Download Pintu App

3 Big Facts Behind 1 Million BTC: Corporatized, Whale-Bought, & Seriously Monitored!

Jakarta, Pintu News – According to the latest report from AMBCrypto as of November 30, 2025, large corporations and whales on exchanges such as Coinbase continue to add significantly to Bitcoin holdings. The amount accumulated by the top 100 companies has broken through the 1,058,000 BTC mark, with a current value of around Rp88 trillion ($5.3 billion) when calculated at an average price of $83,000 per BTC.

Interestingly, even though the crypto market is stagnant and retail is still passive, large purchases continue to occur. Here are three key findings from the report.

1. Large Corporations Own Over 1,058,000 BTC: From Fintech to Energy

Based on data summarized by AMBCrypto, more than 100 public companies now control around 1.05 million BTC. This figure shows an increase despite the volatile Bitcoin price in recent months.

Companies like MicroStrategy, MARA Holdings, and Metaplanet continue to dominate the list, but there is now a broader trend. Companies from the energy sector, financial technology, to global conglomerates are starting to add Bitcoin to their balance sheets as a long-term strategic asset.

Also Read: 7 Proper Ways to Save Money to Make Your Finances Safer

2. JP Morgan Quietly Entered Through ETFs: $300 Million Exposure

Surprisingly, big banks like J.P. Morgan that were once skeptical of cryptocurrencies have now changed course. According to data from Arkham Intelligence, J.P. Morgan has over $300 million in Bitcoin exposure through the BlackRock IBIT ETF.

In detail, the holdings include $332.8 million in direct IBIT shares, $10.7 million from external managers, and call and put options worth tens of millions of dollars. This reflects a cautious investment strategy, but clearly shows the growing interest in Bitcoin from traditional institutions.

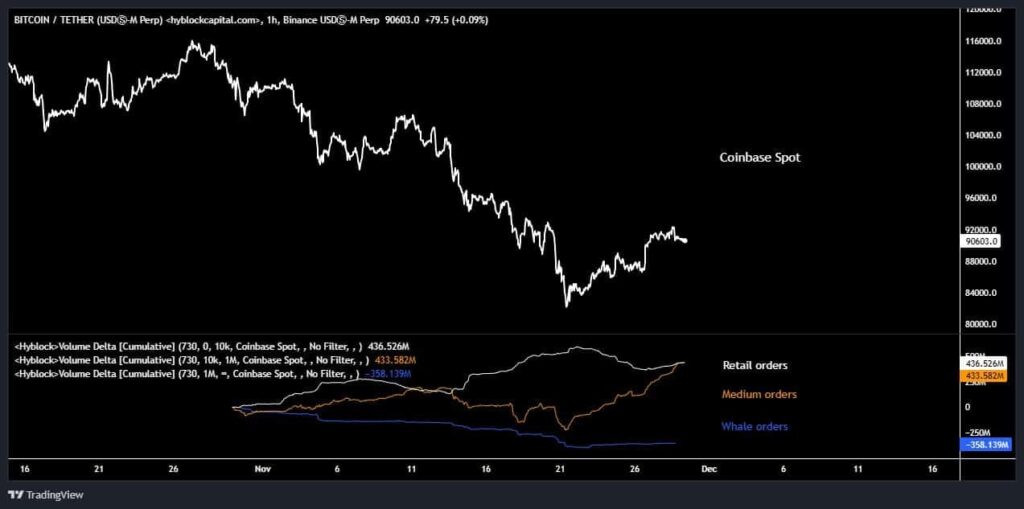

3. Coinbase Whales Do Not Stop Accumulating: Retail Still Undecided

Data from the Cumulative Volume Delta (CVD) shows that whales with orders between $10,000 and $1 million have continued to be net buyers since Bitcoin’s price dropped to a localized point. This is happening even as retail traders are still hesitant to re-enter the market.

The activity chart shows that every time the price drops, large purchases occur – signaling the long-term conviction of large players. Meanwhile, the flow from mid-sized traders is just starting to show positive signals, indicating a potential transition phase.

Also Read: When will the Gold Price Drop Drastically? This is the Full Explanation

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Who currently holds more than 1 million BTC?

More than 100 large public companies such as MicroStrategy, MARA Holdings, and JP Morgan through ETFs, according to AMBCrypto.

What is JP Morgan’s strategy in buying Bitcoin?

JP Morgan invests indirectly through ETFs (IBIT) and uses derivative options as a risk management strategy.

Why do whales keep buying when prices drop?

According to CVD, whales buy when the market is weak to absorb supply and take positions before market sentiment improves.

What impact does institutional accumulation have on BTC price?

Large accumulations can create long-term buying pressure and reduce supply in the open market, potentially supporting prices.

Reference:

- Samyukhtha L KM/AMBCrypto. Big money won’t stop buying Bitcoin! Corporate treasuries now own 1 mln BTC. Accessed December 1, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.