Download Pintu App

21Shares Updates Its Dogecoin ETF Filing, Revealing New Fees and Key Details

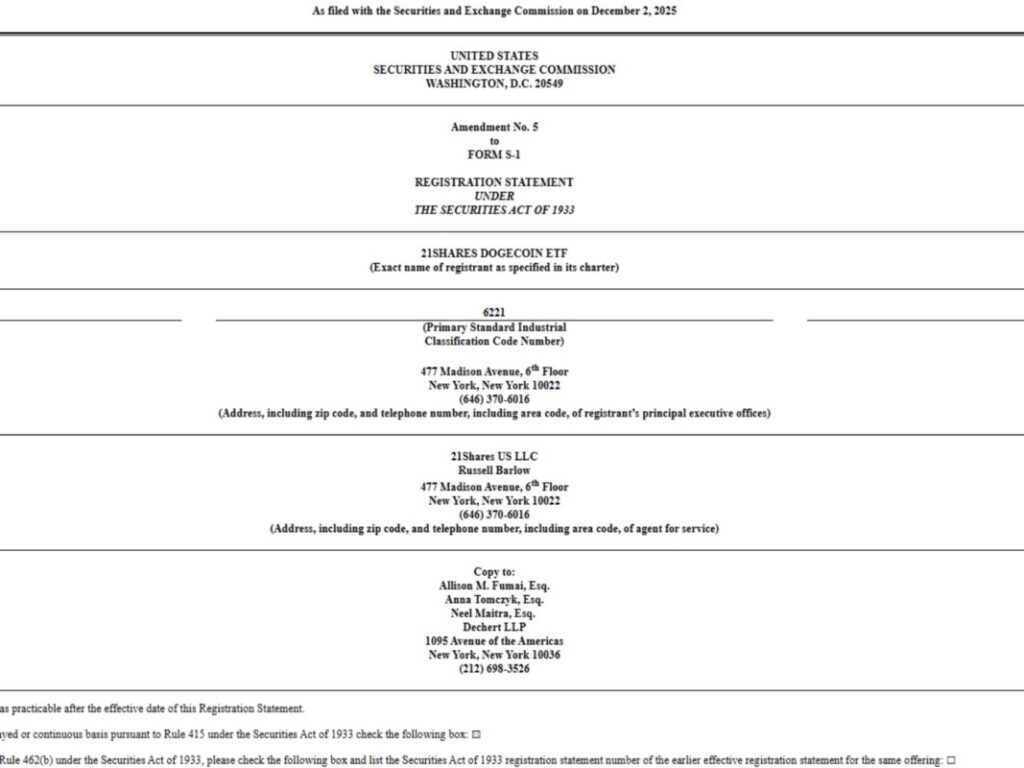

Jakarta, Pintu News – 21Shares has revised its Dogecoin ETF filing with the US Securities and Exchange Commission (SEC) to confirm fees and provide additional details.

This spot-based Dogecoin ETF is expected to join the Dogecoin ETFs from Grayscale (GDOG) and Bitwise (BWOW) this month, which could drive DOGE prices further up.

21Shares Renews Dogecoin ETF to US SEC

According to documents filed with the United States Securities and Exchange Commission (SEC), 21Shares has made a fifth amendment to its S-1 form to confirm a management fee of 0.50%. This fee will be calculated daily and paid weekly retroactively in Dogecoin (DOGE).

Read also: Meme Coins Poised for a December Breakout? Watch These 3 Key Signals

However, the issuer has not disclosed any fee waivers, which are likely to be announced before the official launch. The amendment that caused the delay was retained in the filing, along with the planned activation through a form 8(a) filing.

In the document, 21Shares appointed The Bank of New York Mellon as administrator, cash custodian and transfer agent. Meanwhile, Anchorage Digital Bank and BitGo will act as additional custodians for the trust.

As previously reported by CoinGape, 21Shares’ Dogecoin ETF will trade under the stock code “TDOG” on the Nasdaq exchange. The exchange-traded fund will track the price movements of DOGE based on the CF Dogecoin-Dollar US Settlement Price Index.

$1.5 Million to Buy DOGE

Previously, the issuer also revealed that Coinbase Custody Trust Company will be the primary custodian, and 21Shares US LLC will act as the initial capital investor. For information, the trust will use $1.5 million to purchase DOGE on or before the ETF is officially listed on the exchange.

Other details also disclosed in the filing include the appointment of Wilmington Trust NA as trustee, Foreside Global Services as marketing agent, and Cohen & Company as accounting firm.

DOGE price rises over 11% amid market optimism

At the time of writing (3/12), the price of Dogecoin (DOGE) surged by more than 11% to $0.15 in the last 24 hours. The lowest and highest prices in 24 hours were recorded at $0.1347 and $0.1519, respectively.

Read also: Dogecoin Price Held at $0.15 Today: Falling Wedge Shows DOGE Breakout Potential!

In addition, trading volume also increased by 32% in the same period, indicating great interest from traders.

On the daily chart, the price of DOGE is still below the 50 (50-MA) and 200 (200-SMA) moving average lines, but a break above the trend line provides positive support. The relative strength index (RSI) also rose to 45.19, indicating a potential upside move amid the euphoria surrounding the Dogecoin ETF.

Data from CoinGlass shows a massive buying spree in the derivatives market. Total open interest (OI) in Dogecoin futures contracts increased by more than 8% to $1.5 billion in the last 24 hours.

At the time of writing, the OI of 4-hour futures contracts on Binance, OKX, and Bybit platforms rose by 1.5%, 1.64%, and 1.26% respectively. This reflects the bullish sentiment among derivatives traders.

FAQ

What is the Dogecoin ETF launched by 21Shares?

The Dogecoin ETF launched by 21Shares is a financial product that allows investors to invest in Dogecoin (DOGE) through a regulated mechanism, with a management fee of 0.50%.

When is the Dogecoin ETF by 21Shares scheduled to launch?

A specific launch date has not been announced, but it is expected to happen within this month, subject to approval from the SEC.

Who acts as the custodian for the Dogecoin ETF by 21Shares?

The Bank of New York Mellon, Anchorage Digital Bank, and BitGo are the custodians for the Dogecoin ETF by 21Shares.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. 21Shares Amends Dogecoin ETF Filing to Reveal Fees, Other Details. Accessed on December 4, 2025

- CoinSpeaker. 21Shares Amends Dogecoin ETF Filing. Accessed on December 4, 2025

- Crypto News. 21Shares Files Amendment Spot Dogecoin ETF Fee 2025. Accessed on December 4, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.