Download Pintu App

Japan’s Crypto Taxes Overhauled: This is the Main Impact for Retail Investors!

Jakarta, Pintu News – The Japanese government plans to impose a more moderate tax of 20% on crypto assets, which is expected to increase retail investor interest in the crypto industry.

Big Changes in Crypto Tax

The Japanese government, through its financial watchdog Financial Services Agency (FSA), has proposed lowering the tax rate on capital gains from crypto assets from a maximum of 55% to 20%. This change aims to equalize the tax treatment of crypto assets with traditional financial instruments. The move is expected to attract more retail investors into the crypto market.

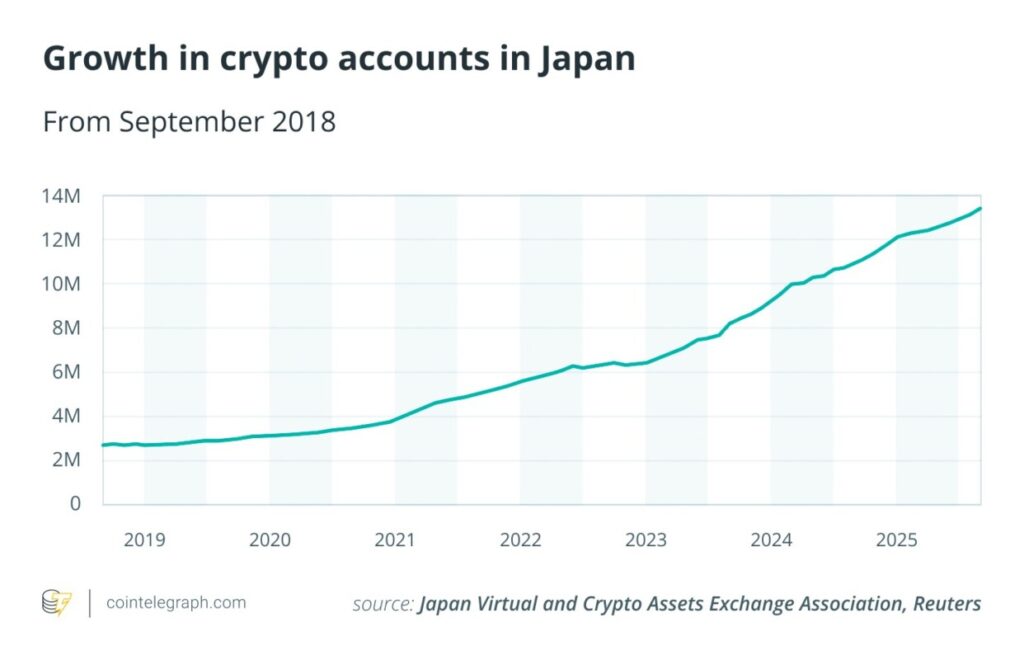

This adjustment is part of a trend of the government softening up on crypto in Japan. From a gray zone to strict regulation, crypto is now being recognized as part of the national growth plan. This recognition, which will soon be realized through lower taxes for crypto traders, is expected to bring in a new wave of retail users.

Also Read: Ripple CEO’s Shocking Prediction: Bitcoin Will Break $180,000!

Regulations that Strengthen the Crypto Ecosystem

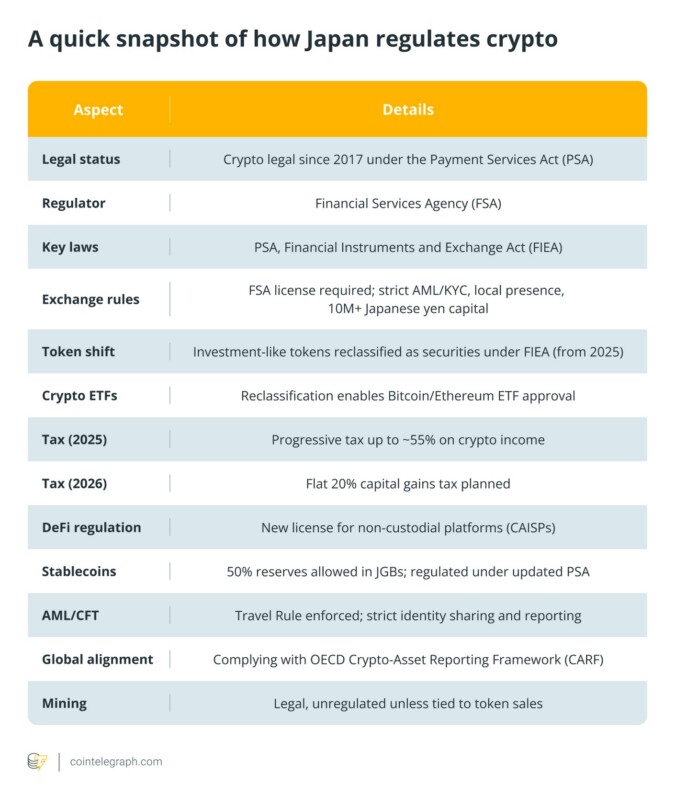

After the Mt. Gox crypto exchange failure in 2014, Japan ruled that digital assets like Bitcoin (BTC) cannot be considered currency or bonds. This left banks and securities firms unable to offer crypto-related services. However, in 2016, the FSA established a regulatory framework for crypto asset service providers under the Payment Services Act (PSA).

Changes to the PSA in 2017 legalized crypto and created standards for exchanges. These standards include Anti-Money Laundering, Know Your Customer, and registration requirements. In 2018, after the Coincheck exchange hack, crypto exchanges in Japan established the Japan Virtual Currency Exchange Association (JVCEA), a self-regulatory body recognized by the FSA.

A Market Ready for Growth

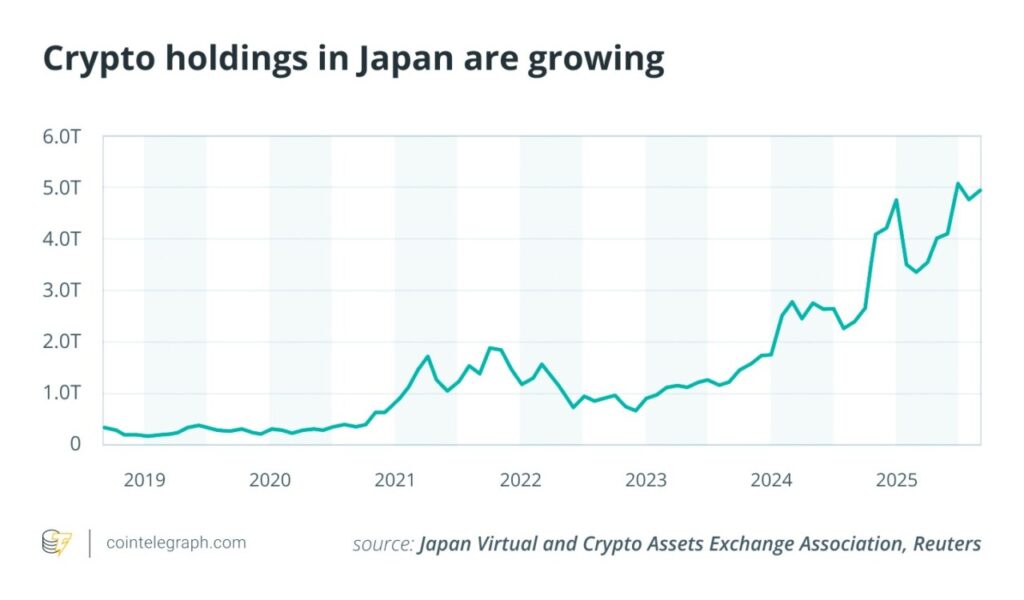

In 2022, new legislation allows certified institutions to offer fiat-backed stablecoins. The FSA also began classifying some cryptocurrencies as “financial products”. These measures have sparked the emergence of new products and offerings, and increased investor interest in digital assets.

With real wages falling relative to inflation, Japanese investors are looking for investments that offer better, albeit riskier, returns. Bitbank’s CEO, Noriyuki Hirosue, stated that the revised tax rules “could greatly expand the market”. Meanwhile, Japanese companies such as SBI and Sony are beginning to move quickly in adopting crypto and blockchain technology.

Conclusion

With plans to reduce taxes and develop stable regulations, the crypto industry in Japan is poised for significant growth. These measures will not only attract new retail investors but also strengthen Japan’s position as a key player in the global crypto market.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is the new crypto tax in Japan?

A1: The new crypto tax in Japan is a proposal to lower the tax rate on capital gains from crypto assets from a maximum of 55% to 20%.

Q2: Why did Japan change the crypto tax rate?

A2: Japan changed the crypto tax rate to equalize the tax treatment of crypto assets with traditional financial instruments, which is expected to attract more retail investors.

Q3: What is the history of crypto regulation in Japan?

A3: After the failure of Mt. Gox failure in 2014, Japan determined that cryptocurrencies could not be considered currencies or bonds. In 2016, the FSA established a regulatory framework under the PSA, and in 2017, crypto was legalized with certain standards for exchanges.

Q4: What is the impact of the crypto regulation changes in Japan?

A4: Changes in crypto regulation in Japan have sparked the emergence of new products and offerings and increased investor interest in digital assets, especially with the adoption of fiat-backed stablecoins and the classification of some cryptos as financial products.

Q5: Who are the key players in the crypto industry in Japan?

A5: Key players in the crypto industry in Japan include major companies such as SBI, Sony, and Sega, all of which are moving quickly in adopting crypto and blockchain technology.

Reference

- Cointelegraph. Japan Crypto Tax Wake Retail Investors. Accessed on December 4, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.