Download Pintu App

3 Meme Coins to Watch Out for in January 2026, What Happens?

Jakarta, Pintu News – Meme coins are still one of the most sensitive categories in the crypto world today. Limited liquidity – due to the end of the year – makes price movements more rapid, even by small changes in supply or treasury wallet activity.

If you’re looking for meme coins to watch in January 2026, there are three names that stand out for very different reasons.

One coin is facing mounting selling pressure, another has remained strong despite market volatility, and another is showing early signs of a potential trend reversal.

Pump.fun (PUMP)

Pump became one of the first meme coins worth monitoring in January 2026 due to major warning signals from on-chain data. Recent data shows that the team behind the project has transferred an additional $50 million in ICO proceeds to the Kraken exchange.

Read also: 3 Altcoins with Strong Catalysts This Week, Potential to Soar or Plummet?

Since mid-November, a total of over $600 million in funds have been moved to the exchange.

This move seems to lean more towards treasury withdrawals than just regular fund management, which raises concerns that project liquidity is starting to dry up. This selling pressure is evident in the on-chain data.

In the last 24 hours, whales have reduced their holdings by 1.61%, indicating that large buyers are no longer supporting the price in this period.

The distribution score also shows that most of the tokens are concentrated in the hands of large holders. This could potentially increase volatility if the sell-off continues.

The price chart is also giving a cautionary signal. PUMP is currently trading around $0.00188 and is in a technical pattern that resembles a bear flag. If the price drops through $0.00179, then a potential further drop could take the price to $0.00146, then $0.00100, and could even reach $0.00088 if the momentum really weakens.

The level that invalidates the upside scenario is at $0.00247, while a valid bullish confirmation will only be seen if the price is able to break $0.00339.

For now, PUMP is a coin meme to monitor, not to buy. The direction of the next trend largely depends on whether buyers are able to stop the selling pressure and reclaim the key $0.00203 level with strength.

Pippin (PIPPIN)

PIPPIN is one of the few meme coins that is still able to hold steady when the general market is moving in a sideways pattern. Despite being down about 7% today, PIPPIN still recorded a gain of about 4.6% in the last seven days. This is what makes it one of the meme coins worth monitoring in 2026 – as the short-term weakness has yet to break the weekly trend structure.

On the daily chart, PIPPIN has turned the $0.46 level from support to resistance and is currently trading in the $0.43 range. If PIPPIN is able to reclaim the $0.46 level, there is potential for an upside move towards $0.55.

If the price manages to break $0.55 convincingly, the technical structure will get stronger and open the way towards $0.71 – which is the previous local high. This could also put PIPPIN in the short-term price discovery area for the January range.

The CMF (Chaikin Money Flow) indicator – which measures large fund flows in or out – has just returned to positive territory for the first time since November 30. Interestingly, when the CMF last broke zero on November 30, PIPPIN had risen nearly 880%. The CMF’s rise above zero again this time indicates fund inflows and early signs of strength, although the price is still testing resistance.

This creates a simple narrative for January:

- If PIPPIN is able to hold above $0.43 and reclaim $0.46, momentum could push the price to $0.55 and possibly $0.71.

- If it fails, the bias returns to neutral.

- PIPPIN’s price action will turn bearish if it drops below $0.30.

Dogecoin (DOGE)

Dogecoin (DOGE) has seen a decline of around 18% in the last 30 days, making it one of the weakest performing major meme coins on the market today.

Read also: Dogecoin Price Prediction in 2026: Can DOGE Break $1?

Despite the sharp correction, DOGE remains one of the meme coins worth monitoring in January 2026, as its on-chain behavior and price structure hint at a potential change in direction.

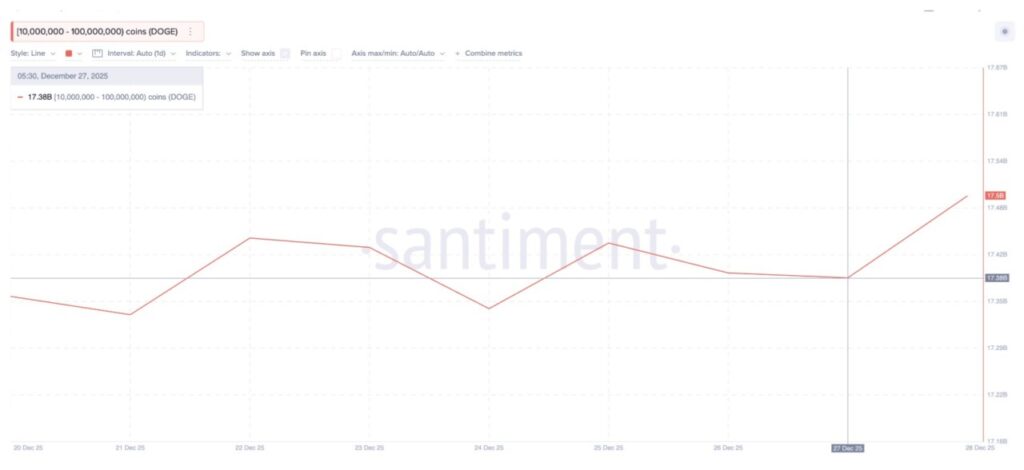

The whales holding 10 million to 100 million DOGE started accumulating again. Their holdings rose from 17.38 billion to 17.50 billion DOGE on December 27.

At current prices, that equates to an addition of around 14 million DOGE – an important signal as it shows that big players are starting to take positions in the first place, rather than selling when the market weakens. If this accumulation trend continues, selling pressure could ease and local price support could become more stable.

The DOGE price chart supports this scenario. Between November 21 and December 26, DOGE printed a lower low, while the RSI (Relative Strength Index) indicator formed a higher low.

This phenomenon is known as a bullish divergence, and it often signals a reversal when it appears on large time frames such as daily charts. This divergence formed just as DOGE tested the support area at $0.120 and bounced.

As long as the $0.120 level holds, the technical structure remains valid. The next level to be tested is $0.141. If the price manages to close above $0.141, it confirms the breakout of the divergence and opens up the upside potential to $0.154 and possibly $0.164. These levels are the first steps in the DOGE recovery scenario in January 2026.

The risk is quite clear: if $0.120 fails to hold, the whales could sell off again. This would weaken the bullish divergence signal and thwart a potential DOGE rebound.

If the price falls below $0.120, the technical structure is weakened, and leadership in the meme coin sector could move to other projects – at least until DOGE shows strength again.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Meme Coins to Watch in January 2026. Accessed on December 31, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.