Download Pintu App

Bitcoin Holds Steady at $88,000 as Analysts Eye Potential Surge to $170,000

Jakarta, Pintu News – An analysis from CryptoQuant explains what needs to happen for the price of Bitcoin (BTC) to surge to $170,000 this year. However, this scenario is the least likely of the three scenarios discussed in the analysis, given that Bitcoin is still struggling to start a new bullish trend.

Then, how will the Bitcoin price move today?

Bitcoin Price Up 0.76% in 24 Hours

As of January 2, 2026, Bitcoin was trading at $88,867, or approximately IDR 1,487,635,777, marking a modest 0.76% gain over the past 24 hours. During this period, BTC hit a low of IDR 1,467,823,672 and reached a high of IDR 1,488,026,364.

At the time of writing, Bitcoin’s market capitalization is estimated at around IDR 29,581 trillion, while its 24-hour trading volume has dropped by 40% to IDR 376.16 trillion.

Read also: Ethereum Struggles to Break $3,000 — Could a 20% Rally Be Ahead?

How Bitcoin Could Rise to $170,000 This Year

An analysis from CryptoQuant revealed that Bitcoin could potentially surge to $170,000 this year, although this scenario is considered a low probability.

The analysis explains that if expectations of monetary policy easing are realized early and fund inflows into ETFs stabilize, BTC prices could be pushed to a range between $120,000 and $170,000 – with the potential to go even higher if supported by some very favorable conditions.

According to a report from CoinGape, the minutes of the FOMC meeting showed that most Fed officials judged the current interest rate to be appropriate to maintain, indicating that a rate cut in January seems less likely.

For the record, the Fed cut interest rates three times last year, which was the trigger for Bitcoin’s price surge to reach a record high (All-Time High).However, since the possibility of a rate cut at the beginning of this year is quite small, BTC prices may continue their downward trend.

Analysis from CryptoQuant also notes that at the start of 2026, Bitcoin has yet to show clear signs of entering a new bullish trend. The market is still in a state of high volatility, which has yet to show a clear direction – either bullish or bearish.

CryptoQuant also added that although ETF adoption and supply limitations provide long-term support, the uncertainty of macroeconomic conditions, midterm election dynamics in the US, as well as derivatives-influenced price action remain factors hindering sustained directional movement for Bitcoin.

The analysis concluded that current market conditions are conditionally neutral to slightly bearish, reflecting the absence of structural confirmation strong enough to drive significant upward momentum in prices.

Two Other Possible Scenarios for Bitcoin

Analysis from CryptoQuant also outlines two other possible scenarios for Bitcoin’s price movement this year.

Read also: Dogecoin Sees 7% Gain, But Retail Trader Interest Is Losing Steam — Here’s Why

The first scenario is considered the most likely (high probability), where Bitcoin will move in a volatile but limited price range. This scenario could happen if expectations of a Fed rate cut remain, but the real economic recovery is still weak.

In this scenario, capital flows are considered to be inconsistent and dominated by short-term ETF activity. Based on these conditions, Bitcoin price is expected to move in a wide range between $80,000 and $140,000, with the main trading zone being in the range of $90,000 to $120,000.

The second scenario, which has a medium probability, could potentially occur in the event of a macroeconomic shock that impacts Bitcoin. If the risk of recession increases, then the deleveraging process and outflow of funds from ETFs could push the price of BTC down below $80,000, potentially even touching the $50,000 range.

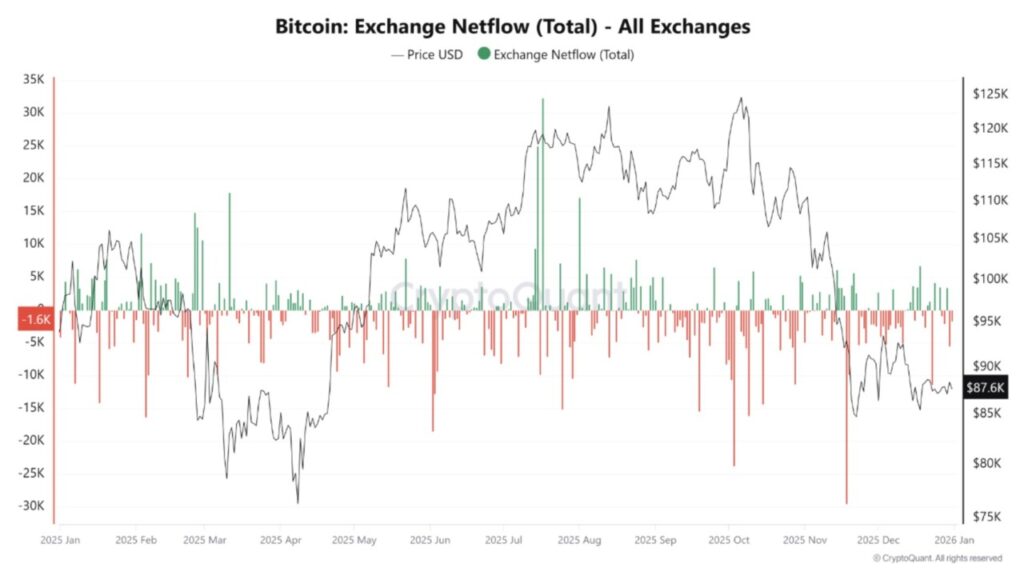

To know which scenario will occur, CryptoQuant advises market participants to monitor several important indicators, such as: Bitcoin reserves on exchanges, net inflows and outflows, weekly ETF flows, open interest (OI) in the futures market, liquidation of positions, as well as data from short-term and long-term holders.

Analysts emphasize that what matters most is how these indicators move together, not separately.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Could Rally to $170,000 in 2026 If This Happens: CryptoQuant. Accessed on January 2, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.