Download Pintu App

Altcoin Bear Market May Be Nearing Its End — Here’s What Crypto Analysts Expect Next

Jakarta, Pintu News – Altcoin investors may end 2025 without seeing any gains in their portfolios. However, many analysts remain optimistic even though the market capitalization of altcoins (TOTAL2) has dropped 30% from its peak this year.

What makes analysts believe that the altcoin bear market may be entering its final phase? The following points highlight the main reasons.

Why Altcoins Are Entering an Opportunity Phase

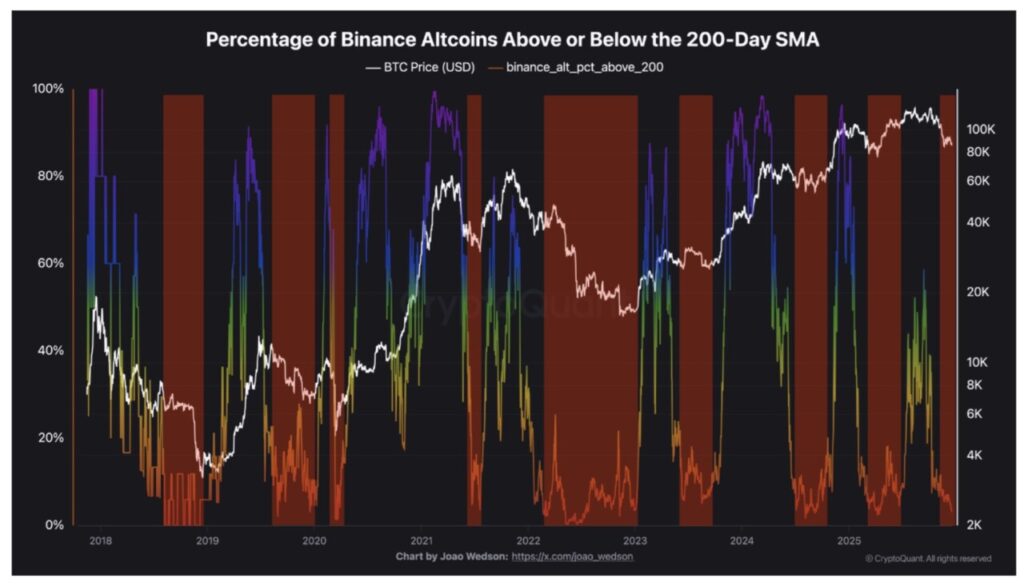

First, data from CryptoQuant shows that only about 3% of altcoins on Binance are trading above their 200-day moving average. This is the lowest point in history.

Read also The Crypto Market Turns Green — Analyst Ali Martinez Highlights 3 Altcoins Poised to Shine

CryptoQuant analyst Darkfost cites a lack of liquidity and investor defensiveness as the main causes. Currently, investors are prioritizing capital preservation over placing funds in risky assets.

The fact that most altcoins are trading well below their long-term averages suggests undervaluation due to negative sentiment. Recent analysis from the BeInCrypto website reveals that altcoins such as XRP (XRP), Toncoin (TON), and Cardano (ADA) have strong fundamentals, but their prices have not been able to recover.

While market conditions may seem bleak, historical comparisons show that weak periods such as this are often attractive opportunities for patient investors.

“While it may seem counterintuitive, periods like this often provide the best opportunities. They can last for quite some time, especially if the market enters a prolonged bearish phase,” says Darkfost.

Second, fear and lack of interest from retail investors often open up the best price zones. Large investors usually take advantage of moments like this to accumulate.

Renowned analyst on platform X, CrediBULL Crypto, highlights this factor as a key signal to identify market bottoms. In his latest post, he emphasized that it is the public’s attention, not capital, that moves first.

When retail investors started losing interest, big players started buying. As signs of an initial upswing appear, retail attention slowly returns. Retail participation then drives the next phase of the bull run.

Technical Signals Show Potential Market Bottom

Third, a number of technical indicators suggest that the altcoin bear market may be nearing its end.

Read also: Shiba Inu Plummets 66% and Signals Serious Problems – SHIB’s Downward Trend Continues?

Renowned market analyst Michaël van de Poppe stated that the current level of altcoin market capitalization acts as a strong support. He described this area as “a zone that needs to be defended.”

“In the end, it seems that we are at a very important support level. It seems worth staying at this level. The solid bounce suggests that a green candle might emerge from this point,” said Michaël van de Poppe.

Some additional signals reinforce this view:

- The ratio of altcoin market capitalization (excluding the top 10) to Bitcoin is now at its strongest support level since 2017.

- The current dominance of altcoins is also on par with levels during the COVID-19 crisis, which was the beginning of a strong recovery.

These factors suggest that altcoins may be in the final stages of decline. The latest analysis from BeInCrypto also considers that the DCA (Dollar Cost Averaging) strategy could be an effective move if started since December.

However, some analysts continue to warn against risks. They think that the altcoin season may not happen even until 2026.

Venture capital inflows are still weak, and market sentiment is likely to take a while to fully recover.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Why Analysts Believe Altcoins Are in the Final Stage of the Bear Market. Accessed on December 24, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.