Download Pintu App

Foreign Investment into US Stocks Hits a Record $646 Billion! What Impact to Crypto & Economy?

Jakarta, Pintu News – The United States (US) stock market is a global magnet in 2025. In the past 12 months, foreign investors have purchased $646.8 billion worth of US stocks – the highest in history.

What caused this massive surge? How will it affect crypto and the world economy? Check out these 3 key points.

1. Global Capital Rotation: Everyone Wants US Assets

According to data from Yardeni Research, foreign fund flows into US stocks surpassed the previous peak in 2021 with a 66% increase. Even purchases of US Treasuries by non-US investors reached $492.7 billion in the same period.

Some major changes are striking:

- China: Treasury holdings fell to 7.6%, the lowest in 23 years.

- UK: Holdings quadrupled to 9.4%.

- Japan: Remains the largest holder (12.9%), but the trend has been downward over the past two decades.

“Everyone wants US assets,” says an analyst from The Kobeissi Letter.

This signals high confidence in the strength of the US economy-or a lack of more attractive alternatives in the global market.

Also Read: 7 Proper Ways to Save Money to Make Your Finances Safer

2. US Domestic Investors Join in, but Consumer Debt Rises Sharply

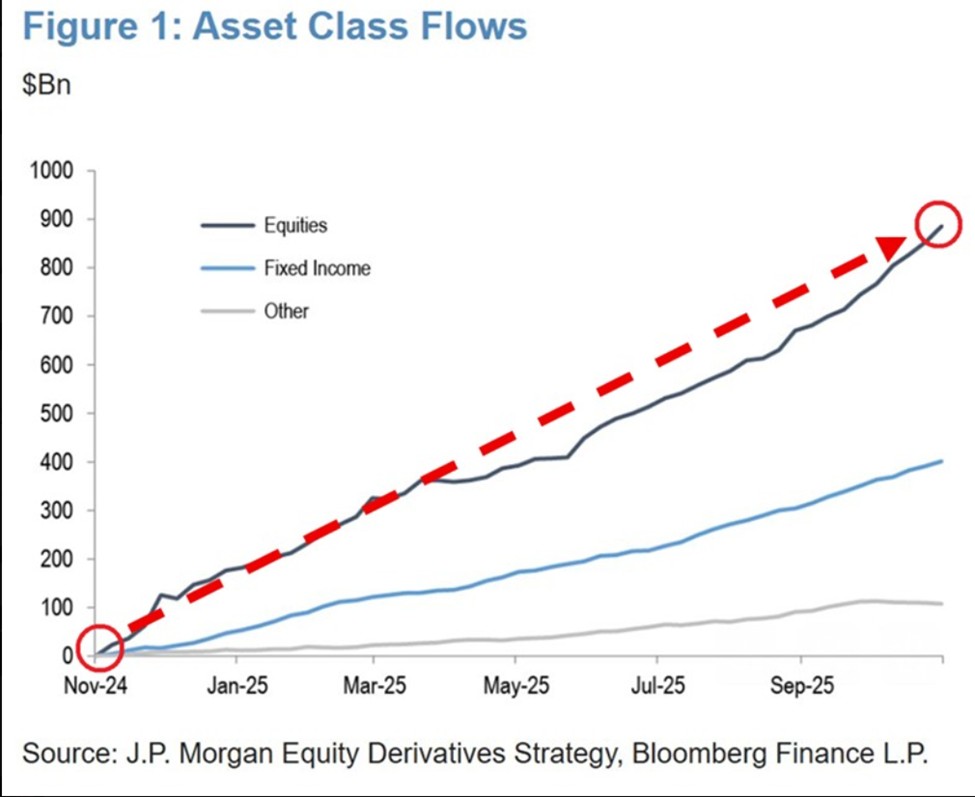

US investors alone added $900 billion to equity mutual funds since November 2024, half of which came in just the last five months. Meanwhile:

- Fixed income funds (bonds): +$400 billion

- Other assets: +$100 billion

- Total US credit card debt Q3 2025: $1.233 trillion (all-time high)

What does this mean? Market optimism does not reflect household finances. The market is bullish, but consumers are struggling.

3. Year-end Sentiment Strong, but Risks Remain

JP Morgan estimates that the S&P 500 could break 8,000 points by 2026. The reason?

- December is historically the best month for the stock market (average return: +1.28%)

- JP Morgan’s “everything rally” forecast sends liquidity flooding into the market

- Crypto also gets splashed with sentiment, especially if the Fed holds rates or ends QT

But take note: the investment record could be reversed if consumer debt becomes a heavy burden and the market loses momentum in Q1 2026.

Also Read: When will the Gold Price Drop Drastically? This is the Full Explanation

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What led to the record purchases of US stocks by foreign investors?

A combination of weakness in other markets, the strength of the US dollar, and confidence in the stability of the US economy.

Is this a bullish signal for crypto as well?

Potentially, as market liquidity increases. But crypto still faces regulatory challenges and macro corrections.

Is record consumer debt in the US dangerous?

It could be. Even if the market rises, the pressure on households could accelerate a recession or financial crisis if not controlled.

Is December always good for the stock market?

Historically, yes. December has a 73% win ratio for the S&P 500 since 1928.

Reference:

- Lockridge Okoth / BeInCrypto. Foreign Investors Set Record With $646.8 Billion in US Stock Purchases. Accessed December 1, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.