Download Pintu App

CoinGecko Reveals 2025’s Most Profitable Crypto Narratives — Which One Came Out on Top?

Jakarta, Pintu News – CoinGecko, one of the leading crypto data aggregators, released a comprehensive report analyzing the profitability of various key crypto narratives for 2025.

This study evaluates the performance over the current year (YTD), by highlighting the average price returns of the top 10 most prominent and most representative tokens in each narrative.

Real World Assets (RWAs) Dominate the Crypto Narrative

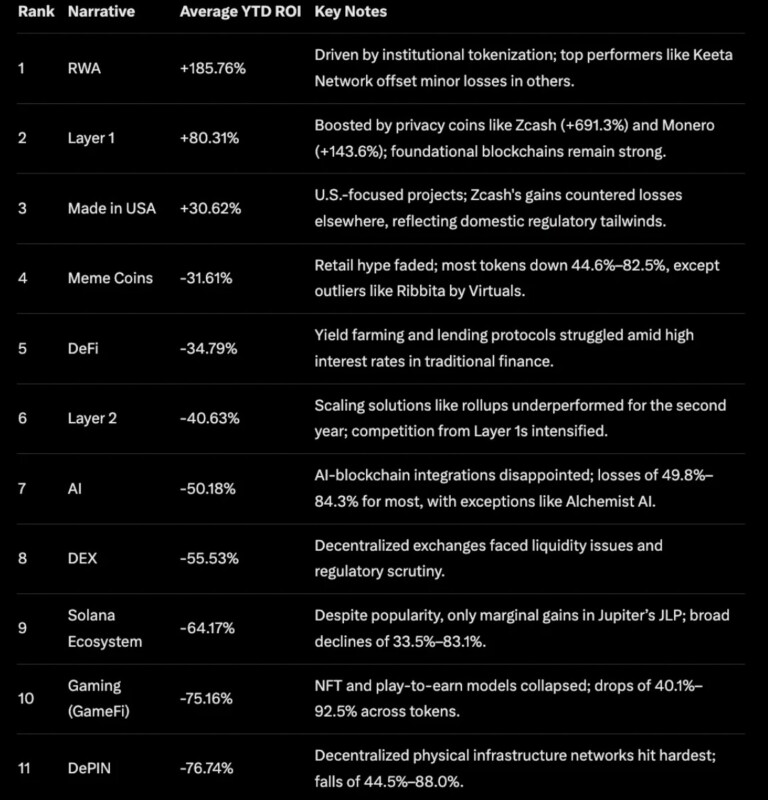

The crypto narrative battle in 2025 shows a sharp contrast to the surge in gains in 2024, with total returns varying from -76.74% to +185.76% so far this year.

Read also: Crypto Trends 2026: Focus on Everyday Use, Not Just Hype!

A report from CoinGecko ranked 11 main narratives based on their average yield. Each narrative was selected for having tokens with a sizable market capitalization and without excessive overlap.

Only three of the eleven narratives recorded positive results, reflecting more cautious market conditions due to institutional adoption, regulatory changes, and a decrease in euphoria towards speculative trends.

The best performing narrative in 2025 is Real World Assets (RWA), which recorded the highest average YTD ROI of 185.76%.

This trend involves the tokenization of traditional assets such as property, bonds, and commodities on blockchain platforms, thus bridging decentralized finance (DeFi) with the real financial world.

RWA’s success in 2025 is driven by increased interest from institutions, particularly from the United States, as more supportive regulations develop-including clearer guidelines on tokenized securities.

Hype vs Return: Popular Trends Start to Lose Steam in 2025

Although Real World Assets (RWA) recorded the highest returns in 2025, the popularity of a narrative does not always align with the returns.

Meme coins remained the most talked about narrative globally, absorbing 25.02% of investor interest. However, despite being in the limelight, the sector still recorded a negative performance throughout the year.

Read also: Analysts Predict a Mini Altseason in Early 2026 as Bitcoin’s Dominance Starts to Shift

The artificial intelligence theme, which took second place in terms of popularity, showed even worse results, with a loss of more than 50%.

This difference in results highlights a frequent pattern in the crypto market: hype-driven narratives tend to experience excessive spikes before eventually correcting sharply. In contrast, narratives focused on the US market and backed by institutions have performed much better.

RWA projects and “Made in USA” initiatives are getting a boost from increased institutional participation-a trend reinforced by the expansion of crypto ETFs, stablecoin adoption, and growing regulatory clarity.

These developments also provided support for the Layer 1 blockchain, which recorded the second-best returns for the year.

Other prominent sectors struggled. Gaming and DePIN (Decentralized Physical Infrastructure Networks) posted the steepest declines, as expectations for metaverse adoption and massive IoT integration did not materialize.

The Solana ecosystem (SOL), despite achieving the highest global share of attention at 26.79%, also experienced poor performance. This points to specific challenges, such as network congestion issues and increased competition from technology upgrades on Ethereum (ETH).

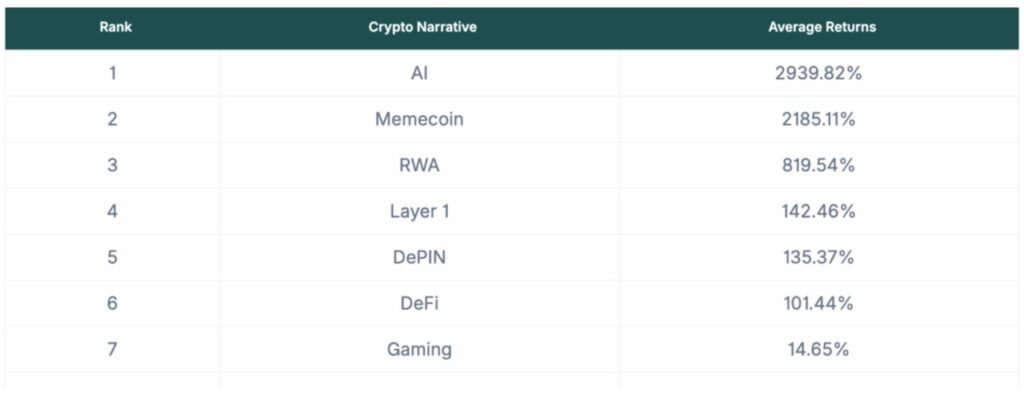

The contrast with 2024 is striking. Last year, AI led the market with a surge of nearly 2,940%, and memecoin jumped more than 2,180%.

But by 2025, both narratives had turned into significant losses. DePIN, which previously posted a 135% gain, is now plunging with a 76% drop-a classic post-hype reversal pattern.

Overall, these changes indicate a maturing market. Investors seem to be moving away from retail-driven speculative themes towards sectors that have real world utility and are backed by institutional capital.

Interestingly, only RWAs and Layer 1 blockchains have remained profitable for two consecutive years-reinforcing the view that these narratives have stronger long-term staying power.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. CoinGecko Ranks Crypto Narratives by ROI – Here’s Which Sector Delivered the Best Returns. Accessed on December 29, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.