Download Pintu App

5 ASTER Facts to Watch: Potential to Rise 30% in December but Faces Risk of Selling Pressure

Jakarta, Pintu News – Altcoin ASTER stole the show again at the end of the year. After experiencing a price correction of more than 5%, this crypto asset showed interesting technical signals in December 2025. Based on data from CoinMarketCap, ASTER received very positive community sentiment, with more than 75% of users optimistic about the next price movement.

However, despite the technical opportunity to rise to $1.50 – or around Rp24,994 ($1 = Rp16,663) – ASTER is also faced with a number of underlying risks such as decreased on-chain activity and a large token unlock schedule that could add selling pressure. Here are five key points to note before considering ASTER in a crypto portfolio.

1. Community Sentiment Remains Positive Despite Falling Prices

Data from CoinMarketCap shows that despite ASTER experiencing a daily price drop of more than 5%, more than 60,000 users are still giving positive support to this altcoin. The community sentiment reflects the market’s confidence in ASTER’s short-term potential.

ASTER is currently trading above the $1 psychological level, signaling that the market has anticipated an accumulation phase. This places ASTER as one of the resilient altcoins that remains highly discussed despite the sideways nature of the crypto market.

Also Read: 7 Proper Ways to Save Money to Make Your Finances Safer

2. OBV and MACD Indicators Show Breakout Potential

According to technical analysis from AMBCrypto, ASTER’s On Balance Volume (OBV) indicator is currently displaying a consolidation pattern similar to the early November period, before finally breaking out to $1.40. If this pattern repeats, then the ASTER price could surge to $1.50 again.

Initial signals from the Moving Average Convergence Divergence (MACD) also showed positive momentum. A thin green color is starting to appear although not yet dominant, meaning that buying pressure is starting to build, but the market is not yet fully bullish.

3. Network Activity Declines and TVL Plummets by Almost 50%

On the other hand, data from DeFiLlama shows that ASTER’s Total Value Locked (TVL) has dropped dramatically from $2.48 billion to $1.32 billion. The drop in TVL indicates a decline in user trust and participation in the ASTER ecosystem.

Trading volumes on DEX and ASTER perpetual contracts also recorded sharp declines, indicating that despite positive community sentiment, actual activity on the network has not fully supported the potential for a major rally.

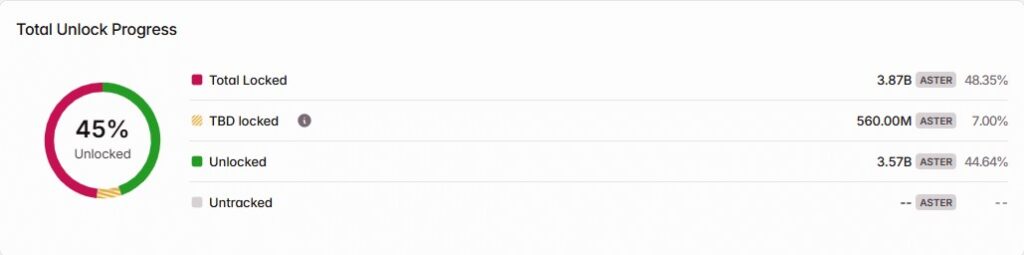

4. Selling Pressure from Unlock Tokens Could Hold Back Rally

One of the biggest risks that analysts are monitoring is ASTER’s scheduled token unlock that will occur this December. Data shows there will be a release of approximately 78.41 million tokens, which is equivalent to 3.89% of ASTER’s market capitalization.

This amount is worth more than $86 million or Rp1.4 trillion, and could potentially create additional selling pressure in the market. This is an important factor that both short-term investors and active traders should be aware of.

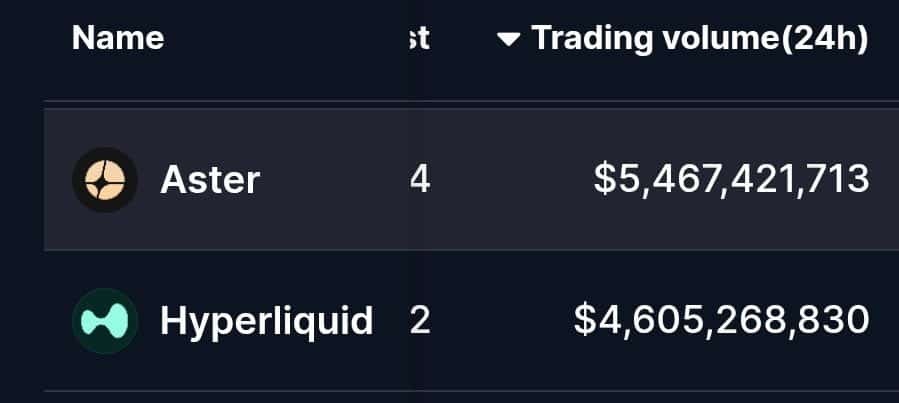

5. ASTER outperforms Hyperliquid (HYPE) in terms of volume

Interestingly, despite the challenges, ASTER is still ahead of competitors like Hyperliquid (HYPE) in terms of daily trading volume. Data from CoinMarketCap shows ASTER’s volume reached $5.467 billion (IDR 91 trillion) compared to HYPE ‘s $4.605 billion (IDR 76.7 trillion).

This indicates that market interest in ASTER is still strong, and could be an important consideration in assessing the potential for a continuation of the price rally going forward.

Also Read: When will the Gold Price Drop Drastically? This is the Full Explanation

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

ASTER FAQ December 2025

What are the technical reasons for ASTER’s 30% increase?

According to analysis from AMBCrypto, the OBV pattern similar to the previous breakout period as well as the MACD signal turning green indicate a potential rally up to $1.50.

When was the last time ASTER had a significant breakout?

ASTER experienced a breakout on November 14, 2025 after technical consolidation characterized by sideways OBV movement.

What was ASTER’s biggest risk in December?

The biggest risk is selling pressure from unlock tokens amounting to 3.89% of market capitalization as well as a decline in on-chain participation, including weaker DEX and TVL volumes.

Is ASTER more interesting than Hyperliquid (HYPE) at the moment?

In terms of trading volume, ASTER is higher than HYPE by more than $800 million, signaling greater market attention to ASTER at the moment.

Reference:

- Lennox Gitonga / AMBCrypto. Can ASTER surge 30% in December? What the data shows. Accessed December 1, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.