2. The Different Direction of BTC and Altcoin Domination

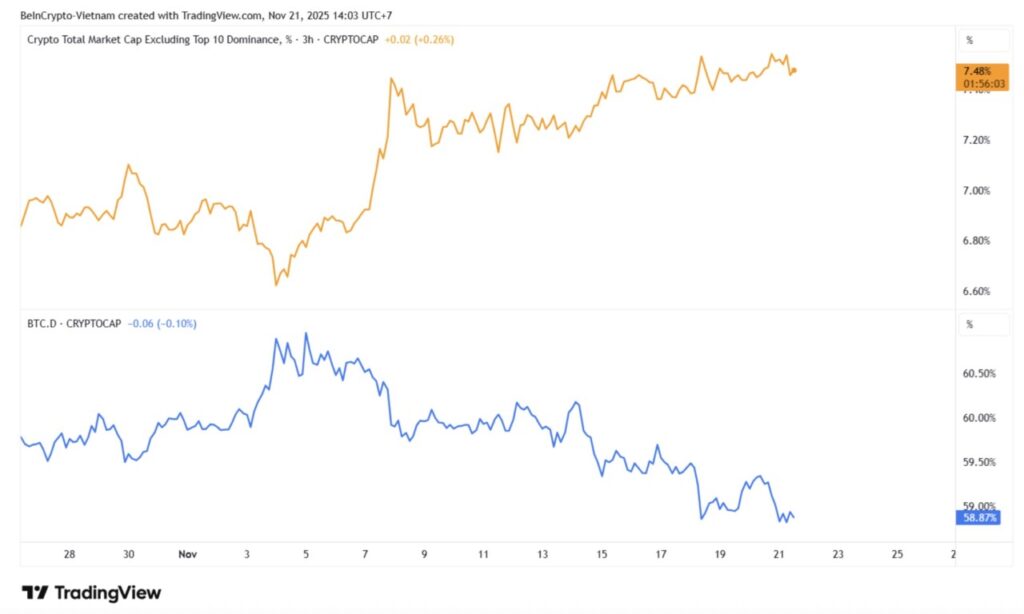

The second important factor is the difference in direction between Bitcoin dominance (BTC.D) and other altcoin dominance (OTHERS.D). Bitcoin dominance measures the share of market capitalization held by BTC, while OTHERS.D measures the market share of all altcoins outside the top 10.

The chart shows that in November, OTHERS.D increased from 6.6% to 7.4%, while BTC.D actually dropped from 61% to 58.8%.

This difference indicates that altcoin investors are no longer prone to panic selling even when they are experiencing losses. Instead, they choose to hold their positions and wait for a recovery.

Historically, when BTC.D declines and altcoin dominance increases, the market often enters a bull cycle for altcoins.

Read also: Bitcoin Price at $87,000 Level Today: If Sentiment is Positive, BTC Has the Potential to Recover!

3. Altcoin Trading Volume Increases

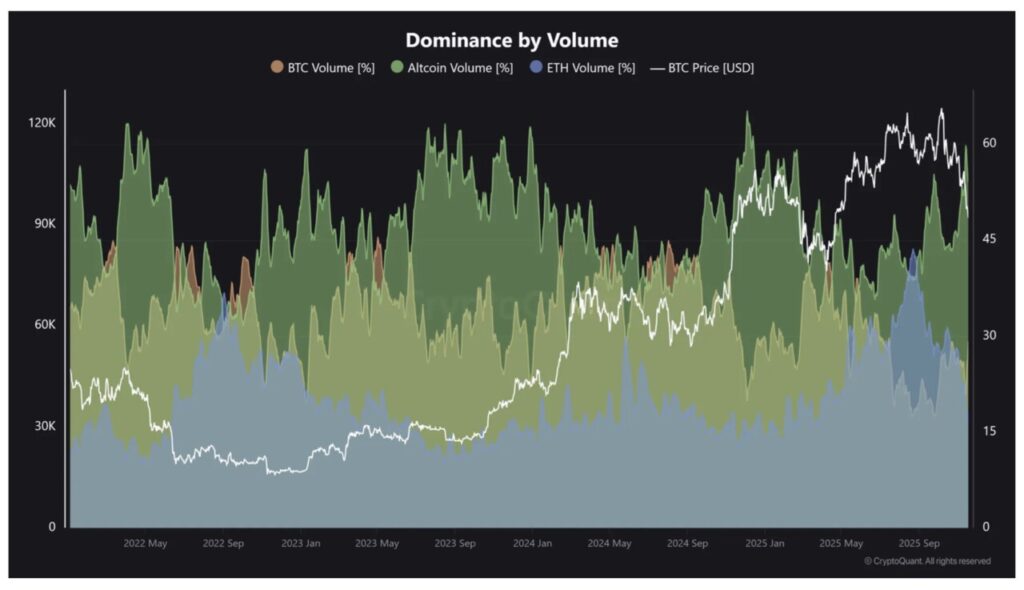

Data from Binance also shows that currently 60% of trading volume comes from altcoins – the highest figure since early 2025. This suggests there is increased interest and activity in the altcoin market, even though the general sentiment of the market is still one of extreme fear.

Maartunn analysts believe that this data shows where the real trading activity is happening. Currently, that activity is heavily concentrated outside of the major cryptocurrencies. Altcoins are again becoming very popular trading instruments on the Binance platform.

“Historically, an increase in the share of altcoin trading volumes has often coincided with increased speculation in the market,” Maartunn said.

Conclusion

Overall, altcoins with medium and small capitalization are currently receiving strong liquidity flows. In addition, they are also showing better price performance as well as increased market share.

These factors indicate that altcoin holders have high expectations of a potential recovery from the market bottom.

FAQ

What is Bitcoin Domination (BTC.D)?

Bitcoin dominance (BTC.D) is a measure that shows the percentage of total market capitalization held by Bitcoin (BTC) compared to other cryptocurrencies.

How did the drop in value between Bitcoin and altcoins compare in November?

In November, Bitcoin (BTC) experienced the sharpest decline, while large-cap altcoins also fell but not as much as Bitcoin. Medium- and small-cap altcoins only fell slightly.

What is Other Dominance (OTHERS.D)?

Other Dominance (OTHERS.D) is a measure that shows the percentage of market capitalization held by all altcoins except the top 10.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Retail Investors Are Betting on a Recovery for Mid and Small Cap. Accessed on November 24, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.