Download Pintu App

4 Reasons Why a Crypto Market Bull Run is Just Around the Corner

Jakarta, Pintu News – The crypto market is showing significant signs of recovery today, November 27, with Bitcoin (BTC) hitting a new high of $91,345, which is the highest peak since November 20 and ~14% above this month’s low. Ethereum (ETH) and Dash (DASH) also saw gains. Here are four key reasons that suggest the crypto market may be entering a bull run phase.

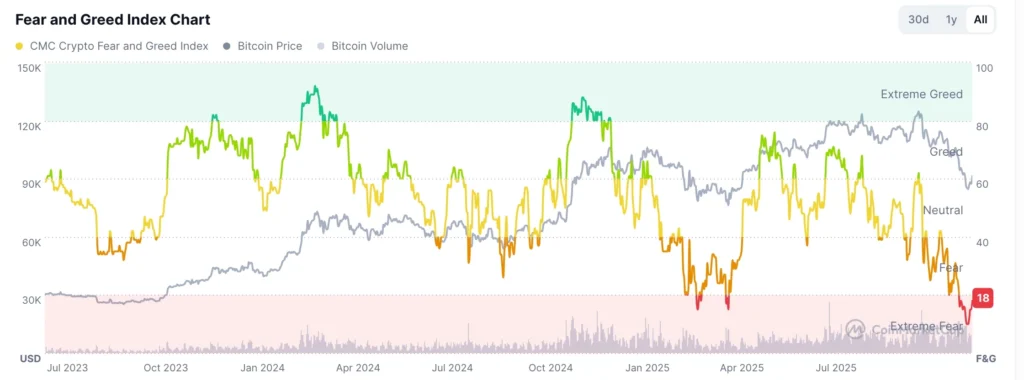

Fear and Greed Index Increases

One of the key indicators pointing to a potential bull run in the crypto market is an increase in the Fear and Greed Index. This index briefly dropped to 8 on Saturday and has since bounced back to 18.

This increase suggests that market sentiment is improving, which could be an early signal of rising crypto prices. When these indices bottom out, it is usually followed by a period of aggressive buying from investors looking for bargains. This often triggers an overall price increase in the market.

Also read: BTC Price Prediction at the End of 2025: Market Optimism Reaches $100,000!

Wall Street Analysts Optimistic

Another signal indicating a possible rally in the crypto market is the optimism shown by Wall Street analysts towards the stock market. JPMorgan Private Bank recently increased their predictions for the S&P 500 Index, forecasting it to rise 20% through 2027.

Analysts from ING, Bank of America, Morgan Stanley, and Deutsche Bank have also shown an optimistic attitude. When the stock market goes on a bull run, it often has a positive impact on the crypto market. Both markets are often considered risky assets, and when investors feel confident about the economy, they tend to be more willing to invest in riskier assets like crypto.

Possible Interest Rate Cut by the Federal Reserve

Another important factor that could support the crypto market bull run is the Federal Reserve’s interest rate policy. With the chances of a rate cut in December jumping to 84%, the market may react positively. President Trump is considering Kevin Hassett as the next Federal Reserve chairman, who is known to be more in favor of cutting interest rates.

Also read: Is XRP price ready to soar? Here are the contributing factors!

If Hassett is elected, this could mean lower interest rates than the current 3.75% to possibly 1%. This would make US bonds less attractive and encourage investors to look for assets with higher yield potential, such as crypto.

Futures Potentially Reach Bottom

Open interest in futures market likely to hit bottom

One other indicator that could signal the start of a crypto market rally is the sharp decline in futures open interest in recent weeks. This decline is now nearing an end, and when open interest picks up again, it has the potential to drive crypto asset prices higher.

One reason for this is evident in the historical pattern on the chart, where open interest always bounces back after a significant decline. For example, open interest fell from $141 billion in December last year to $92 billion in March, before recovering and surging to over $225 billion in October.

Conclusion

With a variety of favorable factors, the crypto market may be about to enter a new bull run phase. Technical and fundamental indicators point to a potential upswing. Investors and market watchers should continue to monitor these developments to make informed investment decisions.

FAQ

What is the Fear and Greed Index?

The Fear and Greed Index is a measurement tool that shows the sentiment of the crypto market. Low numbers indicate fear, while high numbers indicate greed.

Why are Wall Street analysts optimistic about the stock market?

Wall Street analysts, such as those from JPMorgan and Morgan Stanley, are optimistic as they see the potential for economic growth and financial stability that will push the stock market up.

How will the Federal Reserve rate cut affect the crypto market?

Interest rate cuts by the Federal Reserve tend to make bonds less attractive and encourage investors to seek higher-yielding assets, such as crypto, which could boost crypto prices.

Who is Kevin Hassett?

Kevin Hassett is an economist being considered by President Trump to be the next chairman of the Federal Reserve. Hassett is known to favor deeper interest rate cuts.

What impact will the rise in the S&P 500 Index have on the crypto market?

A rise in the S&P 500 Index is often followed by increased investment in crypto markets, as both markets are considered risky assets. Optimism in the stock market can be contagious to the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Top 4 Reasons a Crypto Market Bull Run Could Be Near. Accessed on November 29, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.