Download Pintu App

Fifth XRP Spot ETF Set to Launch Following CBOE’s Approval for Trading

Jakarta, Pintu News – The fifth XRP (XRP) ETF product will begin trading after receiving a new approval from Cboe. As such, the fund will join other ETFs that have recorded fund inflows of more than $950 million in less than four weeks.

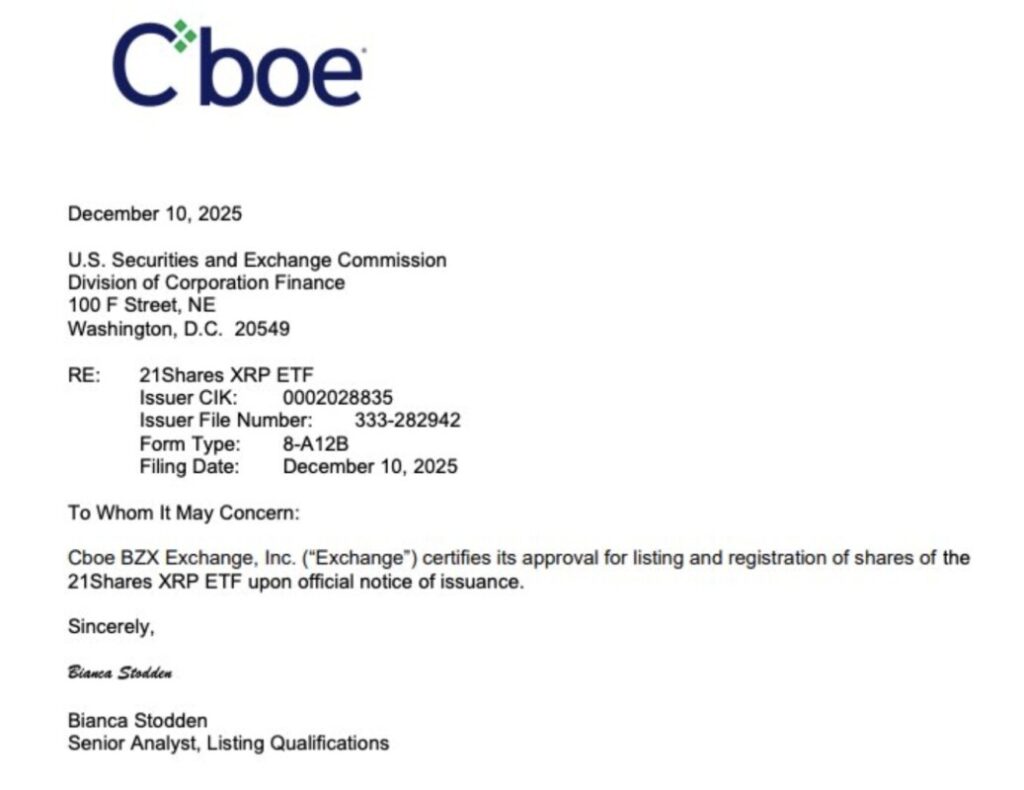

Cboe Gives Green Light to New XRP ETF with Ticker TOXR

Cboe has approved the listing of 21Shares’ new XRP fund that will trade under the ticker code “TOXR.” This approval was disclosed through an official document filed with the SEC. The fund will begin trading on the exchange once it meets the final requirements needed.

Read also: XRP Price Getting Ready to Soar? Triangle pattern hints at 16% upside potential

With this approval, there are now five XRP-based spot ETFs listed in the United States. This approval comes after 21Shares made the fifth update to their S-1 registration form earlier this week, as the final step before the official launch.

However, the document still contains a “delaying amendment” clause, which means that the issuer may still be waiting for a CERT notification or direct approval from the SEC.

Once launched, this XRP ETF will track the CME CF XRP-Dollar Reference Rate, New York variant. This will allow investors to gain exposure to the price performance of XRP without the need to hold the crypto asset directly. 21Shares has also publicly signaled the launch through its X platform.

The TOXR ETF from 21Shares is designed with an annual sponsor fee of 0.3% charged daily and paid weekly in XRP. To enhance security and compliance, 21Shares uses a system with multiple custodians.

Ripple Markets is providing initial liquidity for this ETF by contributing 100 million XRP, which is currently valued at around $226 million. The process of creating and redeeming ETF units can be done either in-kind through XRP transfers or through cash settlement.

This ETF will be the latest product to be launched after Franklin Templeton’s XRP spot fund that was released at the end of last month.

XRP Funds Near $1 Billion Milestone

The XRP spot ETF in the United States has raised nearly $1 billion in fund inflows in just under a month. Based on the latest data, the total inflows stood at around $954 million.

Read also: Ethereum Price Climbs to $3,200 Today: Whale Buys ETH Massively!

Ripple CEO, Brad Garlinghouse, revealed in a post on Monday that XRP is now the fastest growing crypto ETF in the US by total assets under management (AUM), outperforming Ethereum (ETH).

He also noted that the demand for regulated crypto products is increasing in the market.

Interestingly, the XRP spot fund has yet to record a day with net outflows. Even yesterday, despite market fluctuations, the fund saw additional inflows of around $10 million.

On the other hand, Ripple also released an important update for the XRP Ledger. This update aims to improve the stability of the network as well as strengthen the DeFi features in it.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Fifth Spot XRP ETF Set for Launch as CBOE Approves New Fund for Trading. Accessed on December 12, 2025

- Coinpedia. 21Shares TOXR XRP ETF Cleared by CBOE as Inflows Near $1 Billion. Accessed on December 12, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.