Download Pintu App

3 Altcoins that Crypto Whales are Eyeing for 2026, What Makes Them Interesting?

Jakarta, Pintu News – Crypto whales are starting to buy again. After the release of lower US CPI data, large holders started adding risk rather than reducing it.

Flattening inflation, weaker labor market data, and rising expectations for interest rate cuts are slowly changing the way capital is allocated. This buying is not concentrated on any one theme.

Crypto whales are increasing their exposure in various sectors, including DeFi, political narratives, and legendary coin memes. This combination is important. It suggests that these purchases are not a single transaction, but rather a starting position for a broader shift in sentiment, although the current price is still likely to move within a limited range.

Curve DAO Token (CRV)

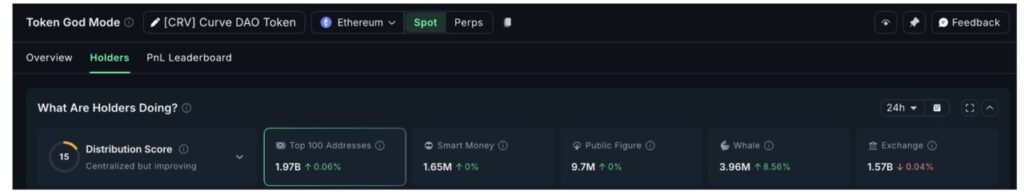

Crypto whales have started buying Curve DAO (CRV) tokens despite the overall market struggling to find direction. CRV is still down about 20% in the past month, but whale behavior suggests that this weakness is seen as an opportunity, not a warning sign.

Read also: Which Crypto will Shine in 2026: Bitcoin, Ethereum, or XRP? Check out the answer!

In the last 24 hours (12/19), whale increased their CRV holdings by 8.56%, raising their stash to 3.96 million tokens. This equates to about 312,000 CRV added in one day.

The size was not large, but the timing was crucial. The Whale entered while market sentiment was still fragile, after the release of lower US CPI data which improved the prospects of a long-term rate cut.

From a price perspective, the CRV price still looks weak to the naked eye. The token has recorded lower lows between early November and mid-December. However, momentum tells a different story.

The RSI (Relative Strength Index) indicator, which measures buying and selling strength, shows a higher low during the same period. This divergence often signals that selling pressure is beginning to ease and a trend shift could be in the offing.

For confirmation, CRV needs to reclaim the $0.38 level, with $0.41 being the key level capping the rally since early December.

A clear release above this level could favor a reversal. However, if the price falls below $0.33, this setup will weaken, and the whale conviction might subside.

Official Trump (TRUMP)

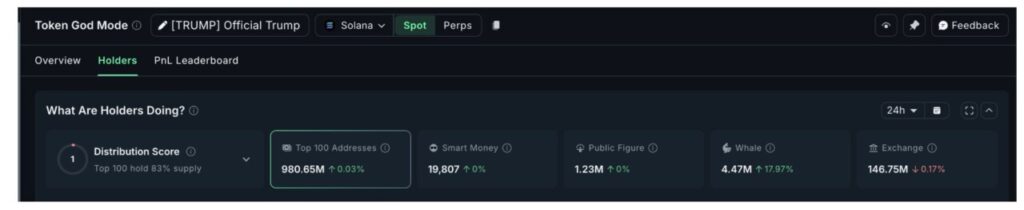

Official Trump (TRUMP) tokens are again attracting the attention of crypto whales after the release of lower US CPI data is expected to ease pressure on risky assets. TRUMP is still down nearly 40% in the last three months, but this weakness seems to be attracting early positions.

With inflation slowing and hopes of interest rate cuts on the rise again, politically sensitive tokens are starting to attract interest again.

In the last 24 hours (12/19), crypto whales increased their TRUMP holdings by 17.97%, adding more than 680,000 tokens. At current prices, these additions are worth around $3.5 million. This is not aggressive price chasing. It looks more like early accumulation while market sentiment is still cautious.

The chart helps explain the right timing. The Smart Money Index, which tracks the positions of experienced traders, started moving up after trending down since December 9. This change suggests that experienced buyers may be preparing for a recovery, rather than just responding to it.

Price levels remain key. TRUMP needs to stay above $4.96 to keep the structure of this recovery intact. If buyers manage to break clearly above $6.05, a level that has capped the rally since late November, the upside momentum could expand.

On the downside, a daily close below $4.96 will weaken the whales’ argument and reopen downside risks.

For now, crypto whales seem to be betting that easing inflation and increasing political liquidity could give TRUMP room to stabilize before the broader market reacts.

Read also: PUMP Prices Plunge 33% This Week, Hitting a 5-Month Low!

Dogecoin (DOGE)

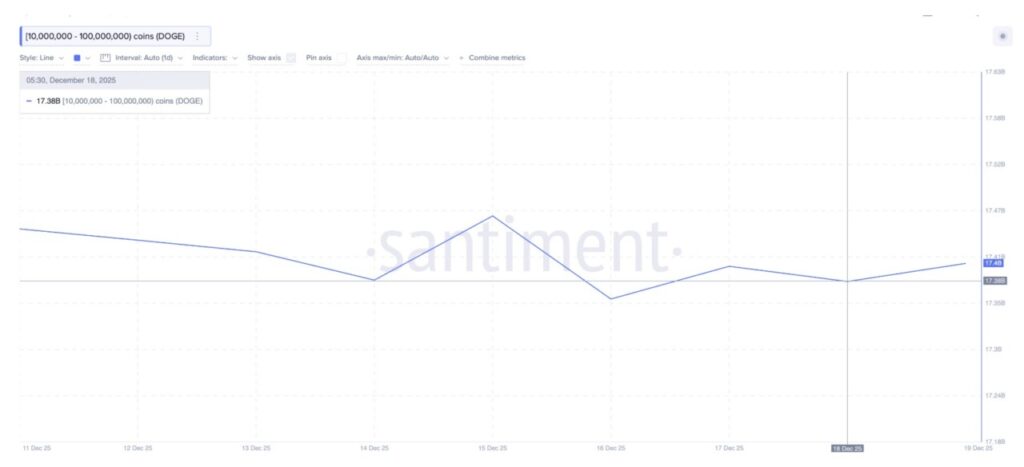

Dogecoin (DOGE) is the biggest name on this list based on market capitalization data. In the last 24 hours (12/19), medium-sized Dogecoin whales holding between 10 million and 100 million DOGE increased their combined balance from 17.38 billion to 17.40 billion DOGE. That’s an addition of about 20 million DOGE.

At current prices, this equates to an accumulation worth about $2.6 million. It’s not a huge number, but the timing is crucial. These wallets have previously reduced their exposure, so this move, right after the release of the US CPI data, could have some significance.

Whale may be responding to early signs of a technical bottom. Between November 4 and December 18, Dogecoin’s price registered a lower low, yet the RSI showed a higher low. This bullish divergence often signals that selling pressure is starting to ease. Dogecoin has gained around 2-3% in the last 24 hours, indicating that buyers are starting to test market conditions.

The key levels are quite clear. $0.13 is the first limit that restricts the recent price recovery. A clean daily close above $0.15 would confirm the trend recovery. Such a move implies an upside of about 19% from current levels and could open up further upside targets.

Risks remain. A drop below $0.12 would invalidate this recovery idea and open up the potential for a deeper drop. For now, crypto whales are buying Dogecoin cautiously, hoping that an easing of macro pressures could bring the risk meme coin back into play.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What Crypto Whales Are Buying After a Cooler US CPI Print. Accessed on December 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.