Download Pintu App

5 Bitcoin (BTC) Prediction Insights – Potential, Risks, and Scenario 2025-2026

Jakarta, Pintu News – The cryptocurrency market is back in the spotlight after a number of publications by CryptoDnes.bg featured brand-new predictions and analysis for Bitcoin (BTC). These articles were observed to be widely discussed by market participants as they incorporate technical, macro factors, and institutional dynamics. Here are the five main points discussed, complete with relevant scenarios and risks.

1. Near-medium term target: potential upside to US$170,000-200,000

According to one analysis on CryptoDnes, in the next 6-12 months, Bitcoin could rise to around US$170,000, even up to US$200,000, depending on market recovery and leverage stabilization. This calculation takes into account that the market has been deleveraging, so as volatility decreases and institutions move back in, the upside potential opens up again.

If this projection is realized, for investors in Indonesia or Southeast Asia with a conversion of 1 USD = IDR 16,663, the range of US$ 170,000 is equivalent to around IDR 2.83 billion per BTC – attractive for crypto as a medium-term asset.

Also Read: 3 Stock Sectors Predicted to be Bought by Investors as the Technology Sector Weakens

2. Conservative target for end 2025: US$ 116,000-122,000

Not all projections are as optimistic as the highest target: according to conservative estimates quoted by CryptoDnes, some institutions see that Bitcoin might end 2025 in the range of US$ 116,000 to US$ 122,000. These projections take into account macroeconomic uncertainties and possible short-term volatility.

This range could be considered a baseline of “stability” if the market fails to spark a major surge – meaning BTC may not explode violently, but remains far from the extreme low price.

3. Correction scenario: possible consolidation until 2028-2030

In a long-term analysis, CryptoDnes warns that after the growth cycle, a period of consolidation could occur between 2028-2030. In this span, BTC prices could range steadily – not shoot up – while waiting for big catalysts such as further institutional adoption or global regulatory changes.

This consolidation phase is important for long-term investors: maintaining positions and monitoring fundamentals may be a realistic strategy if high volatility persists.

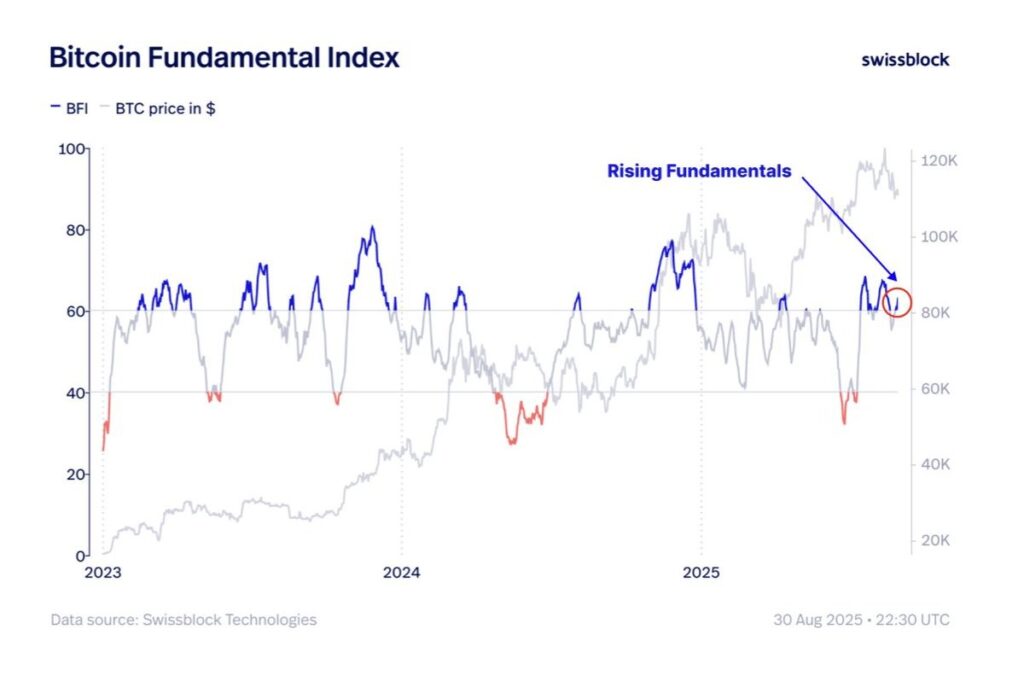

4. Key drivers: institutional adoption, deleveraging and capital rotation

The bullish prediction from CryptoDnes gets a foothold from several drivers: first, the institutional wave – especially large investors and smart money – is considered to start considering allocations to Bitcoin again.

Secondly, the futures and leverage markets have gone through a reset phase, which in analysts’ view could open up room for a rally if sentiment improves.

Third, the rotation of capital into new cryptocurrencies (including Layer-2 protocols and BTC-related projects) suggests that investors are seeking diversification – which could increase liquidity and interest in the crypto ecosystem at large.

5. Risks and conditions to monitor: corrections, liquidity, and market cyclicality

Despite the upside potential, CryptoDnes also underscores a number of real risks. If global markets deteriorate, macroeconomics weigh in, or institutions pull back on funds, prices could stagnate or even fall – especially if the consolidation phase is prolonged.

Liquidity and institutional flows are important metrics: if both weaken, a rebound is likely delayed. The volatility of the crypto market also means that high targets are no guarantee.

Also Read: 4 Key Risks of Cardano (ADA) in December 2025 that Crypto Investors Should Monitor

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is the most optimistic Bitcoin price prediction according to CryptoDnes?

The most optimistic scenario says Bitcoin could reach US$170,000-200,000 in the next 6-12 months.

Is there a moderate estimate for the end of 2025?

Yes – moderate estimates place BTC in the US$ 116,000-122,000 range.

Is there a possibility of Bitcoin experiencing a long-term consolidation?

According to long-term analysis, a major consolidation period for BTC could happen between 2028-2030.

What factors could support a Bitcoin rally to target highs?

Institutional adoption, deleveraging of the futures market, and capital rotation into crypto projects beyond BTC are considered to be the main drivers.

What is the biggest risk if the market goes sour?

Key risks include liquidity drying up, institutions exiting the market, global macro conditions deteriorating, as well as high volatility that could delay or derail the hike target.

Reference

- CryptoDnes.bg. Bitcoin Price Prediction: 2025-2040 Analysis and Key Drivers. Accessed December 2, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.