Download Pintu App

Ethereum Drops to $2,900 as Whale Scoops Up $119 Million Worth of ETH

Jakarta, Pintu News – Ethereum (ETH) price remains in the spotlight as the current market downturn alters short-term positions in both spot and derivatives markets. Despite the overall market weakness, ETH price is showing a positive response to buying from whales and institutional investors.

In addition, leveraged buying and interest in ETFs also emerged as prices fell, reinforcing indications of underlying demand. These conditions make ETH price movements, institutional involvement, and technical structure the main factors determining the short-term direction ahead.

Then, how will Ethereum price move today?

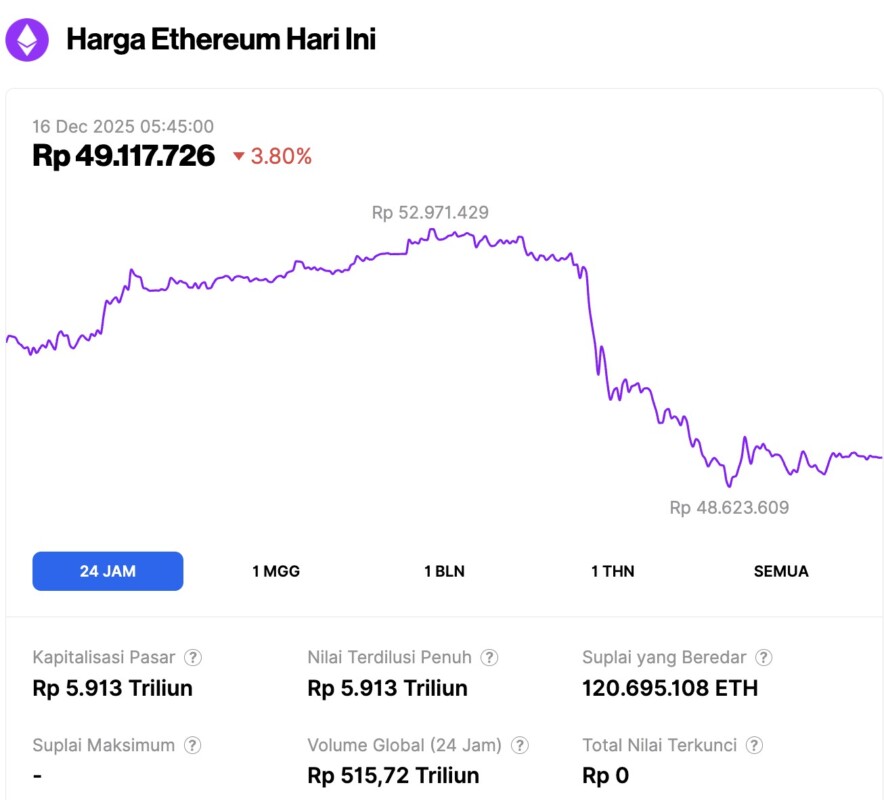

Ethereum Price Drops 3.80% in 24 Hours

On December 16, 2025, Ethereum was trading at approximately $2,940, or around IDR 49,117,726 — marking a 3.80% decline over the past 24 hours. During this time, ETH dipped to a low of IDR 48,623,609 and reached a high of IDR 52,971,429.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 5.913 trillion, while its 24-hour trading volume has surged by 99% to IDR 515.72 trillion.

Read also: Ethereum Proposes ERC-8092 to Improve Privacy and Accelerate Web3 Adoption

Whale Accumulation and ETF Inflows Favor Ethereum Price

According to a report from Lookonchain, a big whale is back to accumulating Ethereum during the market downturn. The whale borrowed $85 million USDT through Aave (AAVE) and sent the funds to Binance. Shortly after, he sold 38,576 ETH worth about $119.3 million.

This move comes after the same whale had previously amassed 489,696 ETH worth nearly $1.5 billion. This kind of positioning indicates strategically calculated exposure amid market weakness, rather than a defensive sell-off – which confirms the existence of strong demand around Ethereum’s important price levels.

On the other hand, institutional demand also strengthened ETH price dynamics. Weekly ETF inflows for Ethereum amounted to $209.1 million, of which BlackRock accounted for $138.7 million. These inflows occurred despite a sluggish market, indicating active asset allocation by large institutions.

The inflow of funds through ETFs helps withstand selling pressure when prices fall. When combined, leveraged whale accumulation and ETF inflows reflect a structured accumulation strategy – not risk reduction.

Analysts Determine Ethereum Price Direction Based on Key Levels

The analyst named Ted focuses his analysis on Ethereum’s clearly-defined price levels, instead of relying on speculative patterns. He notes that despite the daily volatility in ETH price, the asset is still holding above the $3,000 level.

The price briefly dropped below $3,050, but quickly recovered, indicating strong underlying demand. At the time of analysis, ETH was trading at around $3,156 – a position still above the crucial support zone.

Read also: Spot XRP ETF Raises Nearly $1 Billion as Bitcoin and Ethereum ETFs Bleed!

According to Ted, as long as the $3,000 support zone can be maintained, the price of Ethereum has the potential to rise again to the $3,300-$3,400 range. However, he also highlighted the downside risks clearly.

In the event of a decisive break below the $3,000 level, ETH is likely to experience a rapid decline to below $2,800. This analytical approach establishes Ethereum’s price direction based on confirmation of support strength, not just speculative upside forecasts.

ETH Price Structure Shows Support and Potential Recovery

Ethereum price is currently still forming a cup and handle pattern that started to appear after the mid-November drop. The rounded base of the pattern reflects a gradual shift from selling pressure to steady demand, rather than a sudden sharp bounce.

This stage allows the ETH price to recover systematically before entering the handle phase. In this drawdown phase, the price experienced a controlled decline and tested the $3,000 area again. The buyers managed to defend the area strongly, proving that it was a structural support zone – not just a short-term reaction.

The $3,400 and above area is a clear supply zone. ETH price briefly tested this region before reversing, indicating profit-taking and selling pressure. However, the rejection did not disrupt the larger price structure.

ETH is currently moving in a range between $3,000 support and resistance around $3,250, which signals consolidation, not weakness.

In terms of indicators, the Money Flow Index (MFI) helps evaluate the direction of capital flows. With the MFI value hovering around 59, there is no sign of overbought conditions, and buying pressure is still more dominant than selling pressure. This balance favors a potential continuation of the uptrend, rather than a sign of market exhaustion.

Overall, the price structure shows a bias towards an upside continuation as long as ETH stays above $3,000 and is able to reclaim $3,250. This setup frames Ethereum’s potential price movement ahead in the context of supply absorption and resistance in the support zone.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Is Ethereum Price Set for a Rebound as a Prominent Whale Accumulates $119M After the Dip? Accessed on December 16, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.