Download Pintu App

Ethereum Price Drops to $2,900 Today: ETH Bullish Reversal Signal Reappears!

Jakarta, Pintu News – Ethereum (ETH) price has quietly started to recover from its December low. Since hitting bottom on December 18, ETH has gained more than 10%, and broke back into the $3,000 area on December 22.

This rise did not happen by chance. The familiar bullish reversal pattern reappeared on the chart, confirming the price spike. The same pattern previously triggered a 27% rally earlier this quarter.

However, there is one important note – the previous rally stalled at a major resistance zone, and now Ethereum is moving towards the same area again. Whether this recovery will continue or stall will depend on the next price movement.

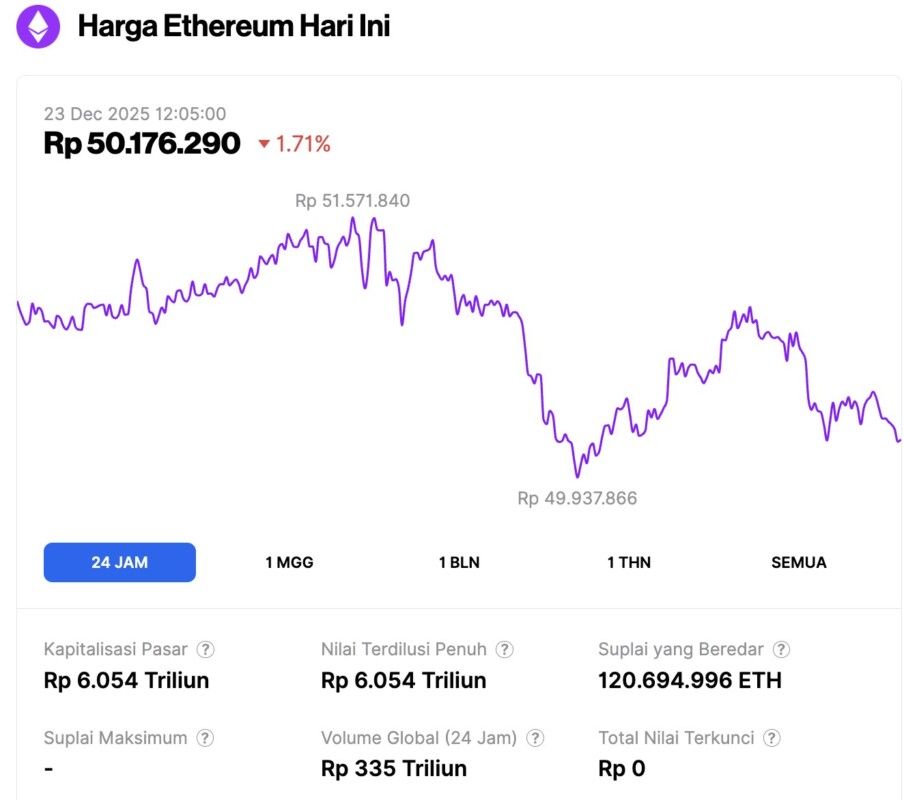

Ethereum Price Drops 1.71% in 24 Hours

As of December 23, 2025, Ethereum was trading at around $2,979, equivalent to approximately IDR 50,176,290, marking a 1.71% decline over the past 24 hours. During this period, ETH touched a low of IDR 49,937,866 and a high of IDR 51,571,840.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 6,054 trillion, while its daily trading volume has surged 34% in the past 24 hours to reach IDR 335 trillion.

Read also: Bitcoin Price Held at $88,000 Today: Can BTC Break the $89,000 Wall?

Bullish Reversal Signal Reappears as Coin Movement Slows Down

The first signal came from the momentum indicator. Between November 4 and December 18, the Ethereum price printed a new low.

However, during the same period, the RSI (Relative Strength Index) recorded a higher low. RSI is an indicator that measures the strength of buying and selling momentum.

When the price drops but the RSI shows improvement, it signals that the selling pressure is starting to weaken, even though the price is still declining. Such a pattern is known as a bullish divergence, and is often the first sign of a trend reversal to the upside.

Interestingly, the same pattern also formed between November 4 and December 1. After the signal appeared, Ethereum briefly rose by almost 27% before being stuck at the resistance area around $3,470.

This time, the momentum signal was reinforced by on-chain activity. The Spent Coins Age Band indicator measures how many ETH coins are changing hands, both from new and existing holders. When this indicator drops sharply, it means that fewer coins are being sold or moved, and more are being held (inactive).

On December 19, the coin moving activity was recorded at around 431,000 ETH. However, on December 22, that number plummeted to just 32,700 ETH – a more than 92% drop in the number of coins moving.

In simple terms, this shows that the potential sellers of ETH have now decreased dramatically. Long-term holders are no longer distributing their assets, and short-term traders are starting to hold back. This reduction in selling pressure helps explain why the RSI has begun to stabilize and Ethereum’s price has managed to recover.

Critical Ethereum Price Levels to Watch Out For

Although Ethereum’s momentum is showing improvement, the asset is still facing major resistance. The first level of importance is around $3,040. ETH needs to hold above this area for the price recovery to take hold – if it fails, the latest rebound could be in danger of reversing.

Read also: The Crypto Market Turns Green — Analyst Ali Martinez Highlights 3 Altcoins Poised to Shine

Above that, there is key resistance at $3,470, as mentioned earlier.

This level was previously the upper limit of the rally triggered by the RSI divergence signal. If Ethereum fails to break this area again, history could repeat itself with a similar price rejection.

However, a clean breakout and daily close above $3,470 could change the situation. This would open up opportunities for the price to rise towards $3,660, and subsequently $3,910, both of which are strong resistance zones from earlier this quarter.

On the other hand, downside risks are still present. If Ethereum’s price drops below $2,940, selling pressure could quickly resume. Below that level, $2,770 will be the next area of support, and $2,610 will serve as a deeper lower limit to contain the decline.

Conclusion: Ethereum is experiencing a recovery with a familiar bullish pattern, supported by a sharp drop in coin selling activity. However, this rally is not yet fully confirmed. Until the price is able to break $3,470, this movement is still an attempted rebound, not a solid trend reversal.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Jumps 10% on Reversal Cues – But History Warns Of A Ceiling. Accessed on December 23, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.