Download Pintu App

Ethereum Holds Steady Around $2,900 as Whales Show Strong Support

Jakarta, Pintu News – The Ethereum (ETH) price is currently showing clear structural strength in its price movement, although on the surface there is still short-term volatility.

While the price movement is temporarily within a range, the strong facts from deeper on-chain metrics, as well as the ETF’s net inflow trend throughout 2025, suggest that a strong accumulation phase is underway.

This is a positive indication that the potential for a significant increase is forming and is likely to occur in the coming months. Then, how will the Ethereum price move today?

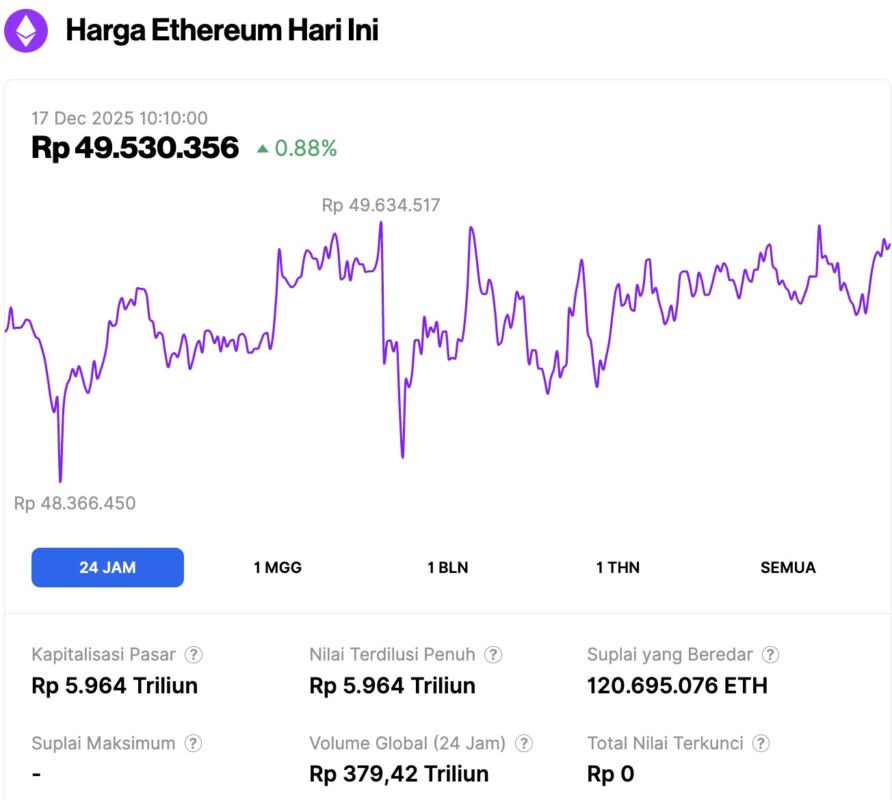

Ethereum Price Up 0.88% in 24 Hours

As of December 17, 2025, the price of Ethereum was approximately $2,959, or around IDR 49,530,356, marking a slight increase of 0.88% over the past 24 hours. During this time, ETH traded as low as IDR 48,366,450 and reached a high of IDR 49,634,517.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 5.964 trillion, while its daily trading volume has dropped by 20%, down to IDR 379.42 trillion over the past 24 hours.

Read also: Bitcoin Holds Steady at $87,000 — But Analysts Warn It Could Fall Back to $10,000

Ethereum Price and Whale Realization Levels Show Strong Support

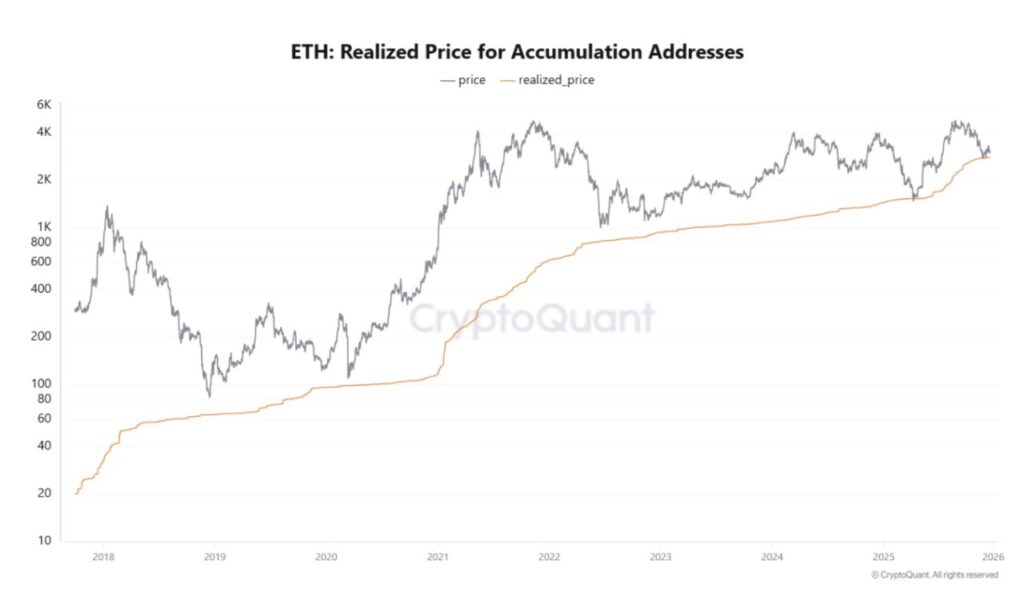

One of the most striking developments on the Ethereum price chart comes from the realized price data associated with accumulation addresses. Based on CryptoQuant‘s on-chain metrics chart, large holders (whales) have consistently raised the base fees of their holdings over the past few months.

In June, the realized price for this accumulation wallet was around $1,560, and it has since risen close to the $3,000 zone.

This rise in realized prices reflects consistent buying activity, not just short-term trading. More importantly, realized prices often serve as psychological and structural support levels, where “smart money” will go to great lengths to minimize losses.

As long as the whales continue to accumulate above this zone, it becomes increasingly difficult for the Ethereum price (in USD) to experience a sustained sharp decline below that level.

Why Whale Accumulation Matters for Ethereum

Whales usually accumulate with a long-term view, especially as they prepare for wider market expansion. This continued buying activity shows confidence that the current price is still valuable, rather than the result of market euphoria.

This behavior reinforces the view that downside risks will be absorbed gradually, instead of triggering a massive sell-off (capitulation).

Read also: 3 Crypto Unlock Tokens Worth Watching This Week

From a structural perspective, this accumulation trend puts the Ethereum price in a healthier position than rallies driven solely by speculation. Instead of quick spikes, price stabilization near steadily rising realized levels is often a precursor to a more sustainable upward trend.

Ethereum ETF Inflows Strengthen Institutional Confidence

In addition to on-chain data, activity in the ETF sector also provides an additional layer of confirmation. So far this year, Ethereum ETFs have recorded more weeks with inflows than outflows. This consistency suggests that institutional participation continues to underpin the market, even amid periods of broader uncertainty.

Interestingly, since September, the pace of weekly outflows has started to decline. This shift reflects improved sentiment, rather than signaling asset distribution.

While ETF flows haven’t triggered a direct price spike, their presence appears to play a significant role in stabilizing Ethereum’s price (in USD) above key zones.

Aligning On-Chain Data with Ethereum Price Predictions

When the trend of accumulation by whales and ETF flows are analyzed together, a clearer picture is formed. Rather than showing signs of market exhaustion, the current conditions indicate a preparatory phase. December will most likely act as a consolidation phase, rather than a month of major breakouts.

As such, Ethereum’s price prediction model is now increasingly focused on the start of 2026. If the accumulation trend continues and institutional demand remains stable, then price projections could point to higher psychological levels in the first quarter.

This congruence between on-chain conviction and institutional capital flows reinforces the positive assumptions towards Ethereum’s price prospects in the long run.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Is Ethereum Price Building a Base for a 2026 Breakout? Accessed on December 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.