Download Pintu App

5 Solana Liquidity Crisis (SOL) Indicators & Potential Bear Market Entry!

Jakarta, Pintu News – Solana (SOL) is back in the spotlight after recent data showed that its liquidity fell to levels that usually appear during bear markets.

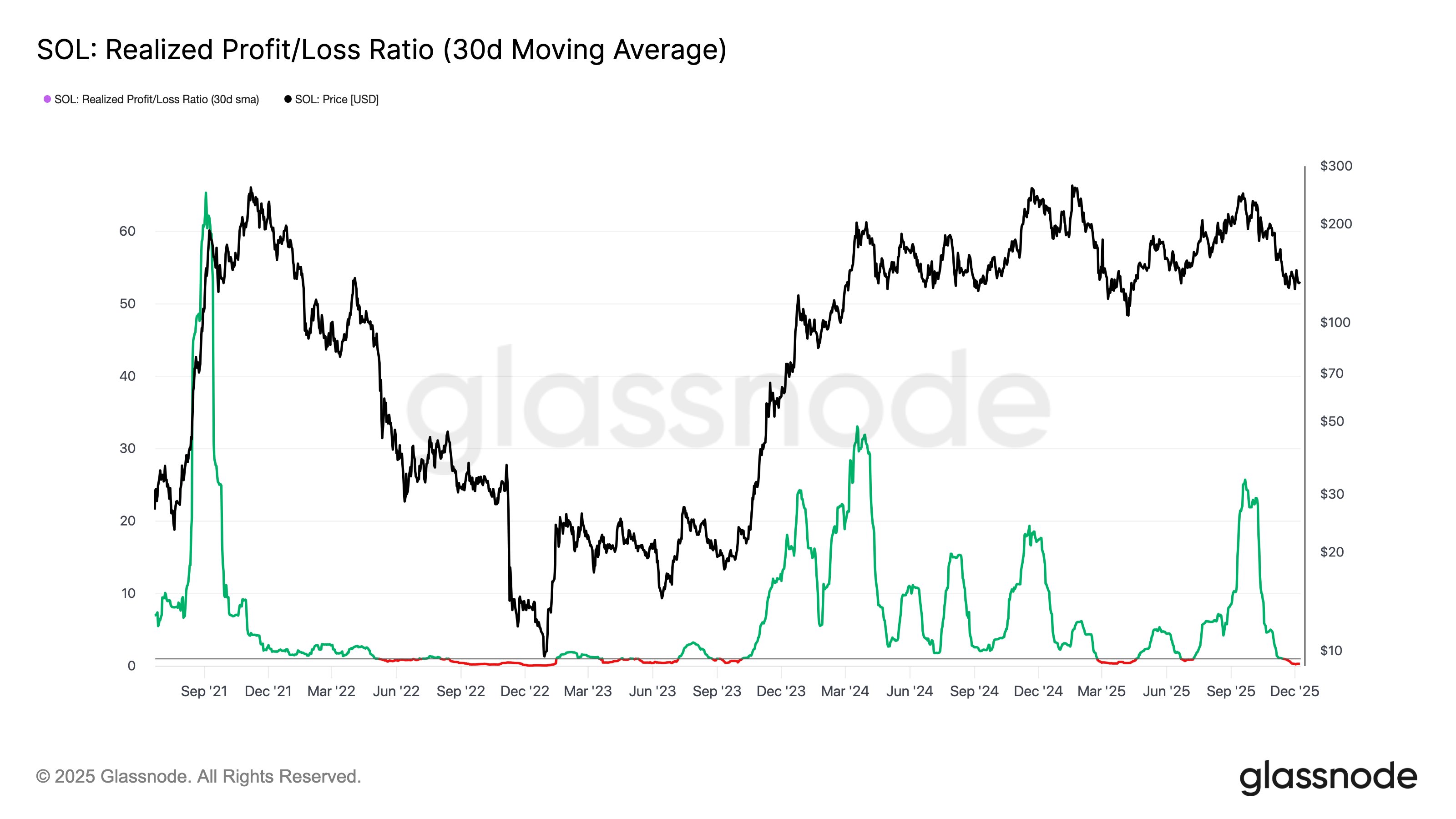

According to a NewsBTC report citing Glassnode’s analysis, the sharp drop in the realized profit/loss ratio exposes significant pressure on investors. This raises concerns as to whether Solana is entering a deeper bearish phase or just experiencing a temporary correction.

1. Liquidity Shrinks to Bear Market Levels According to Glassnode

Glassnode, an on-chain analytics firm cited by NewsBTC, suggests that Solana’s liquidity is now at levels commonly seen during bear markets. Liquidity in the context of cryptocurrencies can be measured through various metrics, and in this case, the focus is on the Realized Gain/Loss Ratio. This metric compares the value of an investor’s realized gains to the value of his or her losses based on the movement history of each SOL coin.

NewsBTC notes that when these metrics weaken consistently, selling pressure generally increases. Falling liquidity means fewer transactions are taking place under healthy market conditions, so volatility tends to increase. In Solana’s context, falling liquidity signals greater caution among investors.

Also Read: 5 Strong Signals from Dogecoin: Price Resilience, New Adoptions, to Potential $1!

2. Profit/Loss Ratio Drops Drastically after September Rally

The graph from Glassnode described by NewsBTC shows that Solana’s profit/loss ratio spiked in September when many investors took profits during the price rally. This increase reflects the high interest in realizing profits when prices move positively. However, things changed drastically after Solana reached its peak price in October.

In November, the indicator fell sharply to below 1, indicating that realized losses were beginning to outweigh gains. According to Glassnode’s ongoing analysis, the metric has remained in the loss zone to date. This illustrates that investor capitulation is increasingly dominant and indicates structural pressures that are weakening prices.

3. SOL Prices Approach a Vulnerable Point Amid Declining Liquidity

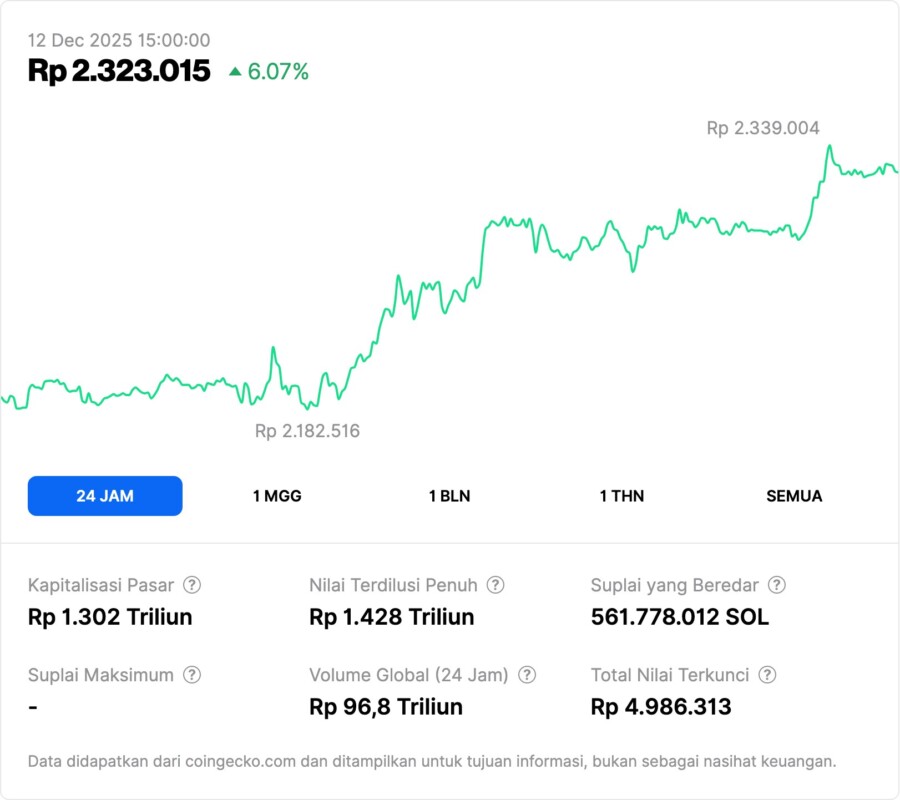

NewsBTC notes that Solana briefly reached $144 on Tuesday before correcting back to around $138. This price drop came as on-chain indicators deteriorated, reflecting weakening buying interest. With decreased liquidity, the price reaction to selling pressure is likely to be stronger.

A comparison of the current situation with the bear market of 2022, as described in the report, shows a similar pattern. In that period, Solana experienced a prolonged phase in the loss zone before finally forming its bottom. This has led to speculation as to whether similar conditions are being repeated.

4. Dominance of Realized Losses Hints at Investor Capitulation

NewsBTC’s underlined Glassnode data shows that the realized profit/loss ratio has settled in the loss zone for several weeks. The dominance of realized losses often signals that many investors are selling at a loss, reflecting a loss of short-term conviction. This phenomenon also exposes significant psychological pressure within the Solana ecosystem.

In a bearish market, the dominance of loss realization usually lasts until prices reach a new equilibrium point capable of attracting buying interest again. As such, the current trend reflects a shift in market structure that will take time to recover. Investors monitoring the situation usually wait for signs of recovery in on-chain data before updating long-term expectations.

5. Solana’s Prospects Amid a Strengthening Bearish Trend

NewsBTC highlights that Solana’s short-term volatility remains high, with daily movements showing sharp fluctuations. The main question for the market is whether this is a temporary phase or the beginning of a long-term bearish trend. The continuation of decreased liquidity and the dominance of realization losses may prolong the pressure on prices.

On the other hand, previous bearish trends suggest that phases like this could be part of a larger cycle before a recovery takes place. However, the report warns that without new liquidity support and positive sentiment, recovery efforts may remain limited. The coming weeks are seen as an important period to assess whether market dynamics will form a more stable price base.

Also Read: 5 Highlights of TRUMP Meme Coin’s $1 Million Game Campaign: New Strategy to Boost Token Value?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is Solana (SOL)?

Solana (SOL) is a cryptocurrency known for its fast transaction capabilities and low fees, widely used in decentralized finance applications.

How does the realized gain/loss ratio work?

According to Glassnode, this metric measures the value of profits and losses realized by investors by tracking the last price of each coin when it changed hands on the network.

Why is liquidity important to Solana?

The NewsBTC report explains that liquidity determines how easily an asset can be traded without drastically affecting the price; low liquidity often signals the risk of high volatility.

What does it mean for the indicator to be below 1?

When the profit/loss ratio is below 1, realized losses are greater than profits, a bearish signal according to Glassnode.

Is the current downturn temporary?

NewsBTC notes that this situation could reflect a temporary phase or the beginning of a longer downward trend, depending on market dynamics and liquidity recovery.

Reference

- NewsBTC. Solana Bear Territory Realized Loss Profit. Accessed December 12, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.