Download Pintu App

Dogecoin Sees 2% Gain; Key Demand Zone Around $0.13 May Fuel Further Upside

Jakarta, Pintu News – Although Dogecoin (DOGE) has deviated from its historical upward pattern, there is an important demand zone that could be a turning point and drive a bullish rally later in the year. Dogecoin price predictions still leave room for a strong rebound before the year ends.

So, how is the Dogecoin price moving today?

Dogecoin Price Rises 2.00% within 24 Hours

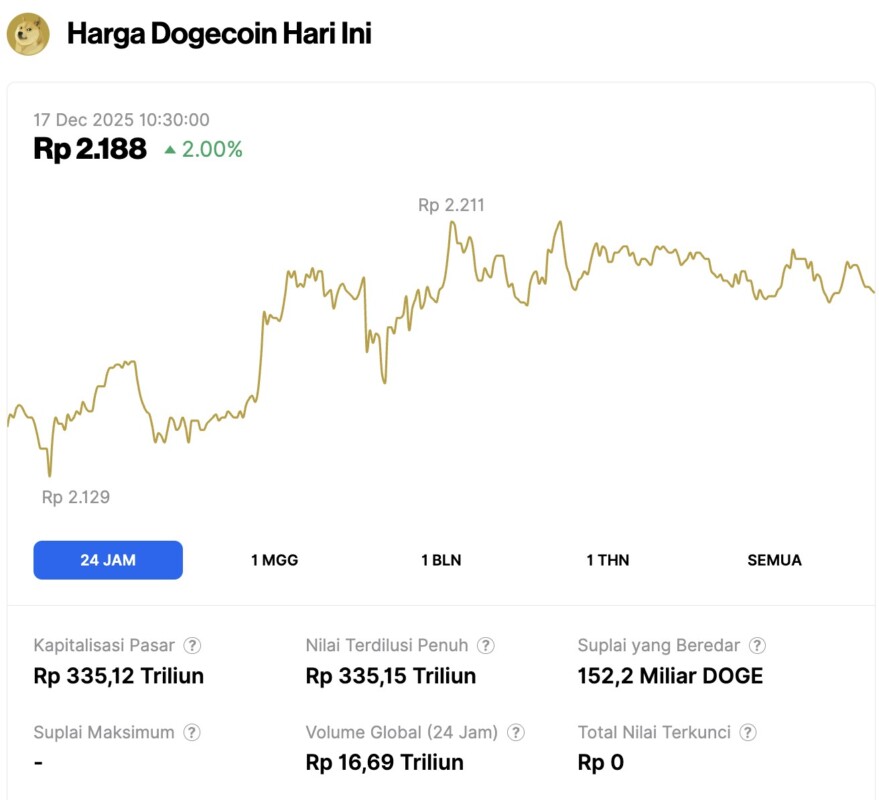

As of December 17, 2025, Dogecoin posted a 2% gain over the past 24 hours, trading at $0.1314, or approximately IDR 2,188. Over the same period, DOGE fluctuated between IDR 2,129 and IDR 2,211.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 335.12 trillion, with a 24-hour trading volume of roughly IDR 16.69 trillion.

Read also: Ethereum Price Hovering at $2,900 Today: Whales Show Strong Support for ETH!

Dogecoin Has Reached Its Lowest Price

Dogecoin is currently testing the $0.13 level which could potentially be the cornerstone of a price rally, with demand likely to return if the year-end bullish trend actually materializes.

A popular analyst under the pseudonym BitGur via the X platform highlighted this pattern, and the green candle that appeared today could be a confirmation that the lowest price has been reached, as buying interest in this meme coin returns.

The bottom formation mentioned by Bitgur has evolved into a triple bottom pattern, which is a strong reversal structure characterized by three consecutive touches of the basic trendline.

Based on this pattern, analysts expect a reversal of the downward trend over the past two months, with a target of returning to the $0.182 level – a 40% increase.

Historically, the last quarter of the year tends to provide a fairly positive performance for the Dogecoin price. However, 2025 seems to deviate from this pattern as it hasn’t shown a single green month so far.

So far, the Dogecoin price has weakened by 10.6% during the month of December, reinforcing the ongoing downward trend.

Even so, the analysis from Bitgur could be the turning point that marks December as a green month and maintains the historical pattern that the fourth quarter has at least one month with rising prices.

Read also: Bitcoin Holds Steady at $87,000 — But Analysts Warn It Could Fall Back to $10,000

Dogecoin Price Prediction: December May Be Just the Beginning

The demand zone at $0.13 also coincides with the lower limit of the descending triangle pattern that has been forming for a year, and the triple bottom pattern could be a trigger for a move towards a breakout.

If the triple bottom pattern is successfully confirmed with a clean break above the $0.155 neckline, then the $0.182 target could be a higher and stronger foothold for a further breakout push.

The momentum indicators are still showing bullish tendencies. The RSI indicator continues to form higher lows, pointing towards the neutral line – this indicates buying pressure is slowly building behind the price movement.

Meanwhile, the MACD that had formed a “death cross” below the signal line seems to be temporary, as selling pressure seems to be weakening and losing control of the current trend.

If there is a clean breakout from the triangle pattern, then the upside target of around 260% towards the previous high of $0.50 could be achieved – potentially even towards the full target of $1, which would mean a jump of up to 680%.

However, a move of this magnitude is likely to depend on favorable market conditions – for example, a policy change from the US Fed or the resumption of the quantitative easing (QE) program in 2026 to boost appetite for risky assets.

For now, BitGur’s analysis is a noteworthy scenario in a potential year-end rally – although everything depends on the price’s ability to hold above the $0.13 level.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News – Dogecoin Price Prediction: Bounce Incoming? Strong Demand at $0.13 Could Trigger a Surprise Year-End Rally. Accessed on December 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.