Download Pintu App

Analyst: 2026 Fed Rate Cut Could Trigger Return of Crypto Retail Investors

Jakarta, Pintu News – The potential interest rate cut by the Federal Reserve in 2026 is the main focus of crypto market players. The expectation of monetary policy easing is considered to increase global liquidity and encourage interest in risky assets, including cryptocurrencies. Under these conditions, the crypto market has the opportunity to enter a new recovery phase after a prolonged period of volatility.

The Effect of Interest Rate Policy on Investor Interest

The interest rate cut by the Federal Reserve (Fed) in 2026 is expected to be an important factor that redefines retail investors’ interest in the crypto market. According to a crypto analyst, the Fed’s decision to set interest rates will greatly influence the investment dynamics in the following year.

Lower interest rates tend to make traditional investments like bonds less attractive, prompting investors to look to higher-risk assets like Bitcoin (BTC) and other cryptos for higher yields. By 2025, the Fed has made three rate cuts, and the market has anticipated most of them.

Owen Lau, managing director of Clear Street, stated in an interview with CNBC that the Fed’s interest rate decision is one of the main catalysts for the crypto space in 2026. Lau added that both retail and institutional investors will be more eager to jump into crypto if interest rates continue to be cut.

Read also: Tokenized Stocks Reach $1.2 Billion, Institutional Interest on the Rise?

Market Reaction to Fed Policy

According to Fed meeting notes released in December, the central bank is open to adjusting interest rates in the following year to align with broader economic objectives. “The Committee will be prepared to adjust monetary policy as needed if risks arise that could impede the achievement of the Committee’s objectives,” the notes said.

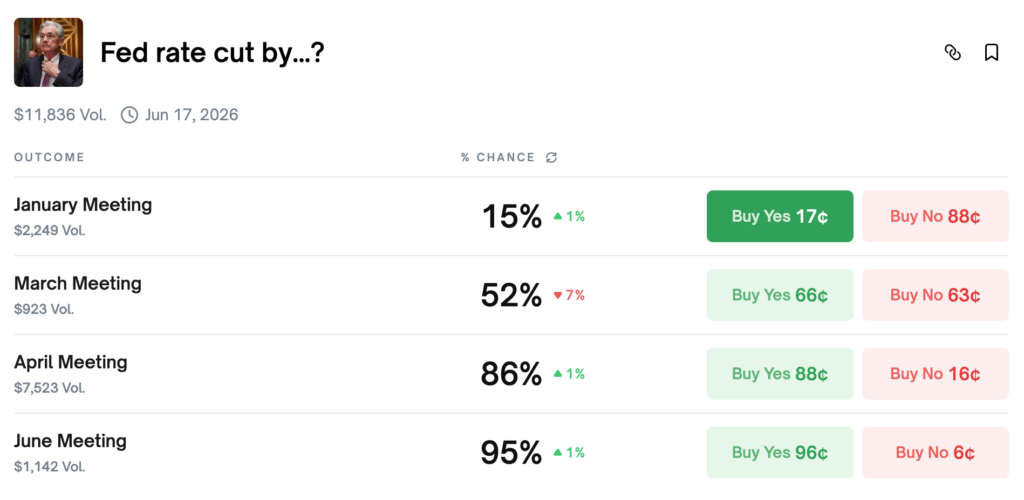

However, data from crypto prediction platform Polymarket shows that the market is skeptical of the likelihood that the Fed will continue to cut rates in the first months of the year. Polymarket data shows there is only a 15% probability of a rate cut in January, while confidence is higher for a cut in March, with a 52% chance.

The Fed’s 2025 interest rate cut pushed the price of Bitcoin (BTC) to a new peak of $125,100 on October 5, although this uptrend was short-lived as a massive liquidation on October 10 wiped out $19 billion of protected positions.

Also read: Metaplanet Invests Big in Bitcoin, Spends $451 Million in Q4!

Current Crypto Market Sentiment

Bitcoin’s (BTC) price drop of 29.3% from its peak in October has led to a decline in sentiment for the crypto market as a whole. The Crypto Fear & Greed Index, which measures overall crypto market sentiment, has been in “Extreme Fear” territory since December 13.

On Wednesday, the index recorded an “Extreme Fear” score of 23. This decline suggests that investors may still be hesitant to return to the crypto market despite the potential for further interest rate cuts by the Fed. This shows the importance of monetary policy in influencing crypto asset prices and investor confidence.

Conclusion

With the potential for further interest rate cuts by the Fed in 2026, the crypto market may see increased interest from both retail and institutional investors. However, certainty regarding Fed policy is still a key factor that will determine the direction of the market. Investors are advised to keep a close eye on monetary policy developments and their impact on the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. 2026: Fed Cuts Key Catalyst, Retail Return to Crypto. Accessed on December 31, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.