Download Pintu App

Peter Schiff Sounds the Alarm on Bitcoin While Gold and Silver Rally

Jakarta, Pintu News – Peter Schiff has joined the growing number of people predicting a fall in the price of Bitcoin (BTC) in the crypto market. This comes as gold and silver prices rise due to the weakening value of the US dollar.

Gold and Silver Price Rally Triggers Fear of Bitcoin Crash Again

Renowned investor Peter Schiff has again warned that Bitcoin could be the first major asset to fall as funds begin to flow back into traditional instruments such as gold and silver, which are considered safe havens.

Read also: Bitcoin Price is Sluggish Today: BTC Still Gets Strong Support from Institutional Investors!

According to him, the rise in gold and silver prices could have a long-term impact on reducing Bitcoin’s attractiveness as a hedge.

In Schiff’s view, investors who bought Bitcoin to protect themselves from a possible collapse in the value of the US dollar could be negatively affected if the price of Bitcoin falls suddenly.

This statement comes amid a sharp surge in silver prices that rose by more than $1.60 in a single trading session, pushing its price past $66 – a record high. Meanwhile, gold also broke the $4,300 mark.

Schiff predicts that silver prices could test the $70 level by the end of the year, and gold prices could potentially set new records in the near future.

Explaining the cause of this trend, Schiff believes that the US economy is heading towards what he calls a “major historical crisis.” According to him, the rise in precious metals prices is a sign that confidence in the US dollar and government bonds is starting to decline.

He also warns that this trend could lead to higher consumer prices or even increased unemployment. According to him, these are the conditions that could cause Bitcoin’s price to crash – not protect it from the crisis.

Peter Schiff is not the only one to have issued such a prediction recently. Bloomberg Intelligence strategist Mike McGlone also stated that Bitcoin could return to much lower price levels if demand continues to decline.

In addition, research firm 10x Research also expects $10-$20 billion in withdrawals from crypto hedge funds, which could put additional pressure on the market as the year draws to a close.

Why are gold and silver prices soaring?

The rise in gold and silver prices was driven by the weakening value of the US dollar as well as market expectations of monetary policy easing. The US dollar is currently near its lowest level in two months, which makes assets priced in dollars, such as precious metals, more attractive to global investors.

Read also: Hyperliquid Aims for HYPE Recovery via Token Burn Proposal!

The market is also awaiting the release of the latest employment data from the US. This data could affect the direction of interest rate policy that will be taken by the Federal Reserve in 2026.

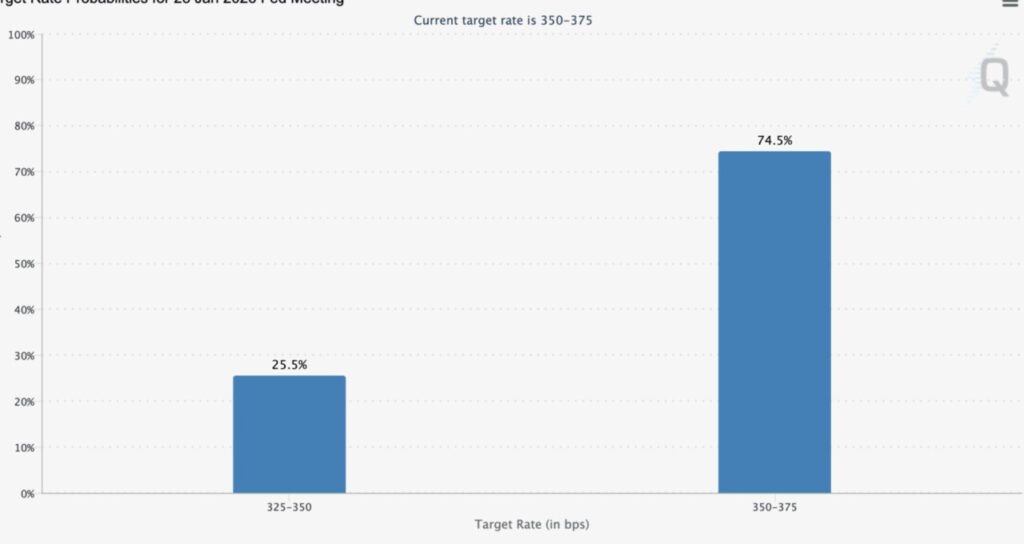

Currently, the market has priced in a high probability of an interest rate cut as early as next year. Some analysts even project that there will be two rate cuts. Lower interest rates are generally favorable for non-interest-bearing assets, such as gold, silver, and Bitcoin.

Despite predictions of a Bitcoin price crash, renowned crypto figure Michael Saylor remains optimistic. He believes that within the next ten years, Bitcoin’s market value will eventually surpass that of gold.

FAQ

Who is Peter Schiff?

Peter Schiff is an investor and financial analyst known for his often skeptical views on the US economy and cryptocurrencies like Bitcoin (BTC).

Why are gold and silver rising in price?

The rise in gold and silver prices was mainly due to the weakening US dollar and market expectations of upcoming monetary easing.

What is the impact of Peter Schiff’s Bitcoin crash prediction?

Such predictions add to concerns in the crypto market, but many long-term Bitcoin holders remain optimistic and reject such views.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Crash Incoming: Peter Schiff Adds to Bearish Warnings as Gold and Silver Rally. Accessed on December 18, 2025

- Coinpedia. Bitcoin Price Crash Could Deepen, Peter Schiff Warns. Accessed on December 18, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.