Download Pintu App

Solana Price Drops to 6-Month Low as Crypto Whales Begin Accumulating SOL

Jakarta, Pintu News – The Solana (SOL) network’s native coin, SOL, ended the week with another price drop, and has now dropped to its lowest support level in six months.

While the retest of this support level indicates weak market demand, recent data suggests that whales may be taking advantage of this moment to buy the dip.

Whale actively buys Solana during price consolidation

According to recent reports on Solana, whales started actively buying during the price consolidation phase. Data from the order book for large transactions shows that whales have been buying SOL in the last three days.

Read also: Jupiter Launches JupUSD Stablecoin and Big DeFi Update at Solana Breakpoint 2025!

To give you an idea, the whales have collectively bought over $14 million worth of SOL through Coinbase, Binance, and OKX exchanges since Friday. In addition, this group of investors also opened long positions worth more than $284 million.

While this activity is not yet a sign of very strong demand, it shows that the whale group is confident enough to enter the market at the current low prices.

Interestingly, this activity occurred while SOL prices were near their lowest point in the last 6 months – a level that is considered critical.

Although SOL prices are still in a consolidation zone, short-term price movements are currently more dominant in influencing market direction. This is due to various macroeconomic factors that create long-term uncertainty, so SOL prices tend to move in narrow ranges over the past 3 weeks.

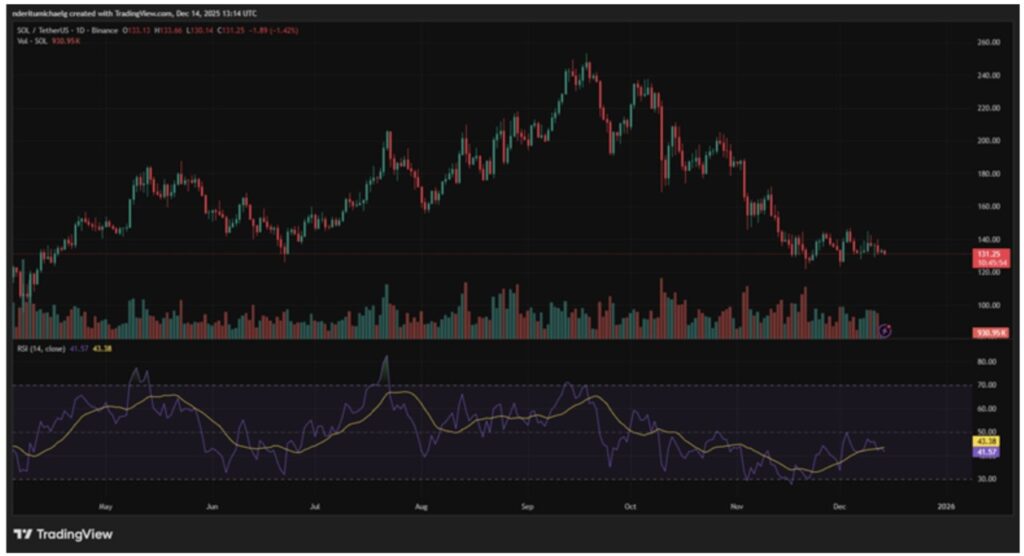

The decline in prices since the middle of last week further strengthened the signal of weak demand, as shown by the RSI indicator which failed to break the 50% level. This means that general market demand is still relatively weak.

Number of Stablecoins on Solana Network hits an all-time high

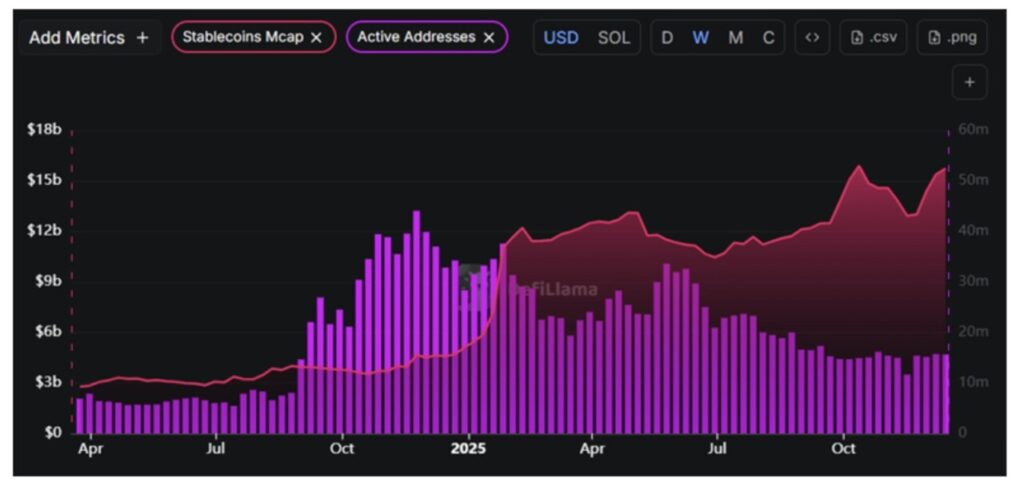

While the SOL price is still trending sideways or sluggish, the Solana network is showing positive growth in several other key sectors. One striking key indicator is the number of stablecoins on the network, which has steadily increased in recent months.

In the latest news update on Solana, this positive trend has continued throughout this month. The market capitalization of stablecoins on the Solana network surged to reach $16.44 billion, which is a record high in history.

The increase in the stablecoin’s market capitalization indicates that liquidity is flowing into the Solana ecosystem. This is a positive growth signal and could indicate that investors are getting ready to move their value or assets within the Solana ecosystem.

Outside of the stablecoin sector, Solana’s network activity has also remained relatively stable. There were about 15.65 million active addresses in the last 7 days.

Weekly activity on the network has also been consistent for four consecutive weeks, indicating that activity is stabilizing after having declined from slightly higher levels in the second quarter of 2025.

Interestingly, in terms of transaction volume, the Solana network still significantly outperforms Ethereum (ETH). Based on the latest data, the number of transactions on the Solana network is 48 times more than the number of transactions on the Ethereum network.

Read also: Ethereum Price Held at $3,100 Today: ETH Breakout Zone Coming into View?

Net Flow in Solana Network Drops to Early October Levels

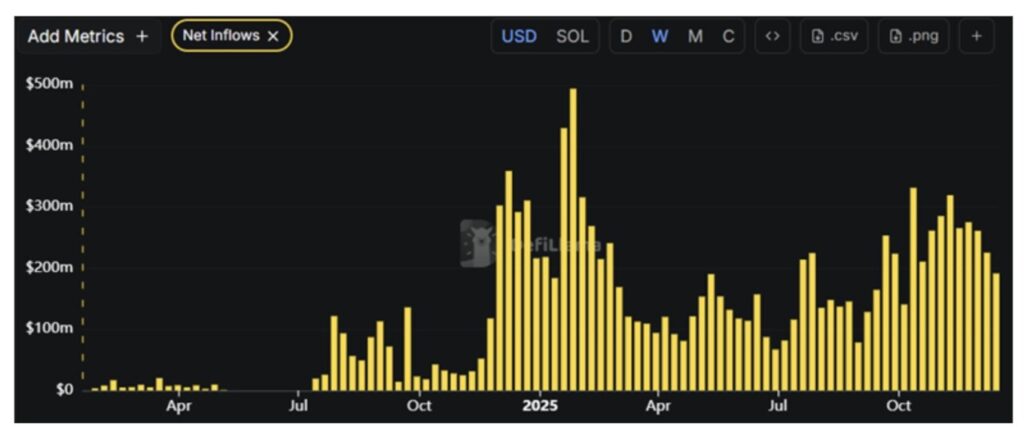

While stablecoin activity on the Solana network continues to grow, the net flow indicator can provide a more accurate picture of the movement of value between networks.

In the period from December 8 to 14, Solana’s net flow fell to $111.91 million.

In comparison, the weekly net flow had peaked at $331 million in the period from October 6 to 12, which was the highest level during the second half of 2025. The decrease in net flow reflects the decline in value flowing in and out of the Solana network to other blockchain networks.

Typically, the net flow value will increase when the market is bullish or when investor confidence is high – situations that are also usually accompanied by a surge in network activity.

However, the current decline in weekly net flows indicates a cautious stance from market participants, reflecting market conditions that have not fully recovered from uncertainty.

However, the net flow figure still indicates significant network activity, and thus remains an important indicator in monitoring liquidity flows and market sentiment.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coin Republic. Solana News: SOL Price At 6-Month Low As Whales Stack Up. Accessed on December 15, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.