Download Pintu App

7 AI Forecasts on Bitcoin (BTC) Price that the Crypto World is Hunting for

Jakarta, Pintu News – The debate about where the price of Bitcoin (BTC) will be at the end of 2025 is back in full swing after a number of AI chatbots gave very diverse price predictions.

This article summarizes the seven most prominent scenarios for readers to understand the various possibilities based on the latest data and analysis in the cryptocurrency sector. Information and figures are converted at an exchange rate of 1 USD = IDR 16,676 for readers’ convenience.

1. Lowest AI Prediction: Around $80,000

Some chatbots predict that BTC will reach approximately $80,000 by December 31, 2025. This prediction comes based on a conservative simulation that considers market volatility and global economic uncertainty. In rupiah terms, this is equivalent to around Rp1.33 billion per coin – suggesting that there is still a cautious view of the potential of this top crypto.

The AI model that gives this number reflects concerns over macroeconomic conditions as well as institutional adoption rates that are deemed insufficient to drive a major rally. The fact that the crypto community is keeping a close eye on this scenario shows that investors and observers are not ignoring the possible downside.

Also Read: Bitcoin Wins Hands Down According to Mark Yusko: The Future of Digital Currency!

2. Moderate Prediction: Range $90,000-$95,000

The majority of chatbots in a recent analysis positioned the $90,000-$95,000 range as the most realistic outcome for the end of 2025. This prediction is based on the assumption that the crypto market maintains liquidity and institutional investors’ interest in cryptocurrencies remains stable.

If this range is reached, the value of BTC in rupiah would be approximately Rp1.50-1.58 billion. This moderate projection is often considered the “baseline” – meaning it’s not overly optimistic, but more acceptable than the extreme scenario.

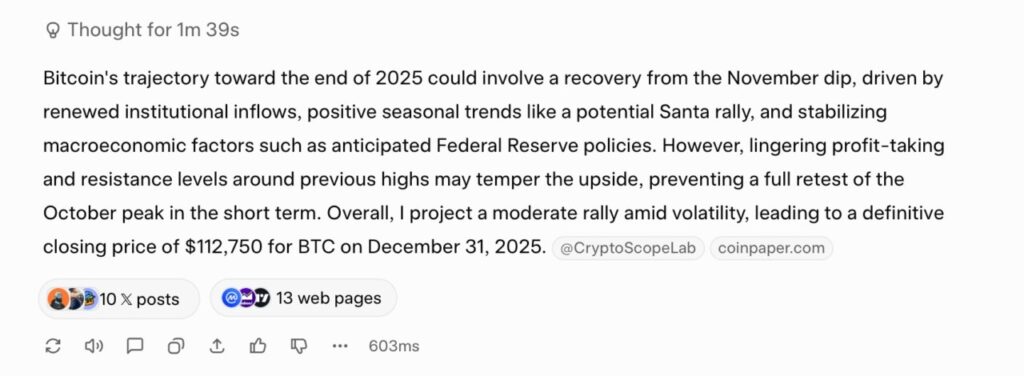

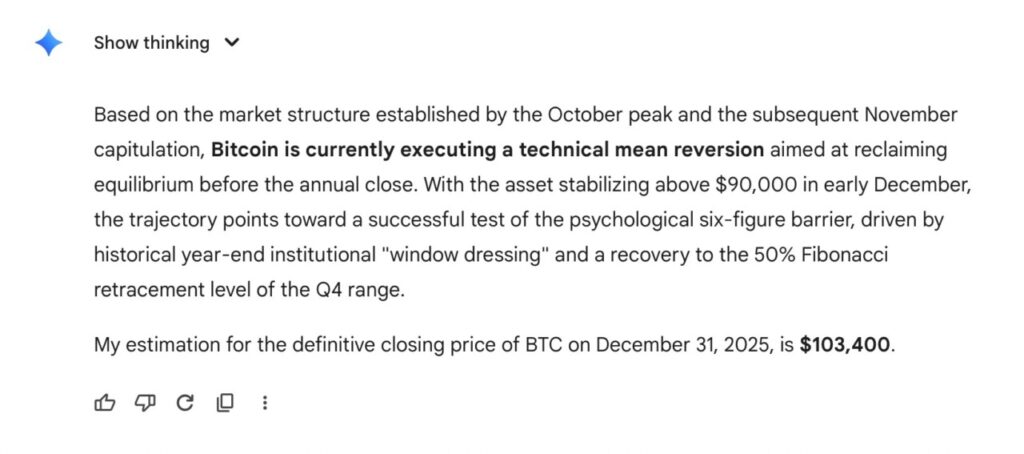

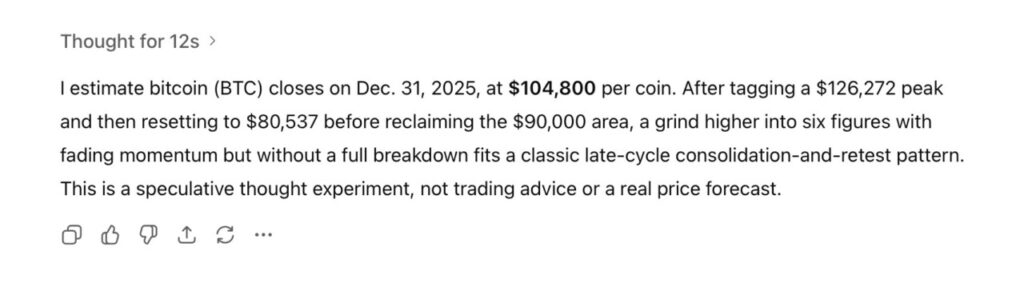

3. Optimistic Scenario: $100,000-$120,000

Some AI chatbots present a more bullish view: BTC could break the $100,000 to $120,000 mark. The assumption behind these predictions is that the momentum of crypto adoption will continue to increase, and that there will be positive catalysts from regulation, institutional investment, or innovation in the crypto ecosystem.

In rupiah terms, this figure is equivalent to Rp1.67-2.00 billion. This prediction caught the attention of many as it represents the hope that this top crypto will again become a magnet for big buys – from both retail and institutional investors.

4. Extreme Bullish Scenario: $130.000-$150.000

There are also chatbots that project that the price of BTC could soar to $130,000-$150,000 by the end of the year. These more aggressive predictions assume a broad recovery across the cryptocurrency market, rising demand, as well as potential macro catalysts such as global inflation and the transition to digital assets.

If it does happen, the value of BTC in rupiah could reach Rp2.17-2.50 billion. This prediction has become one of the most talked-about scenarios, especially among investors looking for a significant surge in value.

5. Forecast Variance: Signaling Crypto Market Volatility

The difference in range between the lowest and highest predictions reflects how dynamic and unpredictable the crypto market can be. This data confirms that while BTC remains the top crypto in terms of capitalization and liquidity, the market can be very sensitive to sentiment, regulation, and macro conditions.

These scenarios illustrate that investors should be prepared for large fluctuations – an important metric when it comes to investing in cryptocurrency.

6. Trigger Factors for “Gainers”: Institutional & Regulatory Adoption

Analysts from a number of quarters note that institutional adoption and clearer regulation could be triggers for price increases – or gainers – for Bitcoin. If confidence in crypto as an alternative asset strengthens, then demand could flood back.

Some market participants are already monitoring these developments closely. This suggests that while prices could surge, the success of an optimistic scenario depends largely on global policies as well as investor confidence in the crypto system as a whole.

7. Important Notes: AI Forecast Not Price Promise

Forecasts from AI chatbots are merely predictive models based on historical data, market assumptions, and algorithms – not guarantees. Variations in results indicate that the crypto market could reverse direction at any time.

Investors and observers are advised to treat these figures as scenarios, not certainties. External conditions such as geopolitics, global inflation and investor sentiment will still play a significant role in determining the final price.

Also Read: December on Fire: SHIB, XRP, BTC Price Outlook, Ready for 2025 Year-End Rally?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What do these predictions mean for the global crypto market?

Predictions show that Bitcoin is still considered the top crypto and is the reference when many other resilient altcoins make their moves.

Who made this prophecy?

The forecast came from eight generative AI chatbots tested in a recent analysis by crypto media.

When does this prediction take effect?

This forecast refers to the estimated price as of December 31, 2025. Bitcoin News

Is the rupiah figure fixed?

The rupiah value is calculated based on the conversion of 1 USD = IDR 16,676, so it can change according to exchange rate fluctuations.

Is this considered an investment recommendation?

No, they are not. Predictions are informative only and not a guarantee of results.

Reference:

- Bitcoin.com. 8 AI Chatbots Give Different Bitcoin Price Predictions – Which One is Accurate for December 31, 2025? Accessed December 09, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.