Download Pintu App

XRP Holds Strong Bullish Trend as ETF Assets Climb Past $1.18 Billion

Jakarta, Pintu News – XRP (XRP) has again attracted market attention as the confluence of technical structure, institutional product flow, and regulatory developments reinforce each other. This indicates that the asset has entered a trend higher across multiple time frames.

Market data shows that XRP is consolidating around the $2 level, having previously broken out of a long-term archetype that has been in place for several years.

At the same time, the increase in assets in XRP-linked funds and improved sentiment towards Ripple’s regulatory outlook are strengthening the current market structure, rather than weakening it.

Technical Structure Shows Shift Toward Bullish Trend

From a technical point of view, XRP has completed an important transition in its movement structure.

Read also: Shiba Inu Takes a Big Step with the Launch of Regulated Derivatives in the US

On the daily chart, XRP has remained above its 21-day exponential moving average (EMA) around the $1.80 level for several weeks in a row – a pattern that has historically often been associated with trend continuation in XRP’s previous expansion phases, rather than a sign of a final rally.

Crypto market analyst EGRAG CRYPTO, known for focusing on the long-term cycle of XRP, called this shift a structural change, rather than speculative.

“If we ignore the formation percentage and focus only on the market structure, then the more likely scenario is an upward movement, not a downward one,” EGRAG CRYPTO wrote on platform X.

XRP’s successful rise through the multi-year consolidation zone marks the first sustained impulsive move since the previous cycle peak. In technical analysis, this kind of impulsive move usually indicates a transition from an accumulation phase to an expansion phase. The decline that follows is often just a temporary correction, not a trend reversal.

The symmetry of the time cycle – which compares the duration and structure of previous XRP market phases – when combined with the Fibonacci extension model, suggests a potential 43% to 75% further upside from the latest high.

However, this projection is conditional. If the price of XRP consistently closes daily below the $1.60 level, then this bullish structure will weaken and signal that the breakout is unable to hold.

XRP ETF assets rise to $1.18 billion, showing strong institutional interest

Along with technical developments, institutional exposure to XRP-based products has also continued to increase. Data shared by ChartNerdTA, citing ETF flow tracker WhaleInsider, shows that total net assets in XRP-related ETF products have now reached around $1.18 billion, having recorded net inflows of over $20 million recently.

“$XRP ETF: Total Net Assets now stands at $1.18 billion,” ChartNerdTA wrote.

These figures largely reflect ETF products traded outside the United States, including ETPs that are registered in certain international jurisdictions and have been formally regulated.

Read also: OpenSea Introduces POWER Game Token as a New Payment Option in the NFT Marketplace

Data visualizations from SoSoValue – a digital asset fund flow monitoring platform – show that net inflows have remained positive since mid-November, with total assets continuing to show an upward trend.

While these products are structured differently from the Bitcoin and Ethereum-based spot ETFs that have been approved in the US, the growth in assets nonetheless signals increased institutional participation and demand for regulated XRP exposure, amid an increasingly clear regulatory environment.

Consolidation Phase Indicates Market Balance, Not Weakness

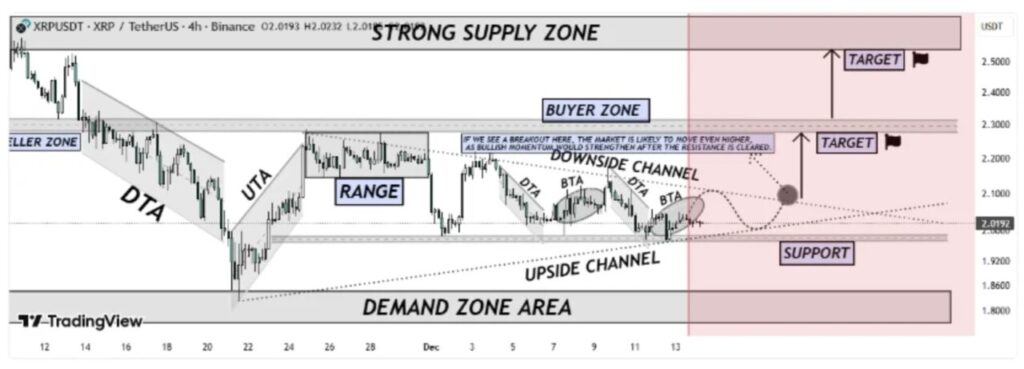

XRP’s current short-term price movement reflects a consolidation phase, not a sign of weakness or reversal. According to TradingView analyst ZACKFX7, who focuses on range-based market structures, XRP is currently trading within a clear zone after rebounding from a tested demand area.

“XRPUSDT is currently trading in a clear range after a strong bounce from the demand zone,” the analyst said.

Within this range, the price reaction continues to form higher lows, signaling that buyers are still active while prices are falling. This pattern generally indicates an accumulation phase, where the market absorbs selling pressure before resuming the uptrend.

If the price manages to break the upper limit of the range and enter the buyer-controlled zone, then the path towards the upper supply target is likely to open up. Conversely, if support fails to hold, the market may retest the demand zone in a controlled manner, without necessarily invalidating the larger upside structure.

Regulatory Progress Remains a Key Supporting Factor

Regulatory developments continue to act as an important backdrop, although not a direct trigger for the current price movement. Continued progress in the legal case between Ripple and the SEC is slowly reducing uncertainty for institutional players considering exposure to XRP, although no new legal milestones were announced during this period.

While regulatory clarity has improved compared to previous years, legal outcomes remain an important variable. Any negative developments could still impact market sentiment, liquidity, as well as the availability of XRP products in regulated markets.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Brave New Coin. XRP Price Prediction: XRP Maintains Bullish Structure While ETF Assets Expand to $1.18B. Accessed on December 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.