Download Pintu App

Ethereum Price Rebounded to $3,000 Today: Tom Lee Predicts ETH Could Explode to $9,000!

Jakarta, Pintu News – Tom Lee’s latest prediction about Ethereum (ETH) has the crypto world abuzz. According to him, ETH’s recent sharp decline is a strategy to shake out weak investors before a massive rally.

Lee predicted that Ethereum could bottom out at around $2,500, then surge to $9,000, even as early as January.

Currently, Ethereum is starting to show signs of recovery. However, traders are still wondering: will Tom Lee’s aggressive prediction of ETH breaking $9,000 actually come true, or is this just a temporary bounce (bull trap) before a further decline?

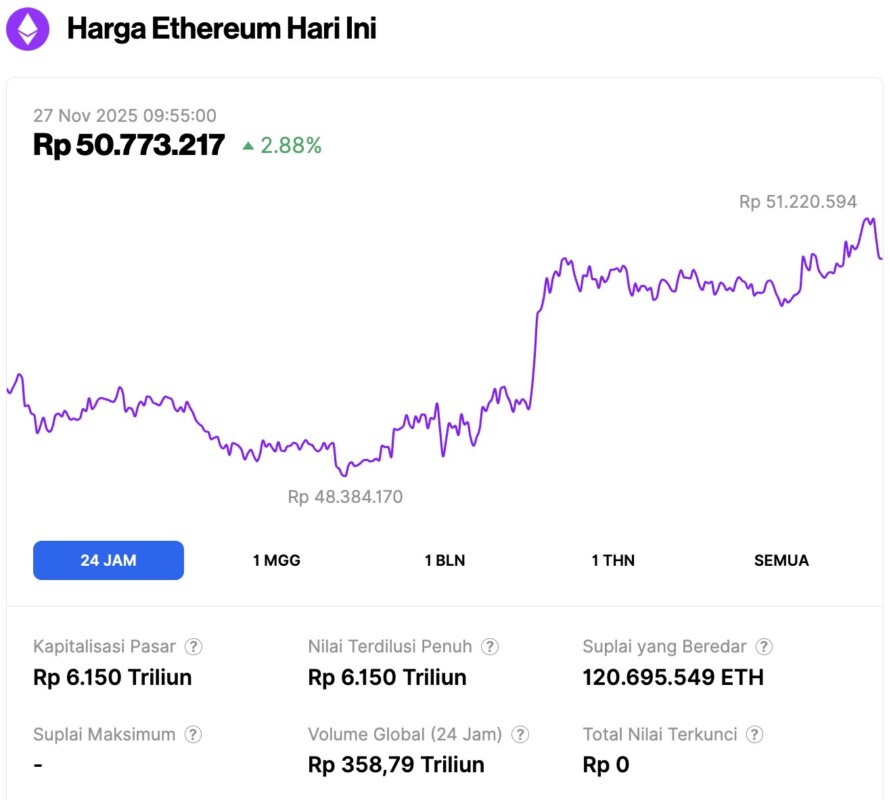

Ethereum Price Rises 2.88% in 24 Hours

As of November 27, 2025, Ethereum was trading at approximately $3,039, or around IDR 50,773,217 — marking a 2.88% increase over the past 24 hours. During that time, ETH fluctuated between a low of IDR 48,384,170 and a high of IDR 51,220,594.

At the time of writing, Ethereum’s market capitalization is estimated at about IDR 6,150 trillion. Meanwhile, its 24-hour trading volume has dropped by 25%, falling to IDR 358.79 trillion.

Read also: Bitcoin Price Rises to $91,000 Today: Here’s BTC’s Technical Outlook!

Tom Lee’s Ethereum Prediction: Why He Forecasts a Bottom at $2,500

Tom Lee argues that Ethereum’s price drop from $4,800 to $2,800 does not change the long-term value of the asset.

He revealed that BitMine has appointed Tom DeMark as a strategic advisor, and the two share the view that this drop was triggered by an engineered liquidation action, rather than fundamental weakness.

Lee described the recent price fall as a “forced washout”, not a structural damage to Ethereum’s foundation. According to him, the real upside potential will begin once this market cleansing process is complete.

Lee even mentioned that it would be more ideal if crypto prices continued to fall slowly, as it would provide a healthier base for the next spike.

Why Tom Lee Says January Could Be a Moment of Price Explosion

BitMine has just announced an update on its asset holdings, revealing that they own over 3.6 million ETH at an average price of $2,840. This means that despite the downturn in the crypto market, their Ethereum holdings are still in a profit position.

Even though the market is bleeding, Tom Lee still gives a very optimistic bullish prediction for the rest of the year.

“In the short term, ETH may drop to $2,500, but that’s only a small correction compared to its upside potential,” Lee said. He predicts that Ethereum could reach $7,000 to $9,000 by the end of January.

Currently, Ethereum has rebounded by 10%, which has traders increasingly focused on the possibility of a bullish trend reversal.

Ethereum Price Prediction: Between Optimism and Technical Reality

Although Tom Lee’s prediction for Ethereum is very optimistic, the technical conditions give a different signal.

Read also: Crypto Price Predictions: ETH, XRP, and DOGE Show Signs of Recovery

On November 13, Ethereum broke below the 220-day diagonal support (red icon), which was a strong indication that the previous uptrend was over. However, now the bulls are starting to fight back. ETH price is attempting a breakout from a short-term descending wedge pattern – an early signal of a potential recovery.

However, even if this breakout results in a price spike, ETH will still face strong resistance at the diagonal support line that has now turned into resistance. This level has previously rejected ETH’s upward movement several times, and failure to break through it again could wipe out any gains made.

Therefore, the upside potential is currently limited by the $3,500 area, which is a double resistance both horizontally and based on Fibonacci retracement.

Will Tom Lee’s Prediction Come True?

Tom Lee’s bullish outlook has injected optimism into the ailing crypto market. He projects a bottom at $2,500 and targets Ethereum prices to reach $7,000-$9,000 by January – a projection that clearly shows significant upside potential.

However, the technical indicators are still giving warnings. ETH price recovery must first break through the initial hurdle at the $3,500 level to pave the way for higher targets.

Right now, Ethereum is at an important crossroads. The next few days will determine whether Tom Lee’s aggressive predictions will be proven, or if the technical charts will win again.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Tom Lee Gives $2,500 Ethereum Bottom Prediction – Believes Price Will Hit $9,000 in January 2026. Accessed on November 27, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.