Download Pintu App

The Rise and Fall of 2025’s Top 5 Cryptos — Did Investors Win or Lose?

Jakarta, Pintu News – The year 2025 witnesses the dynamics of the crypto market becoming more complex and full of surprises. Amid global volatility, the five largest crypto assets by market capitalization remain in the spotlight for investors and industry players.

From spectacular price spikes to shocking sharp corrections, their journeys have been full of twists and turns that beg the big question: has investing in crypto this year been more of a hit, or a miss? This article will review the performance of the top five cryptos throughout 2025.

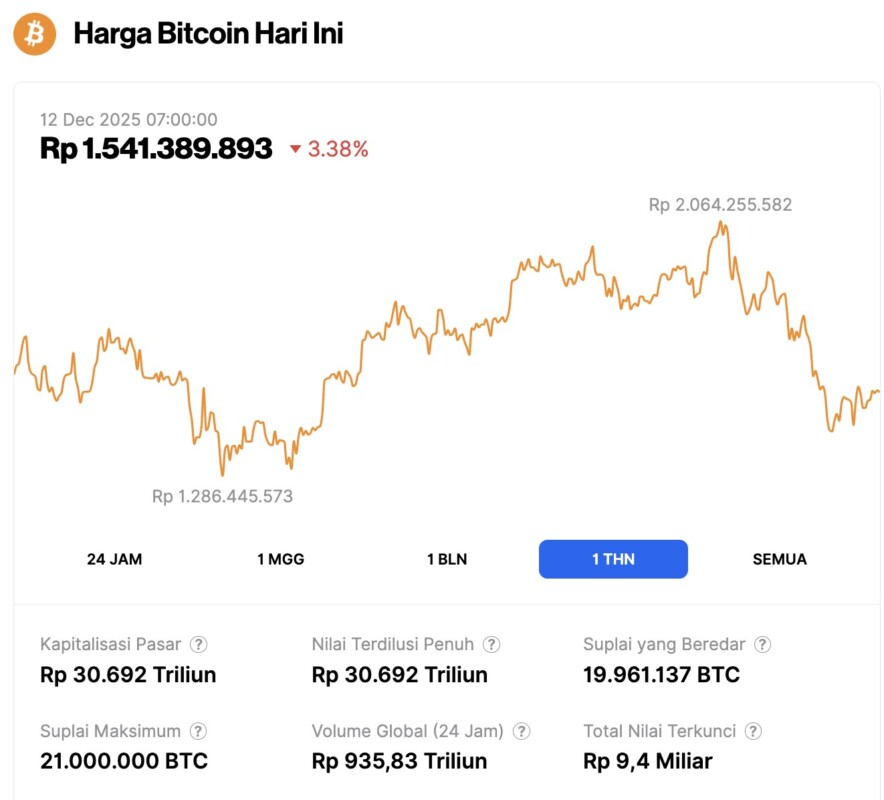

Bitcoin Price Drops 3.38% in 1 Year

As of December 12, 2025, the price of Bitcoin (BTC), as the number 1 largest crypto by market capitalization, was recorded at Rp1,541,389,893, a decrease of 3.38% in the past 1 year.

Read also: Bitcoin, Ethereum, & XRP: 3 Hottest Price Forecasts Toward the End of 2025

In the span of the past year, the chart shows a fairly volatile price movement, with the lowest point being around Rp1,286,445,573 and the highest point touching Rp2,064,255,582. This reflects the high volatility that remains a key characteristic of the crypto market.

In terms of fundamentals, Bitcoin’s market capitalization is currently at Rp30,692 trillion, with a total circulating supply of 19,961,137 BTC out of a maximum supply of 21,000,000 BTC.

Meanwhile, global trading volume in the last 24 hours was recorded at Rp935.83 trillion, indicating high liquidity and high investor interest in these assets.

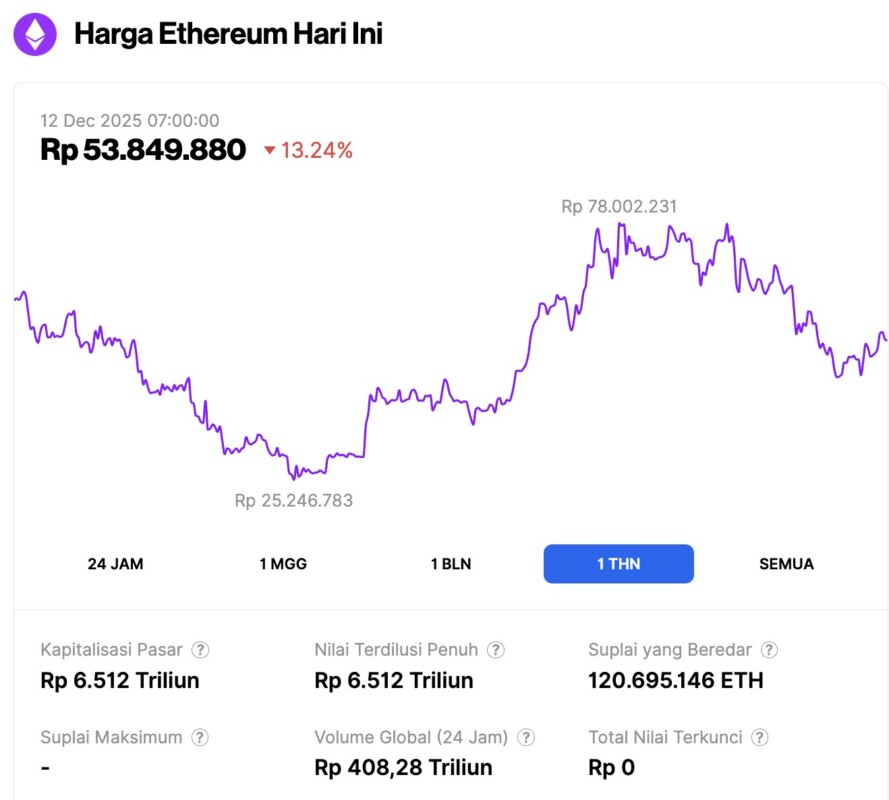

Ethereum Price Drops 13.24% in 1 Year

On December 12, the price of Ethereum (ETH), which occupies the position of the second largest crypto by market cap, was recorded at Rp53,849,880, a sharp decline of 13.24% in the 1-year period. If you look at the price movements over the past year, Ethereum had reached a high of around Rp78,002,231, but also fell to a low of Rp25,246,783.

In terms of fundamentals, Ethereum has the same market capitalization and fully diluted value of Rp6,512 trillion, with an outstanding supply of 120,695,146 ETH.

Global trading volume in the last 24 hours was recorded at Rp408.28 trillion, indicating that there is still high activity in buying and selling ETH amid price pressure.

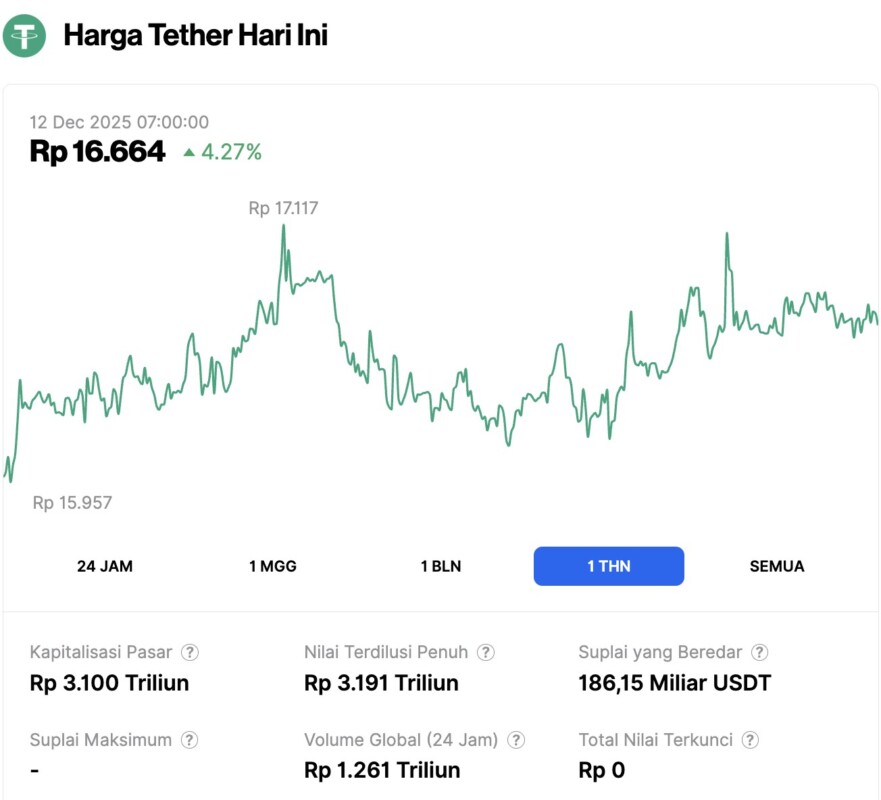

USDT Price Increases 4.27% in 1 Year Time

As of December 12, the price of Tether (USDT), the third-largest crypto by market cap, stood at Rp16,664, an increase of 4.27% over a 1-year period. As a stablecoin that is usually pegged to the US dollar, USDT’s price fluctuations against the rupiah reflect exchange rate movements, not crypto market volatility as with other assets.

Over the past year, the price of USDT against the rupiah moved in a relatively stable range, with the lowest level at Rp15,957 and the highest reaching Rp17,117. In terms of market capitalization, Tether recorded a value of Rp3,100 trillion, with a fully diluted value slightly higher at Rp3,191 trillion.

Global trading volume in the last 24 hours was a record high at Rp1,261 trillion, reflecting the massive liquidity and high usage of Tether in various crypto transactions, inter-asset trading, and transfers across exchanges and countries.

Read also: YouTube allows US creators to pay with PYUSD stablecoin

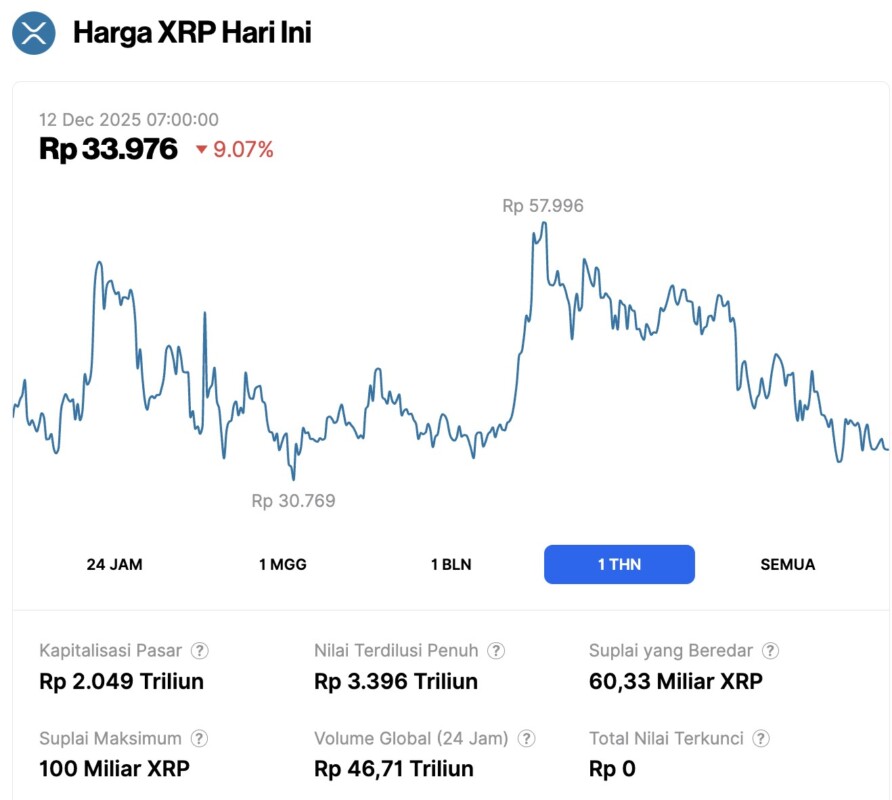

XRP price drops 9.07% within 1 year

On December 12, the price of XRP (XRP), as the fourth largest cryptocurrency by market cap, was recorded at Rp33,976, a sharp decline of 9.07% in the 1-year time period. When looking at the price movement over the past year, XRP had recorded a high of Rp57,996 and a low of Rp30,769.

In terms of fundamentals, XRP’s market capitalization currently stands at Rp2,049 trillion, while its fully diluted value is estimated at Rp3,396 trillion. Currently, the circulating supply stands at 60.33 billion XRP, out of a maximum total supply of 100 billion XRP. This means that about 60% of the total supply is already in the market.

Global trading volume in the last 24 hours was recorded at Rp46.71 trillion, indicating that XRP remains a highly liquid and widely traded asset on various crypto exchanges.

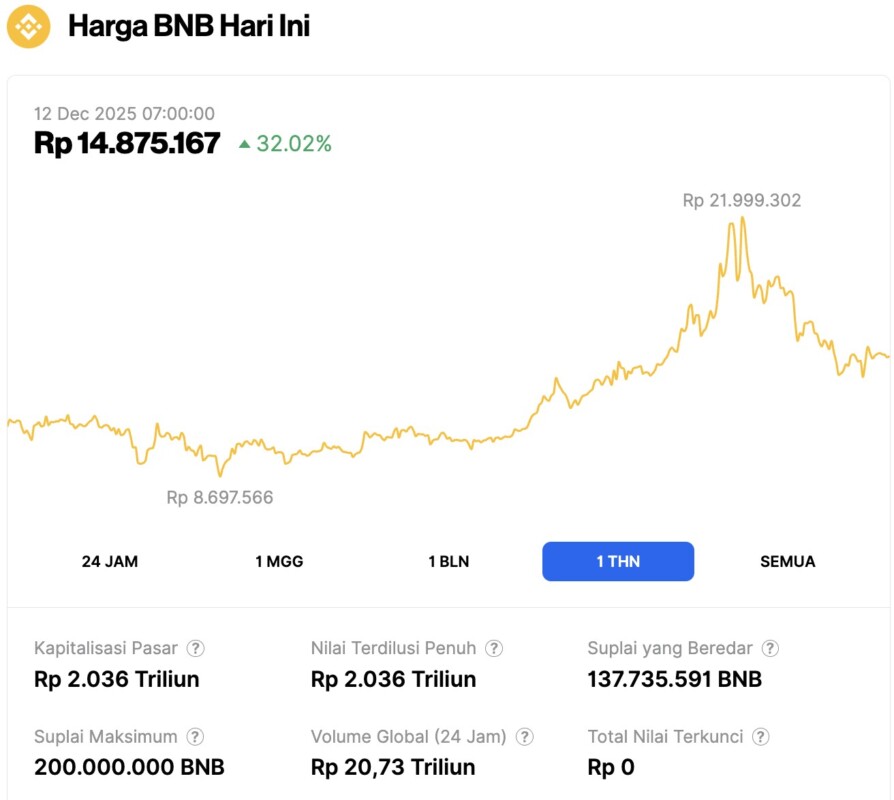

BNB price rises 32.02% within 1 year

On December 12, the price of BNB (Binance Coin), as the fifth-largest cryptocurrency by market cap, was recorded at Rp14,875,167, experiencing a sharp jump of 32.02% within 1 year. This increase indicates a strong positive sentiment in the market, driving a significant price rally in a short period of time.

Over the past year, BNB has experienced quite dramatic price movements. The lowest price was recorded at around Rp8,697,566, while the highest price reached Rp21,999,302. In terms of fundamentals, BNB’s market capitalization currently stands at Rp2,036 trillion, with an equivalent fully diluted value, signifying that most of the tokens have been in circulation.

Trading activity is also quite high, with global volume in the last 24 hours reaching Rp20.73 trillion, indicating that market interest in BNB is still very large.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.