Download Pintu App

Dogecoin Struggles to Gain Momentum as DOGE ETF Flows Fail to Spark a Rally

Jakarta, Pintu News – Dogecoin (DOGE) price briefly traded around $0.132 as the market attempted to extend its recovery after last week’s sharp decline. Buyers tried to stabilize the price above the $0.130 level, but repeated failures near the declining resistance area kept the near-term momentum fragile.

With the group EMA above the current price and weak ETF flows, market conditions are still cautious. So, how will the Dogecoin price move today?

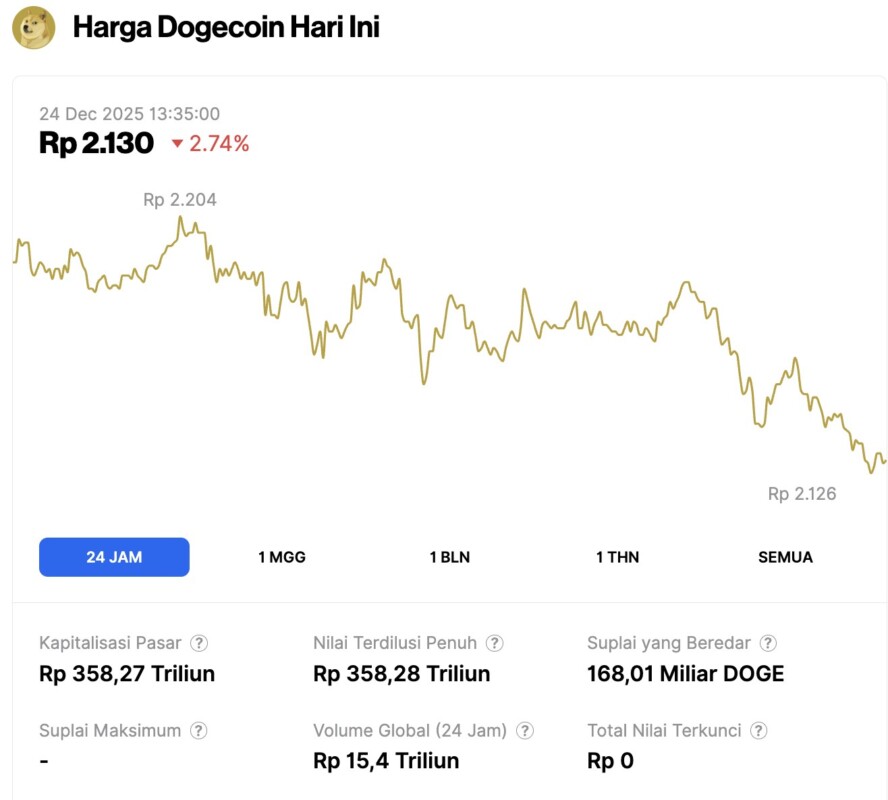

Dogecoin price drops 2.74% in 24 hours

On December 24, 2025, Dogecoin’s price slipped 2.74% over the past 24 hours, trading at $0.1270, equivalent to IDR 2,130. During that period, DOGE fluctuated between IDR 2,204 and IDR 2,126.

As of this writing, Dogecoin’s market capitalization is approximately IDR 358.27 trillion, with a 24-hour trading volume of around IDR 15.4 trillion.

Read also: Ethereum Holds Steady at $2,900 as Analysts Set Sights on $7,000 Target

Declining Structure Still Keeps Control in Sellers’ Hands

On the 4-hour chart (23/12), Dogecoin is still stuck in the descending channel that has formed a pattern of price movement since early December.

Any attempt at recovery is always stuck at the upper boundary of the channel, emphasizing the pattern of lower highs. The latest rebound from the $0.120 low was not sustained, indicating that selling pressure is still strong whenever the price rises.

The price also remains stuck below the 20, 50, 100, and 200 EMAs, which are all bearishly arranged in the $0.132 to $0.143 range. This cluster of EMAs continues to reject any attempts at price increases, turning what was previously an area of support into resistance.

As long as DOGE has not been able to break out of this zone, the price increase is likely to be corrective in nature, rather than forming a new trend.

The Supertrend indicator on the 4-hour timeframe is around $0.127, serving as an important pivot for direction. If the price is able to hold above this level, the consolidation phase is still maintained. However, if it fails, the risk of a decline back to the previous low is open.

Fibonacci Levels Define Price Battle Areas

Fibonacci retracement levels drawn from the November peak to the December bottom are still the main guide to short-term price behavior. Currently, DOGE is moving around the 0.382 retracement level at $0.1316, which in recent sessions has been a price magnet point.

Above that, the 0.5 level at $0.1352 and 0.618 at $0.1388 form the next resistance zone. These levels coincide with the cluster of EMAs as well as the upper boundary of the descending channel, reinforcing the area of selling pressure (supply zone) between $0.135 to $0.145.

On the downside, the 0.236 retracement level at $0.127 is an important area. If the price breaks it clearly, then the psychological level of $0.120 will be threatened again, which is the area where buyers previously made aggressive purchases.

Short-Term Momentum Begins to Show Fatigue

On the 30-minute chart, DOGE is still moving inside a narrow rising channel, but momentum is starting to weaken. The price failed to stay above the centerline of the channel, so any upside attempts are shallow and limited.

Read also: Bitcoin Price Hovering at $87,000 Level: Can BTC Reach $100K Before 2025 Ends?

The RSI has dropped to around 42 after previously registering some bearish divergence in the area of the latest price peak. Each price increase is accompanied by weaker momentum, indicating a potential loss of steam to continue strengthening.

Meanwhile, the MACD indicator is still flat with the signal line hovering around the zero level. The fading histogram bars confirm that buying strength has not increased, although prices look stable in the short term.

Without any momentum recovery or increase in trading volume, the intraday rally risks being rejected at the resistance area.

Derivative Data Shows Cautious Market Attitude

Derivatives data paint a picture of a cautious market. Open interest currently stands at around $1.58 billion, relatively unchanged in the last 24 hours, suggesting that traders have not been aggressively adding new positions.

Trading volume did increase slightly, but it was not followed by an increase in open interest, signaling a lack of conviction behind the latest price movement.

Liquidation data in the last 24 hours also shows little activity on both sides (longs and shorts), reinforcing the indication that the market is currently leaning more towards a consolidation phase rather than continuing its strong trend.

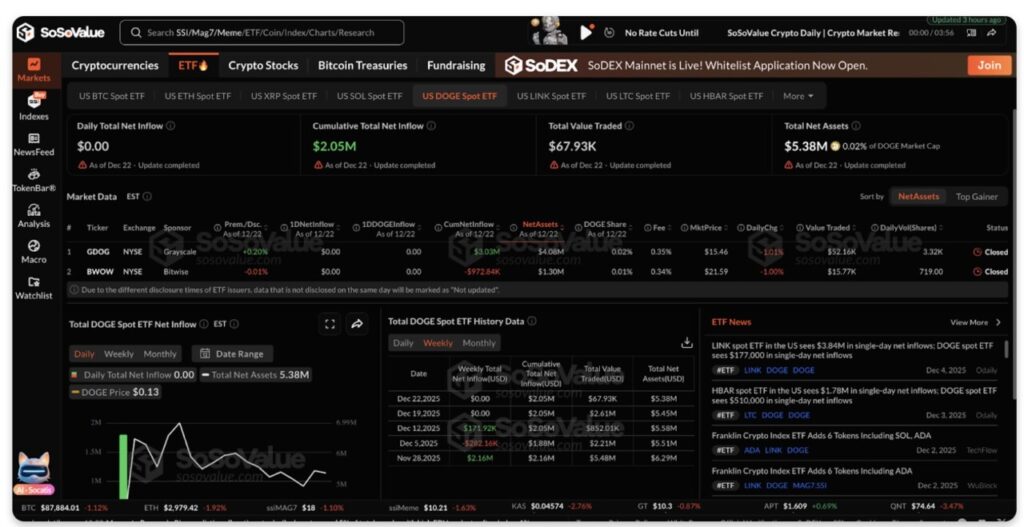

ETF Flows Haven’t Provided a New Trigger

Data related to the DOGE spot ETF has also not shown significant directional support.

Daily net inflows have remained flat, while total cumulative inflows stand at around $2.05 million, a relatively small number compared to Dogecoin’s overall market capitalization.

Trading activity in DOGE-linked ETFs also remains sluggish, reflecting the lack of institutional participation at current price levels.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpaper. Dogecoin Price Prediction: Failed Rebounds Signal More Downside Risk. Accessed on December 24, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.