Download Pintu App

Pepe Coin Price Teeters on the Edge as Bearish Pattern Emerges

Jakarta, Pintu News – The price of Pepe coin (PEPE) fell by almost 10% on December 1, and this sharp decline adds new pressure to the overall meme coin market. Currently, the price of Pepe is trading near a fragile support zone – a zone that previously stabilized short-term sentiment.

Interestingly, the general market mood deteriorated after a strong rejection on the weekly chart, indicating deeper structural problems.

Meanwhile, pressure from sellers continues to dominate the price direction, as volatility increases across multiple time frames. Any attempts at price recovery quickly fade away, reinforcing the existing uncertainty.

The Pepe coin price is currently in a sensitive phase, and market confidence remains weak as buyers struggle to defend key zones.

Classic Breakdown Pattern Pressures Pepe Coin Price

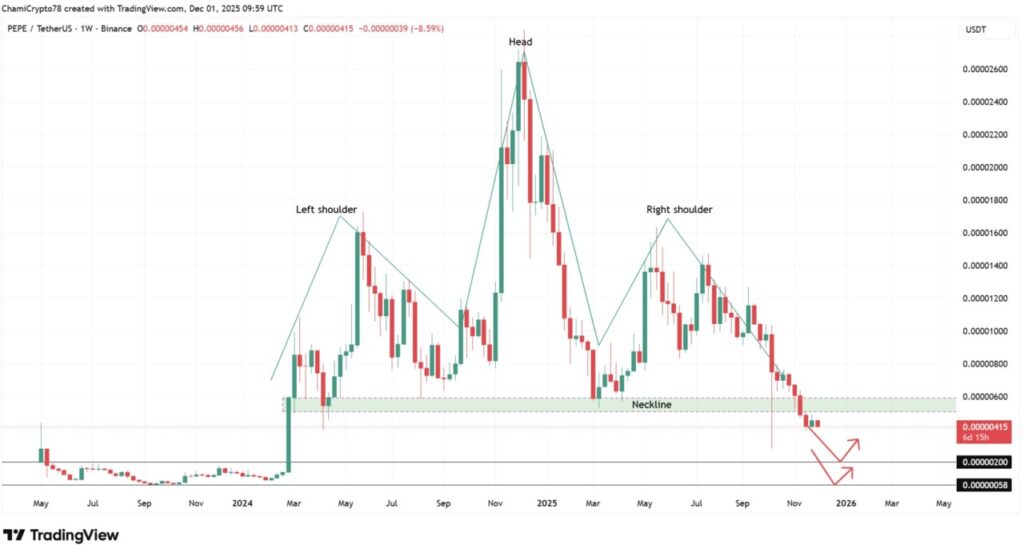

The weekly chart shows a classic head-and-shoulders pattern signaling a potential major breakdown. The left shoulder forms as the price starts to rise at the beginning, while the head creates a sharp peak before weakening again.

Read also: Altcoin Season Coming in 2026? Signs to Watch Out For

The right shoulder appears with weaker strength, and any recovery attempt is stopped by selling pressure. The pattern becomes more serious when theneckline is clearly broken, confirming more pressure on the overall price structure.

At the time of writing, Pepe’s value is trading at $0.00000415, with the chart showing consistent rejection near the downtrend line. The Pepe coin price is now approaching the $0.00000200 zone, which is the projection of the breakdown move.

In addition, this region becomes very important as pressure continues to mount on the weekly chart. If the selling pressure continues unabated, then deeper support at $0.00000058 could be the next target.

Meanwhile, any push towards the failed neckline at $0.00000600 loses its strength quickly. To reverse this trend, Pepe needs a strong weekly close above that level-but so far there have been no early signs of a convincing change in direction.

Technical Indicators Form a Bearish Outlook

The RSI indicator is at 33, which reflects strong weakness after several weeks of failing to break the midpoint. Interestingly, the RSI is now approaching oversold territory, but has yet to show a meaningful buy signal.

This pattern shows that buyers are still hesitant, while the general market sentiment remains heavy. Pepe prices continue to struggle whenever this indicator fails to form an initial strength signal, and this pattern continues to be a key guide to market direction.

Meanwhile, the MACD line is below the signal line, which confirms a strong bearish structure. The distance between these two lines continues to widen consistently, and this widening confirms the sellers’ dominance. The MACD histogram features thick red bars, where each bar further pressures the already weak price structure.

Taken together, these signals reinforce the challenging long-term outlook for Pepe coin prices-especially as both indicators are moving in a downward direction. This combination limits the possibility of a quick recovery and keeps market caution levels high.

Decrease in Open Interest Pressures Meme Coin Market

Open interest fell by 16.55% to $217.71 million, and this sudden drop adds heavy pressure to the Pepe coin price amid an already difficult week. This drop indicates an aggressive closing of long positions, rather than normal position rotation.

Read also: Shiba Inu Prediction 2026: Analysts Forecast a Parabolically Large Price Spike

Interestingly, this pattern is in line with the behavior of several other major meme coins, as overall market sentiment weakens. Pepe prices are now moving in a market with less speculative activity, so the chances of a strong intraday rebound have decreased.

On the other hand, reduced open interest also reduces the potential for a sharp short squeeze. This makes sellers’ positions more comfortable and increases the risk of further price declines. Pepe coin price is likely to struggle if open interest continues to decline, as decreased leverage usually limits short-term strength.

However, if open interest begins to stabilize around current levels, Pepe prices may enter a phase of slower movement instead of continuing their sharp decline. The decrease in leverage reflects real caution in the market, and this tone is affecting the short-term performance in various other meme assets.

What Will Happen Next?

Pepe coin price remains under heavy pressure as the weekly pattern confirms a clear breakdown. Multiple indicators support the bearish sentiment, while the sharp drop in open interest limits the potential for a meaningful recovery.

Buyers should be able to defend nearby support levels to slow down potential deeper losses, although control of the market is currently still in the hands of sellers. Pepe price needs a significant change on the weekly chart to break out of this downtrend. Until that change happens, the overall outlook remains strongly skewed towards continued downside risks.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Is Pepe Coin Price at Risk After Forming This Bearish Pattern? Accessed on December 2, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.