Download Pintu App

5 Facts about Shiba Inu (SHIB) Early 2026: Open Interest Up 20% & Implications for Crypto Market

Jakarta, Pintu News – Shiba Inu (SHIB), one of the largest meme coins in the cryptocurrency market, showed significant market dynamics in early 2026 with a 20 percent spike in open interest in the last 24 hours. This change is indicative of increased trader participation as well as a potential change in SHIB’s market direction in the short term. This article summarizes five key points of the metric change based on the latest crypto market data.

1. 20 Percent Open Interest Surge

Shiba Inu’s open interest has increased by around 20 percent in the last 24 hours to reach around USD 103.87 million, according to CoinGlass data cited by U.Today report. Open interest reflects the number of open positions in the derivatives market, which could indicate an influx of new capital or improved liquidity in the SHIB market.

An increase in open interest is often considered by analysts as a signal of increased trader participation, although it doesn’t always guarantee a clear direction of price movement. In this context, the rise in this metric comes after Shiba Inu reversed the previous three-day downtrend.

Also Read: 7 BTC Facts Predicted to Bottom at $37,500 in 2026 – Latest Crypto Market Analysis

2. SHIB Price Consolidates in a Narrow Range

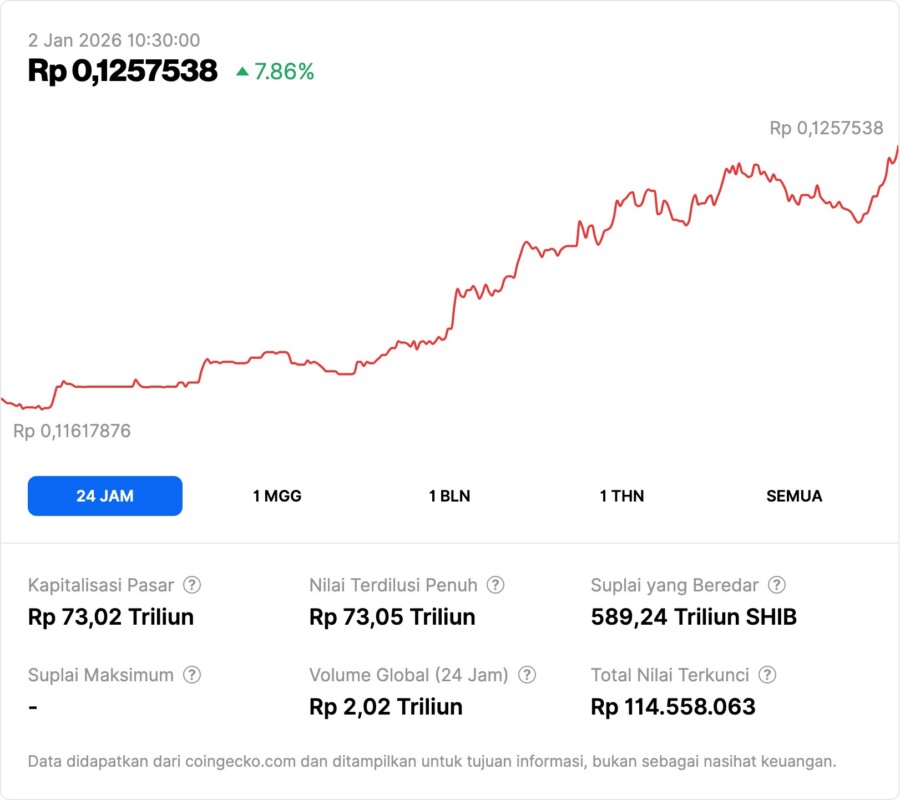

At the time of the report’s release, the price of Shiba Inu was down about 0.43 percent in the past 24 hours and was trading in a range between USD 0.00000681 to USD 0.00000765. This narrow price range reflects the market’s lack of momentum despite the sharp increase in open interest.

SHIB’s trading volume also rose by about 20.34 percent in 24 hours, indicating higher market activity; but the relatively stable prices reflect that the market is still waiting for a clearer trend direction.

3. Open Interest & Market Liquidity

Open interest is an important indicator in the derivatives market as it reflects the total number of contracts that have yet to be closed or settled. A spike in open interest indicates the potential for greater liquidity and a shift in trader positioning, which could be the basis for subsequent price momentum.

In the crypto market, rising open interest is often seen as the start of a more energized price phase, but without confirmation by strong price movements, this signal is still indicative only.

4. SHIB Community Reaction

In the same report, the admin of the Shiba Inu community on Telegram, RagnarShib, stated that “the best is yet to come,” emphasizing that the SHIB ecosystem remains alive and is built by its community. This comment provides social context to the SHIB market dynamics in early 2026.

This community opinion reflects the high spirit of participation among SHIB holders, although it does not directly affect technical metrics such as open interest or market price.

5. Fundamental Ecosystem Factors

The report also noted developments in the Shiba Inu ecosystem, including the launch of Zama Protocol on the mainnet which successfully performed a confidential transfer of cUSDT stablecoins on the Ethereum network. Developments like these could have a fundamental long-term impact on the utility of the Shibarium network and the SHIB user community.

These fundamental factors are often long-term catalysts that support the ecosystem and can influence investor perception of meme coin assets like SHIB in the broader cryptocurrency market.

Also Read: 5 Veteran Analyst Insights Say 2026 Could Be Peak Gold & Silver

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Tomiwabold Olajide/U.Today. 14,445,863,488,009 SHIB in Day: Shiba Inu Open Interest Jumps 20% in 2026 Start. Accessed January 2, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.