Download Pintu App

Dogecoin Sees a Small Price Increase—Is a Recovery Underway?

Jakarta, Pintu News – Large Dogecoin holders continue to reduce their exposure, with around 150 million DOGE having been sold in the last 5 days. So, the question arises – is this a sign of continued distribution or just momentary profit-taking?

This selling appears to have occurred while the Dogecoin (DOGE) price was trading at the lower end of its recent price range. This indicates that the whales are reacting to a weakening market structure, rather than chasing a potential price increase.

However, prices did not experience a sharp decline, indicating a steady absorption from other market participants. Even so, repeated selling flows limited price recovery efforts, and kept pressure on any rallies that occurred.

In short, this whale behavior could reflect caution and risk reduction, not a sign of accumulation. As long as the big wallets continue to reduce their balances, upward price momentum will be difficult to build.

Not only that, such supply changes add pressure to a market that is already on a downward trend, making derivative positions and liquidity dynamics even more important.

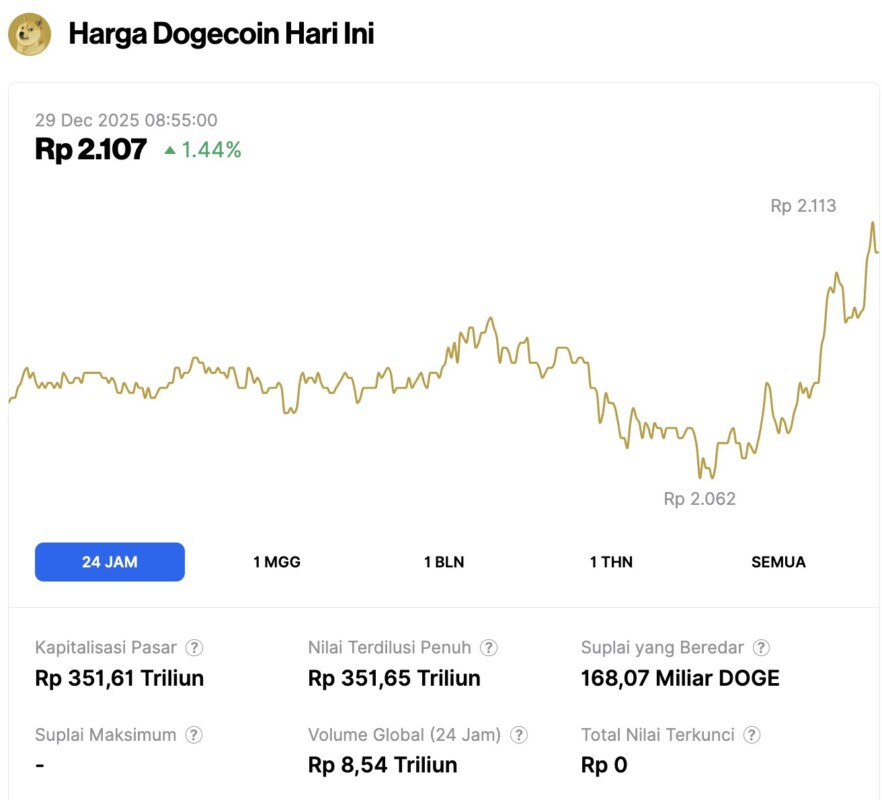

Dogecoin Price Rises 1.44% in 24 Hours

As of December 29, 2025, Dogecoin saw a modest 1.44% gain over the past 24 hours, trading at $0.1256, or approximately IDR 2,107. During the same period, DOGE fluctuated within a range of IDR 2,062 to IDR 2,113.

At the time of writing, Dogecoin holds a market capitalization of roughly IDR 351.61 trillion, with a 24-hour trading volume of around IDR 8.54 trillion.

Read also: Ethereum Holds Steady Around $2,900 as Crypto Whales Begin Accumulating ETH

Overcrowded Long Positions Against a Weakening Spot Trend

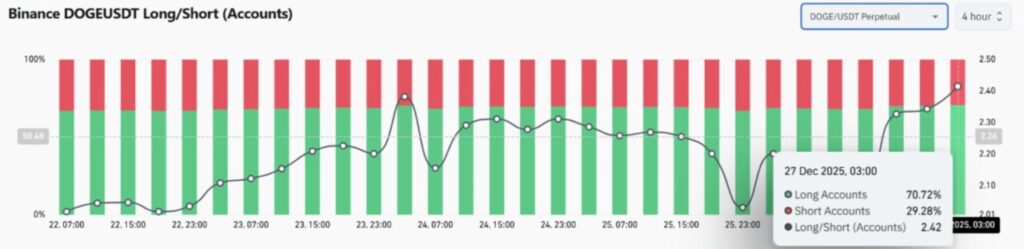

Despite the big sell-off from the whales, derivatives traders are still showing a very bullish attitude.

Data from Binance even shows that more than 70% of accounts went long, pushing the long-to-short ratio close to 2.4. This imbalance could be seen as a sign of optimism that is not in line with the price weakness in the spot market.

However, a position that is too skewed in one direction is often a weak point, especially in a declining market. When prices fail to rise as expected, confidence in long positions can quickly weaken.

On the other hand, this persistent long bias indicates the expectation that prices will bounce from oversold conditions. As a result, the market is in a tug-of-war between confidence in the recovery and the still-weak market structure.

If prices start to stabilize, long positions will gain confidence. But if the downward pressure continues, the potential for forced liquidation could exacerbate volatility.

This imbalance is what makes DOGE so sensitive to even relatively small price movements.

Rise in Open Interest Shows Risky Confidence

Open Interest rose to around $1.49 billion, an increase of 1.6% even though DOGE prices actually fell. This difference in direction is important to note.

A rise in Open Interest when prices are weakening usually signals an influx of new leverage, not natural demand from the market. Traders are adding exposure in the hope of a trend reversal, inspired by DOGE rallies that have occurred in the past due to the meme factor.

However, leverage also increases risk when the market structure is not favorable. So, an increase in Open Interest does not mean increased market power-it increases the potential for liquidation if prices continue to weaken.

In addition, leverage-driven positions tend to add to short-term volatility, instead of supporting sustained price recovery.

As such, DOGE may be in a fragile market – where the confidence of market participants is growing faster than the price structure is improving. This imbalance could trigger a sharp reaction when the price approaches important levels.

Down Channel Resists Price Momentum

As of December 27, Dogecoin’s price is moving within a clear descending channel that has been in place since early October – characterized by a consistent pattern of lower highs and lower lows.

Currently, the price is near the lower boundary of the channel, around $0.12 – a zone that has repeatedly managed to slow down selling pressure, not accelerate it.

Last but not least, the RSI is hovering around 36, still below the neutral level, but showing signs of stabilization, not further weakening. This indicates that the bearish momentum is weakening, not strengthening.

Read also: 3 Must-Watch Meme Coins for Christmas and New Year’s Week 2026

If the price is able to hold the support of this channel and starts to reclaim the resistance in the range of $0.155-$0.186, then it will signal the first shift in the price structure in recent months. If DOGE manages to breakout from the channel, then the price could head towards the supply zone at $0.206-$0.25, which was previously a distribution area.

Therefore, although the general trend is still corrective in nature, the compression of the structure and stabilization of momentum keep the upward target at the $0.25 level, provided that DOGE is able to convincingly break out of the downward channel.

Dogecoin Short Loses, Volatility Punishes Entry Time

The latest liquidation data shows that the liquidation of short positions is greater than longs, although the overall trend is still downward.

Currently, short positions are recording losses of around $69,800, while long liquidations are only around $5,600. This imbalance suggests that many traders entered short when the price was already at a low point – only to be squeezed by a short-term price bounce.

These short-term rebounds often punish late bearish positions, while the long-term structure still favors sellers. The result is a volatile market, moving up and down with no clear direction, and keeping both sides – both long and short – in a constant state of uncertainty.

Conclusion: Signs of Recovery Begin to Emerge

While the whale selloff is still ongoing, Dogecoin is showing some early signs of recovery, not collapse.

Price continues to hold channel support, while momentum is stabilizing and selling pressure is weakening. Moreover, the short liquidation data indicates that the bearish side is starting to experience fatigue – the sell-off is no longer resulting in sharp price drops.

If DOGE manages to hold the current support and break the immediate resistance, then the price structure will start to favor a trend change. In this context, a recovery towards the $0.25 zone becomes the most likely upward path.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Dogecoin – Is price recovery next after whales unload 150M DOGE? Accessed on December 29, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.