Download Pintu App

XRP Shows Bullish Strength, But the Price Still Can’t Break Through

Jakarta, Pintu News – The price of XRP (XRP) has not been able to keep up with the weekly gains experienced by Bitcoin (BTC) and Ethereum (ETH), and is still moving within a narrow range that has been in place since mid-November.

Meanwhile, one bullish signal from on-chain data has reached a three-month high – usually a strong indicator for price recovery. However, until now, the price of XRP has barely moved. Let’s explore why.

Dormancy Hits a 3-Month High, but Long-Term Holders Continue Selling

This story stems from the activity of spent coins. This indicator measures how many old XRP tokens change hands each day. The data shows a drastic drop from 186.36 million XRP on November 15 to just 16.32 million XRP today – a 91% drop, and the lowest level in three months.

Read also: Pi Network Price Slips Today — Is a Correction Coming Before the Next Rebound?

When the old supply stops moving, the selling pressure drops significantly. This is why the dormancy rate – which increases when spent coins activity decreases – is now at its highest level in three months. Under normal market conditions, this would normally push the price of XRP up.

However, the price of XRP did not show a positive response as the conviction groups moved in the opposite direction.

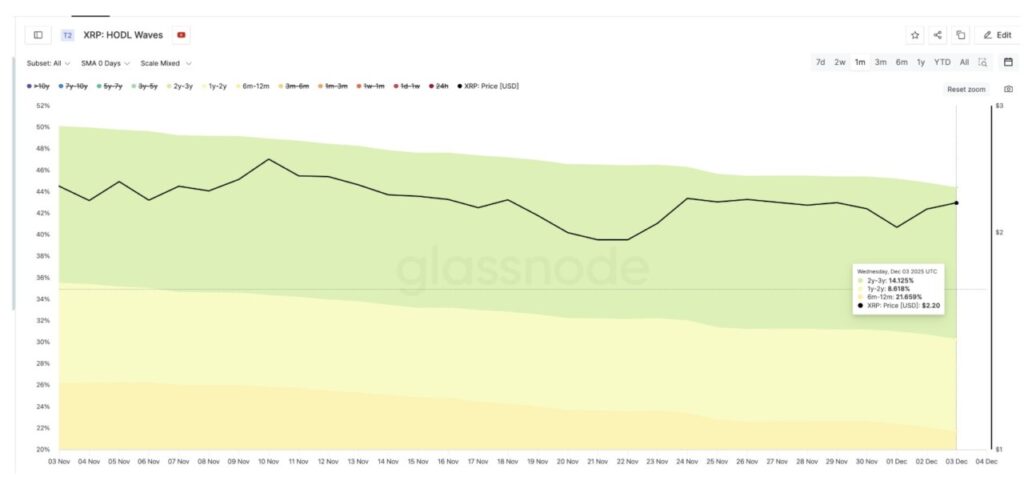

HODL Waves data, which tracks supply based on age of ownership, shows a distribution (sell-off) of long holders over the past month. The group holding XRP for 6-12 months dropped from 26.18% to 21.65%. The 1-2 year group dropped from 9.34% to 8.61%. Even the 2-3 year group decreased from 14.58% to 14.12%.

These groups are usually the pillars of trend strength as they control a supply that rarely moves. When their share decreases, the potential for price increases weakens.

This also explains why the recent whale buying spree – discussed earlier – has not been able to lift the price of XRP.

Although whales are adding to their holdings, the persistent selling pressure from long holders is still more dominant. Until long-term supply stops coming out of this group, the increase in dormancy alone is not enough to prompt a price breakout.

XRP Price Needs to Close Above $2.28 to Break Out of its Consolidation Pattern

The price chart shows the same tug-of-war situation. Since November 15, the XRP price has been stuck in a range between $2.28 and $1.81, without a single daily close making it past the $2.28 level.

Read also: Crypto Whale Buys $1.3 Billion in XRP, Triggering 8% Price Surge

This level remains a key boundary that must be broken for upward momentum to build. If XRP manages to close above $2.28, then the next targets are in the range of $2.56 and $2.69 – areas that were previously significant price reaction points.

Conversely, if the price closes below $1.98, the current technical structure will weaken and increase the downside potential back to $1.81.

For now, the message is clear: dormancy levels are at a three-month high as spent coins activity drops, but long-term holders are still distributing.

As long as the conviction groups remain unstable and there is no daily close above $2.28, the price of XRP will most likely continue to move within the same range.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Price Metric: 3-Month High Breakout Attempt. Accessed on December 5, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.