Download Pintu App

Ethereum (ETH) Has the Potential to Rise to $3,400, Check out the Supporting Factors!

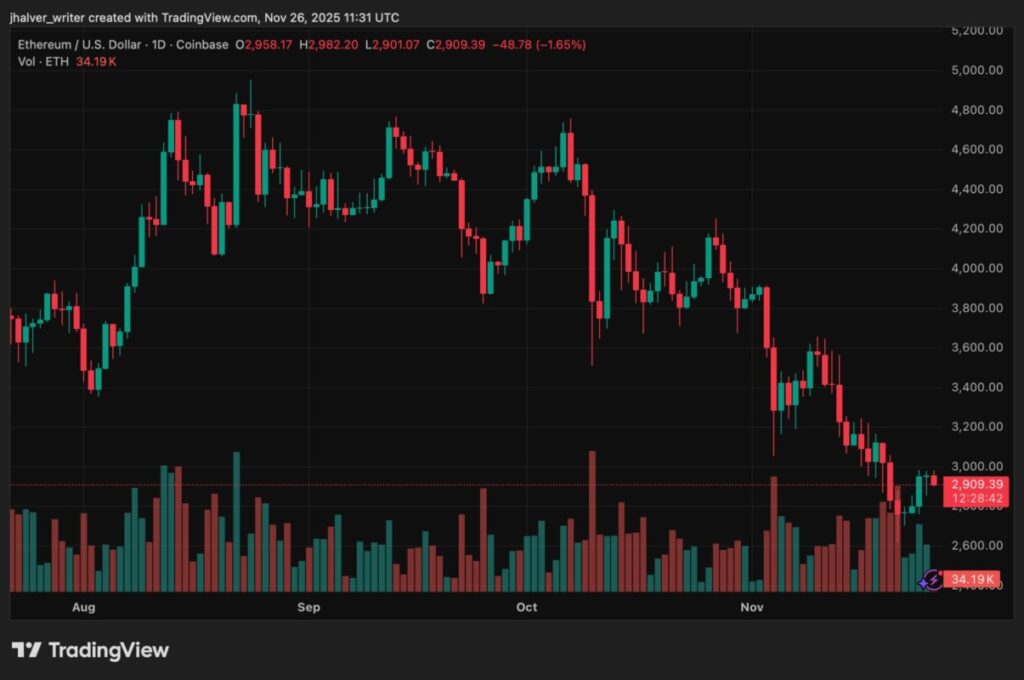

Jakarta, Pintu News – Ethereum (ETH) is currently holding around the $2,900 level, supported by improving macro sentiment, accumulation by large investors, and increased fund flows into ETFs. These conditions reinforce hopes of a near-term rebound towards $3,400.

Fed Rate Cut Expectations and Institutional Demand

Ethereum has been moving between $2,700 and $3,300 in recent weeks, but some new catalysts helped the asset stabilize above $2,900. CME FedWatch data shows the probability of a rate cut in December jumped from 30% to over 80%.

Lower interest rates typically encourage investment in riskier assets like crypto. Institutional fund flows reflect this shift. The spot Ethereum ETF in the US recorded inflows of $96.67 million on November 24, with BlackRock alone contributing $92.6 million, which was the first inflow in two weeks.

Also Read: JPMorgan Predicts Oil Price Fall to $30 by 2027

Accumulation by Whales and Technical Indicators

BitMine, the treasury giant, continues to accumulate Ethereum aggressively, adding 69,822 ETH (over $200 million) last week, bringing its total holdings to 3.63 million ETH, around 3% of the circulating supply. Meanwhile, whale wallets holding 10,000-100,000 ETH accumulated 440,000 ETH in a single week, signaling renewed confidence despite the general market still being cautious.

Despite trading below the 20-day SMA at $3,132, Ethereum is showing signs of early bullish momentum. The MACD histogram has crossed over into positive territory, and the RSI is near the 50 neutral line, with room to move higher before reaching overbought levels.

Short-term Outlook and Market Risk

Although bullish momentum is building, Ethereum is still trading within a broad descending channel, and the market structure remains fragile. Failure to reclaim $3,132 soon could send ETH back towards $2,750, with deeper support at $2,623 and a cycle low at $2,659.

However, with rising institutional demand, accumulation by whales, and rate cut optimism, the probability of Ethereum retesting $3,400 continues to rise. The current confidence level is at Medium (65%), as ETH’s path to $3,400 is still viable but requires confirmation through key resistance levels.

Conclusion

With various supporting factors, Ethereum has a strong potential to reach the target price of $3,400 in the near future. Investors and market watchers should continue to monitor macroeconomic indicators and large accumulation activity to make informed investment decisions.

Also Read: True XRP Holders Keep Calm Amid Weak Markets, Here’s the Outlook for December 2025!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Ethereum (ETH)?

A1: Ethereum (ETH) is a blockchain platform that allows developers to build and run decentralized applications (dapps).

Q2: Why Ethereum (ETH) could potentially rise to $3,400?

A2: The potential rise in Ethereum (ETH) prices is driven by expectations of interest rate cuts by the Federal Reserve, which boosts investment in risky assets, as well as massive accumulation by institutional and whale investors.

Q3: What impact will the Federal Reserve’s interest rate cut have on Ethereum (ETH)?

A3: Interest rate cuts by the Federal Reserve tend to lower borrowing costs, which encourages investment in riskier assets like Ethereum (ETH), increasing its demand and potential price increases.

Q4: Who has accumulated Ethereum (ETH) recently?

A4: BitMine, a treasury giant, and whale wallets with holdings of 10,000-100,000 ETH have accumulated large amounts of Ethereum (ETH) recently, showing confidence in the asset.

Q5: What are the risks associated with investing in Ethereum (ETH) right now?

A5: Key risks include high market volatility, fragile market structure, and potential failure to reach key resistance levels that could result in further price declines.

Reference

- NewsBTC. Ethereum Steadies Near $2900 as Fed Rate Cut Odds Fuel $3400 Rebound Hopes. Accessed on November 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.