Download Pintu App

5 BitcoinOG Whale Action Indicators that Drive New Optimism for ETH

Jakarta, Pintu News – Ethereum (ETH) has regained the market’s attention after breaking through the $3,300 level and briefly approaching $3,400, indicating an increasingly clear short-term momentum shift. However, according to a report by NewsBTC, bullish confidence is still fragile as ETH has yet to confirm a macro trend reversal.

In the midst of this situation, the aggressive moves of a whale named BitcoinOG came into the spotlight after he increased his long Ethereum position by hundreds of millions of dollars.

1. BitcoinOG whales double down on long positions as market remains skeptical

According to on-chain data from Lookonchain cited by NewsBTC, BitcoinOG-which was previously known for executing large shorts on Bitcoin (BTC) during the October 10 crash-is now increasing its long exposure to Ethereum. This decision comes at a time when most traders are still cautious about market conditions. This contrasting move shows the clear difference between retail sentiment and high-capital investor strategies.

The report highlights that this increase in long positions came right after ETH showed a solid price recovery. This has led to speculation that BitcoinOG may be anticipating a potential big run-up, even as general market sentiment remains unsure of Ethereum’s short-term direction.

Also Read: 5 Strong Signals from Dogecoin: Price Resilience, New Adoptions, to $1 Potential!

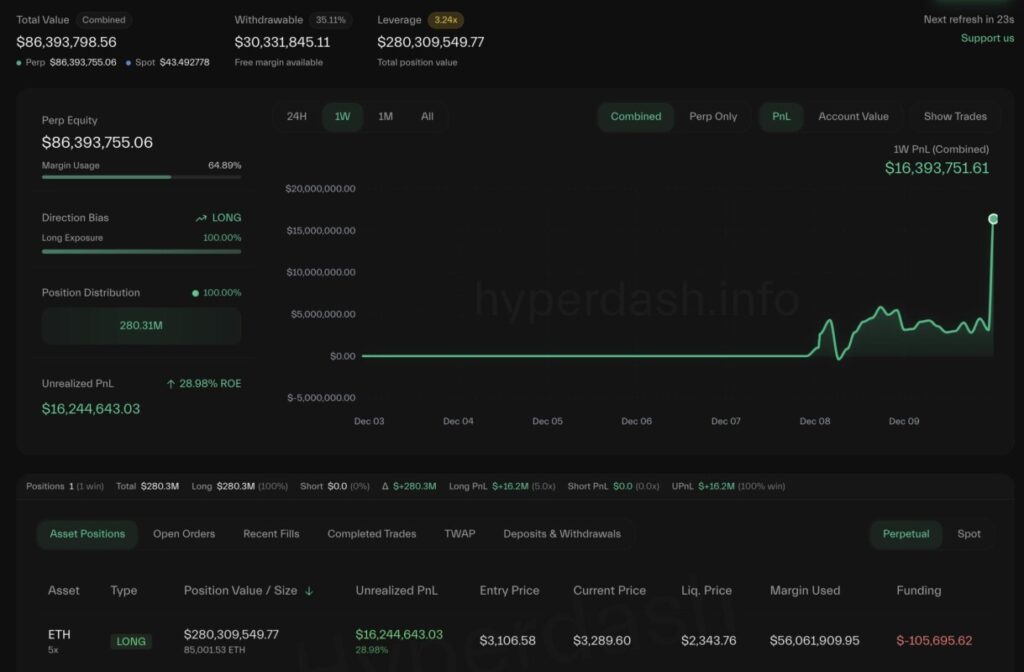

2. Position of $280 Million and Unrealized Gains of Over $16 Million

Lookonchain notes that BitcoinOG now holds 85,001 ETH worth approximately $280 million. According to NewsBTC’s report, this position has resulted in an unrealized profit of more than $16 million. Its size not only confirms the whale’s faith in ETH’s upside potential, but also suggests that it is prepared to endure volatility ahead of major macro events.

Such aggressive behavior is usually read as a strategic signal from experienced investors-often called “smart money.” When large market participants take significant positions consistently in one direction, it can shape new sentiment expectations among other market participants.

3. Sentiment Divergence between Whale and Retail Investors

NewsBTC reports that BitcoinOG’s move contrasts drastically with the cautious stance taken by most retail traders. This divergence suggests that some large market participants are seeing opportunities that are not immediately apparent to other investors. In market behavior analysis, sentiment differences like this are often indicators of shifting price trends that may be forming.

Aggressive accumulation in periods when the market is still hesitant is often a sign that large participants have identified stronger market parameters for potential upside. In the context of Ethereum, this could reflect a belief that ETH is in a broader structural breakout phase.

4. Risks and Opportunities Ahead of FOMC Meeting

BitcoinOG’s move comes ahead of the Federal Open Market Committee (FOMC) meeting, which NewsBTC says could be a major catalyst for market volatility. The Federal Reserve’s decision on interest rates will affect liquidity and risk appetite across cryptocurrencies.

NewsBTC notes that a rate cut could improve liquidity conditions, weaken the US dollar, and be a driver for Ethereum’s rise. However, if the FOMC gives hawkish signals or is more conservative than market expectations, high volatility could arise and pressure ETH which is currently at a critical resistance area.

5. 4 Hour Chart Confirms Bullish Momentum but Strong Resistance Awaits

Analysis of the 4-hour chart quoted by NewsBTC shows a clean breakout from a multi-week downtrend, accompanied by high volume and a strong recovery above the 50 EMA and 100 EMA. Technical structures like this are often the first sign of a short-term uptrend forming.

However, ETH is now below the tight resistance zone at $3,380-$3,420, where sellers previously dominated. The current consolidation below this zone indicates that the market is in neutral: bulls are trying to maintain acceptance above $3,300, while bears maintain defense at the next resistance level. A move above this zone is required to confirm the continuation of the bullish trend.

Also Read: 5 Highlights of TRUMP Meme Coin’s $1 Million Game Campaign: New Strategy to Boost Token Value?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Who is BitcoinOG?

According to NewsBTC, BitcoinOG is a whale known for successfully executing large shorts on Bitcoin during the October 10 market crash and is now switching to a long Ethereum position.

How big of an Ethereum position does BitcoinOG have?

Lookonchain notes that BitcoinOG holds 85,001 ETH worth approximately $280 million with unrealized gains of over $16 million.

Why is the BitcoinOG step important?

NewsBTC considers this action important because it shows a divergence between whale behavior and retail sentiment, which is often an indicator of changing market trends.

What is the biggest risk to Ethereum’s current long position?

The main risk is the FOMC meeting, where the interest rate decision could trigger huge volatility and affect the liquidity and price direction of ETH.

What are the main resistances for Ethereum in the short term?

According to the 4-hour chart analysis, ETH faces strong resistance at $3,380-$3,420 and needs to break this zone to confirm a continued bullish trend.

Reference

- NewsBTC. The Whale Who Can’t Stop Buying: Bitcoin OG Scales Ethereum Long to $280M After Price Surge. Accessed December 12, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.