Download Pintu App

Chainlink Sees Strong Accumulation, But LINK Price Fails to Respond – Why?

Jakarta, Pintu News – Chainlink (LINK) is attracting the attention of whale, institutional, and retail traders despite weak market conditions. On-chain data shows massive accumulation, but price action still lags.

Chainlink reserves on exchanges hit yearly low

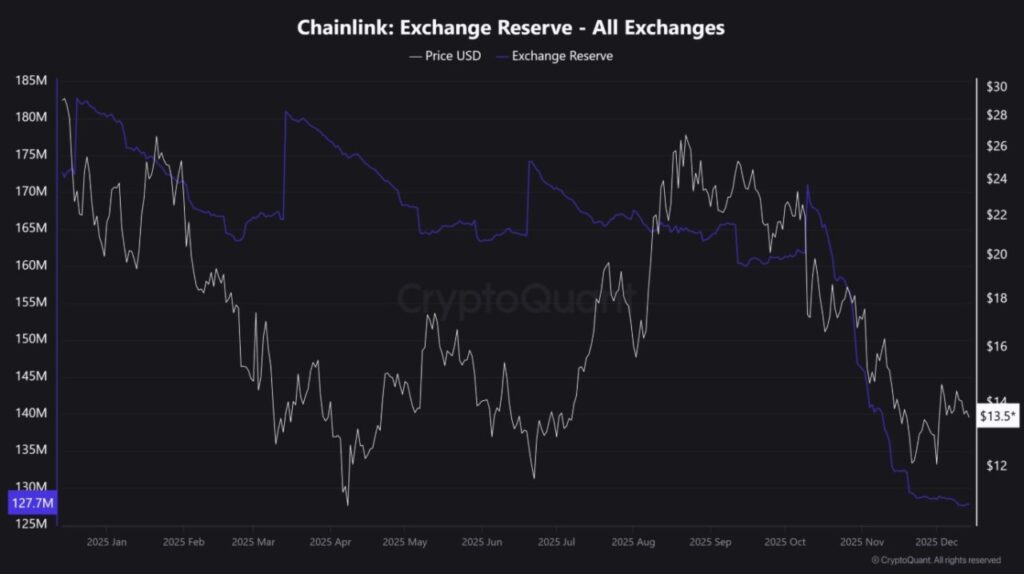

Exchange Reserve data from CryptoQuant shows that over 44.98 million LINK tokens have exited exchanges over the past year. This decline brings LINK’s reserves on exchanges to the lowest level in the past year.

Read also: Solana Price Drops to 6-M

In the crypto market, falling reserves on exchanges are often interpreted as a sign of accumulation, as investors move their tokens toself-custody. This behavior generally reduces selling pressure.

However, the price of LINK has not reflected these positive signals. During the same period, the token’s price dropped sharply from almost $29 to around $13.60.

This directional divergence between accumulation and price has traders questioning whether accumulation alone is enough to withstand pressure from the broader market.

Wall Street cash flow unable to boost LINK price

Beyond demand from the crypto community, institutional interest has also started to show through the Spot Chainlink ETF in the United States. Data from SoSoValue shows that the Spot LINK ETF has recorded capital inflows since its launch on December 2.

These inflows indicate fresh funds flowing into the product, which usually puts buying pressure on the underlying asset. Even so, the price of LINK continues to decline.

This weakness is in line with the overall state of the crypto market, which remains under pressure after bullish momentum faded since around October 10.

Trading volume shrinks as prices fall

On December 14, LINK was trading around $13.65, down about 2.25% in the last 24 hours. Trading activity has also fallen sharply.

Spot volumes fell by more than 48% to around $295.6 million over the same period. The low participation suggests that traders are opting for caution amid market uncertainty.

Read also: Will Bittensor Price Surge to $400 After the First TAO Halving?

This volume weakness reinforces the view that the current price movement is not supported by strong market conviction.

On the daily chart, LINK has been moving in a consolidation zone between $13.19 and $14.70 since early December. The price is currently near the lower boundary of the zone. The area also serves as an important support level around $13.20. If this level fails to hold, LINK has the potential for further declines.

Based on the previous price structure, a drop from this consolidation zone could open up a downside opportunity of around 16%. Below $13.20, price support looks quite limited.

Meanwhile, the Average Directional Index (ADX) is at 20.91. A reading below 25 indicates that the strength of the current trend is weak.

Trader’s Focus on Short Positions

Amidst these conditions, traders seem to be cautious and tend to follow the general market trend.

Data from CoinGlass shows that traders were taking excessively leveraged positions in the price range of $13.45 (lower bound) and $13.99 (upper bound). At these levels, there were $2.01 million worth of leveraged long positions and $3.04 million worth of leveraged short positions.

Overall, the short-term sentiment is bearish. Nevertheless, the falling stockpiles on exchanges and steady ETF inflows still hint at a long-term accumulation taking place behind the scenes.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Chainlink sees accumulation yet price slips – What’s going on? Accessed on December 15, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.