Download Pintu App

Smart Money Is Accumulating These 3 Undervalued Altcoins — Could a Major Rebound Be Next?

Jakarta, Pintu News – Amid high volatility in early December, the search for the best altcoins to watch in December 2025 is intensifying.

While many major assets have experienced sharp declines, the current market conditions are opening up rare opportunities – as smart money begins to quietly shift their funds and accumulate projects with strong fundamentals at discounted prices.

With liquidation imbalances continuing to rise, there are three assets that now stand out as potential candidates for recovery.

Chainlink: The Power of Interoperability under Market Pressure,

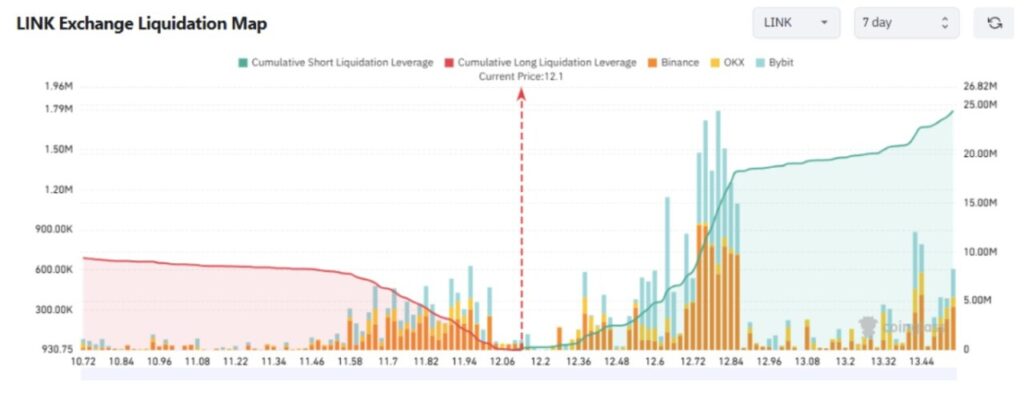

Chainlink (LINK) continues to attract institutional attention despite the sharp increase in short positions against LINK, as seen in LINK’s liquidation chart.

Read also: Arthur Hayes: Bitcoin Could Break $500K and 5 Top Altcoins to Watch in 2026

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is now connected to over 70 blockchains, offering one of the most secure frameworks for transferring assets and messages between independent networks.

In addition, the Chainlink Runtime Environment (CRE) further strengthens Chainlink’s role in supporting institutional-grade smart contracts. The technology is also playing a big role in the booming Real-World Asset (RWA) sector – where experts estimate the value of the sector could reach $16 trillion by 2030.

Various RWA platforms rely on Chainlink’s Data Streams feature to provide verifiable high-speed data. However, LINK’s current liquidation chart shows that the cumulative volume of short positions is still greater than that of long positions, reflecting the heavy selling pressure during the market’s downtrend.

If the market begins to recover and LINK breaks back through the $12.86 level, the liquidation pressure from short positions could reach over $25 million – potentially reinforcing the recovery trend. With solid fundamentals and strong linkages to the RWA sector, LINK’s medium-term price outlook remains positive and well-structured.

Bittensor: Growing AI Demand and Halving Dynamics

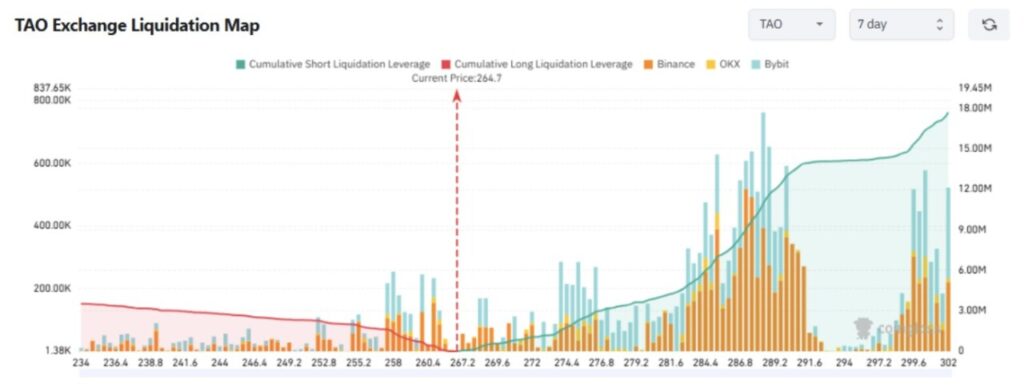

AI remains one of the hottest topics throughout 2025, making Bittensor (TAO) one of the most promising altcoins to buy in December 2025. Bittensor incentivizes AI and machine learning contributions in a decentralized manner, offering a unique use case compared to conventional altcoins.

One of the main advantages of TAO is that its tokenomics are similar to Bitcoin. With a maximum total supply of 21 million and a halving mechanism, supply pressure will continue to occur periodically.

The next halving is expected in two weeks’ time, which will cut the block reward from 1 TAO to 0.5 TAO. This means that daily production will drop from 7,200 TAO to 3,600 TAO – a potential price driver if demand remains stable.

However, TAO’s liquidation chart also shows a general market imbalance, with shorts dominating. If TAO manages to recover and break above $291.2, the total liquidation of short positions could exceed $16 million. This move could trigger a sharp price spike, supporting more optimistic price predictions for TAO ahead of 2026.

Read also: Meme Coins Poised for a December Breakout? Watch These 3 Key Signals

Solana: Robust Ecosystem Activity Amid Short Pressures

Solana (SOL) remains one of the strongest candidates as the best altcoin to watch this December. SOL’s liquidation chart shows significant imbalances, signaling very high short interest.

In early December, traders aggressively shorted SOL, but on the other hand, the blockchain outperformed in various on-chain activity metrics.

According to data from DeFiLlama, Solana currently ranks second in terms of total value locked (TVL) after Ethereum, with a value close to $8.50 billion. Its main advantages – high speed and low transaction fees – continue to attract new liquidity and interest from developers.

As a testament to the growth of the ecosystem, Circle recently minted approximately 750 million USDC on the Solana network in just 24 hours. This pushed the total USDC issuance on Solana to over 1.35 billion, indicating a strong inflow of funds into the ecosystem.

If the SOL/USD pair manages to recover to the $139.6 level, the total liquidation of short positions could exceed $600 million. This would exert significant buying pressure and potentially trigger a larger price move, supporting SOL’s price upside prospects going forward.

Overall, amidst high market volatility, the combination of liquidation imbalance, ecosystem growth, and potential catalysts make Chainlink, Bittensor, and Solana the three best altcoins for strategic investors to consider this December – especially for those looking for opportunities at a discount before the market stabilizes.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Top Altcoins to Buy in December 2025: Opportunities Emerging After Market Shakeout. Accessed on December 5, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.